Introduction:

The primary purpose of life insurance is to safeguard your loved ones until they are financially dependent on you. However, uncertainty regarding the duration of your financial dependency can pose a challenge. This is where a Whole Life Insurance Plan can be useful, as it provides coverage for your entire lifespan, up to the age of 100. Additionally, it can assist in supplementing your retirement income.

If you are curious about Whole Life Insurance Plans and wondering if they are suitable for you, read on.

What is Whole Life Insurance?

A Whole Life Insurance Policy provides coverage for the entirety of the life assured’s life. The policy remains in force as long as the premiums are paid as and when due. The sum assured or coverage amount is decided at the time of purchase and is paid to the nominee upon the death of the life assured. The maturity age is usually 100 years. If the life assured dies before that age, the sum assured is paid to the nominee. However, if the life assured lives past 100 years, the insurance company pays the maturity amount (Sum Assured plus Bonuses, if any) to the life insured.

How Does Whole Life Insurance Work?

Whole Life Insurance Plan is designed to provide life-long coverage and create a financial cushion for the future in case of death.

It is an easy way to ensure that you and your loved ones are protected financially in the event of your death. By creating a financial cushion, you can rest assured knowing that your loved ones will be cared for financially should something happen to you.

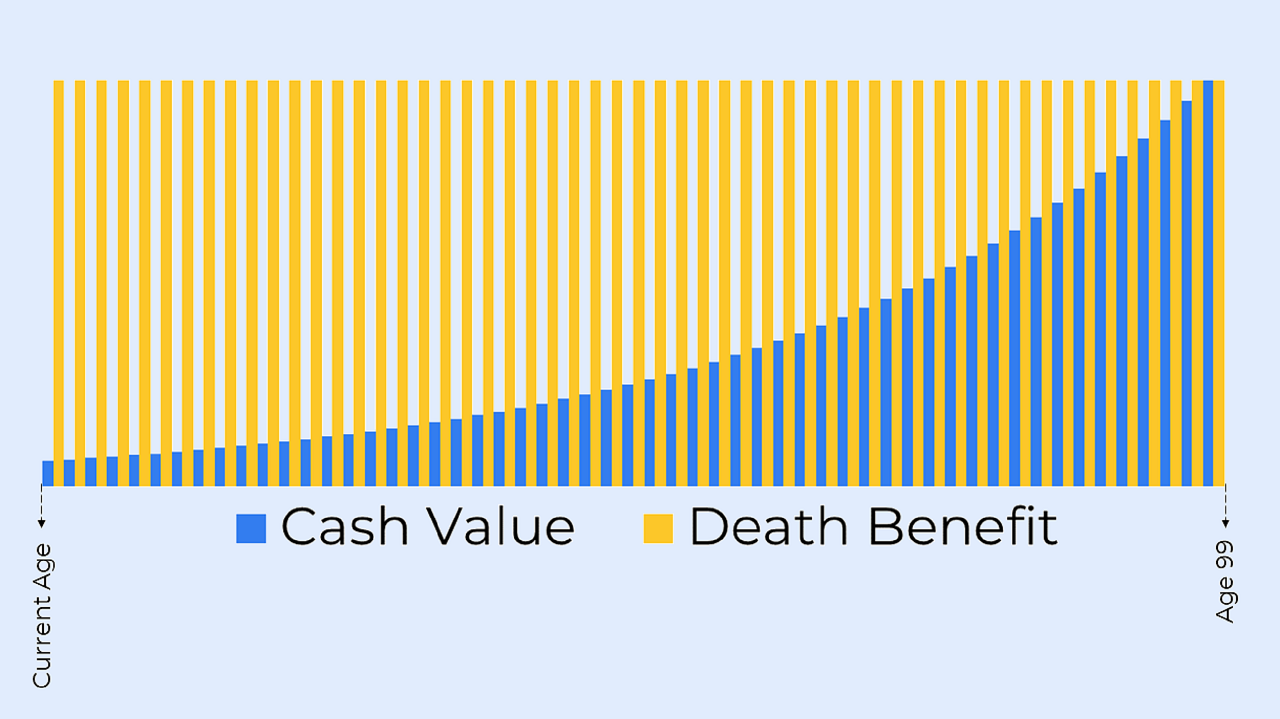

A policyholder has to pay a premium, out of which a portion is used to provide protection, and the remainder is invested in the company. If the company earns a profit, the policyholder is entitled to a bonus on the invested amount. The investment grows in value and is returned to the policyholder if he or she chooses to withdraw or live until the maturity of the plan.

Thus, a Whole Life Insurance Policy covers you for your entire lifetime and helps grow your savings.

There are different types of Whole Life Insurance Policies that offer death benefits, maturity benefits, and survival benefits to the policyholder. The policyholder can choose the type of policy that suits his needs.

Types of Whole Life Insurance Policy:

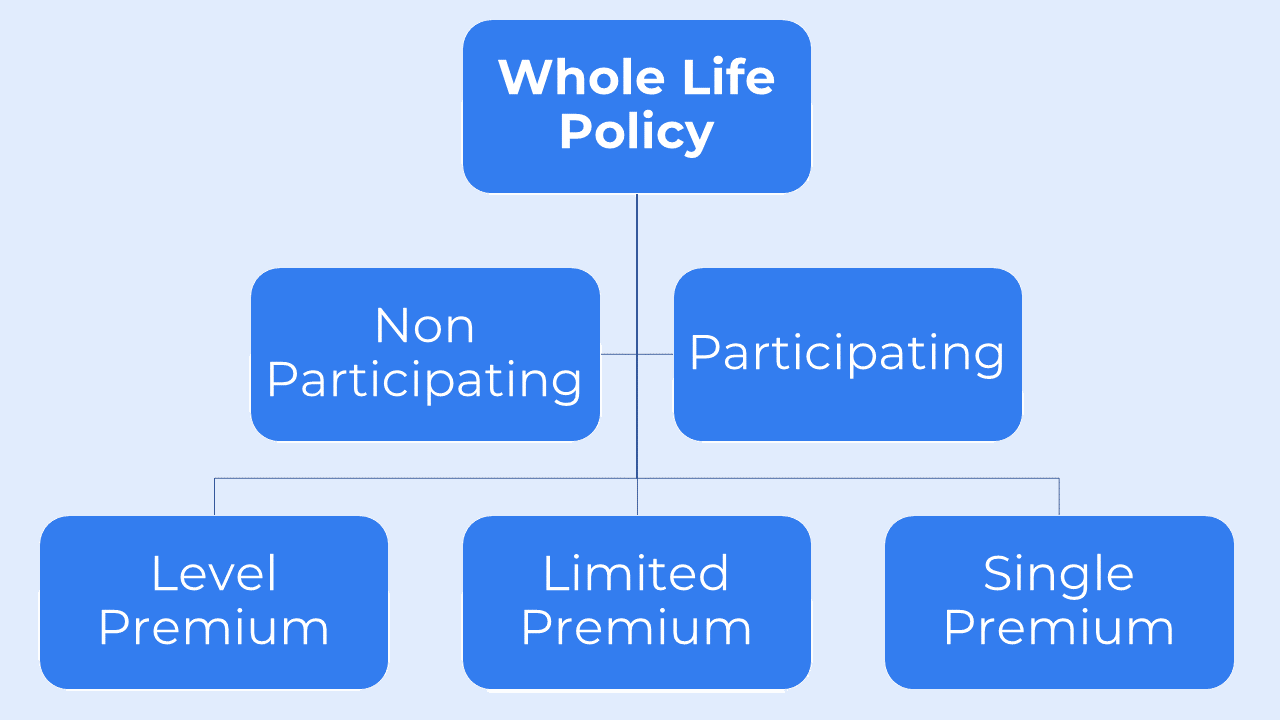

There are two types of Whole Life Insurance Plans to choose from, each providing different benefits. Read about each type of policy to find out which one best fits your needs.

Non-Participating Whole Life Insurance Plans:

A Whole Life Insurance Policy that doesn’t offer you the chance to earn dividends is called a non-participating policy. This kind of policy has a level premium and face amount that stays the same throughout your life. The main advantage of having a non-participating policy is that the cost is fixed, and the premium amount is relatively lower.

Participating Whole Life Insurance Plans:

A key feature of a participating Whole Life Policy is that it has the potential to pay dividends. Dividends are a portion of a company’s earnings that are paid out to policyholders. They are not guaranteed, but if they are paid, they can be used to lower future premium payments or allowed to grow with interest. Dividends can also be used to purchase paid-up additional insurance, which will, in turn, increase the face amount of coverage provided.

Two main categories of whole life insurance policies are participating and non-participating. Within these categories, individuals can choose from three premium payment options.

Option I – Level Premium Whole Life Insurance Plan:

Level Premium Whole Life Insurance Plan is precisely what it sounds like – you have to pay a level premium throughout the policy term. Although you are supposed to pay the premium for your entire life, usually, these policies are designed to collect enough premiums during your earning years so that even if you stop paying the premium after retirement, the policy does not lapse altogether and can still sustain till age 100.

This ensures that your family remains protected no matter what happens down the line. However, non-payment of premiums impacts your death benefit amount and cash value proportionately.

Option II – Limited Payment Whole Life Insurance Plan:

Limited Payment Whole Life Insurance Plan is an excellent option for those who want lifetime protection but don’t wish to commit to paying premiums for an extended period of time. With this plan, customers will pay higher premiums for a shorter period of time.

This kind of insurance is ideal for those who want the peace of mind that comes with knowing they’re covered for life without having to make a long-term commitment.

Option III – Single Premium Whole Life Insurance Plan:

Individuals who wish to purchase a Single Premium Whole Life Insurance Plan must make a single, lump sum payment when the policy is issued. This initial payment will provide the policy with loan value and immediate cash value, both of which could be significant depending on the size of the premium amount.

Because of the high upfront cost, Single Premium Whole Life Policies are considered more of an investment than other types of life insurance.

Benefits of Whole Life Insurance Plans:

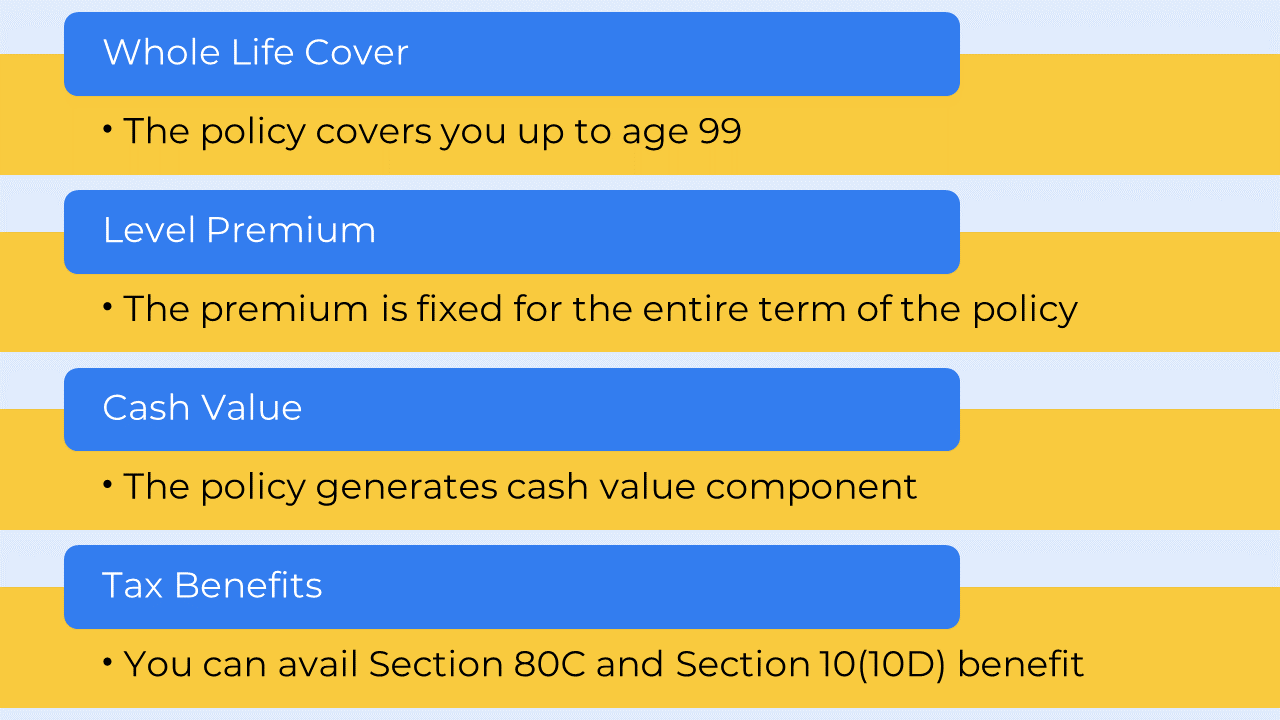

Cover for Whole Life: The policy covers you for 99 years, protecting your loved ones for an extended period of time. Many people have financial dependents even in their old age, and such a policy can take care of their financial responsibilities.

Level Premium: The premium rate is locked in for the duration of the policy, which can offer protection against inflation.

Cash Value: Whole Life Policies generate a cash value component over time as premiums are paid. This cash value can be used to reduce future premiums or be withdrawn. Loans may also be available against the cash value of the policy.

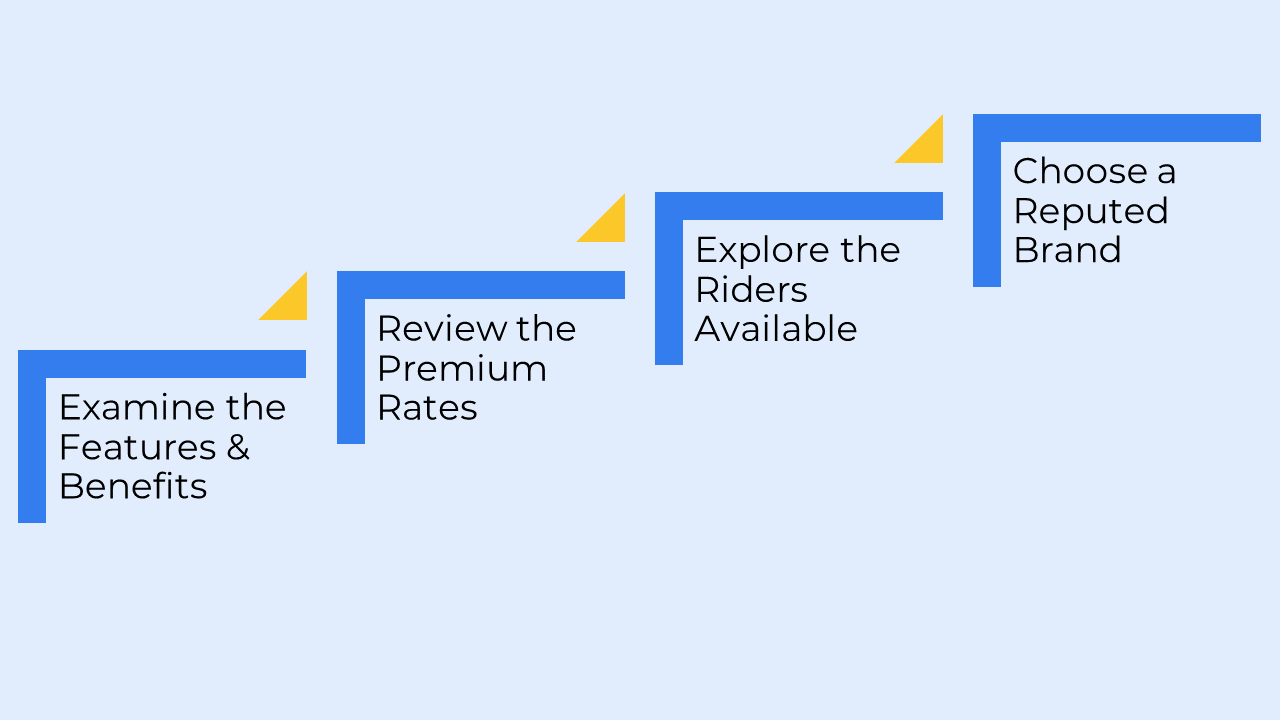

How to choose the right Whole Life Insurance Plan?

When choosing a Whole Life Insurance Policy, be sure to keep the following in mind:

Features and Benefits of the policy: You’ll have to read through multiple policy brochures and compare the benefits/payouts offered by various plans. Make sure to choose a policy that provides coverage and payouts that are ideal for you. Also, check the policy tenure range, sum assured options, eligibility criteria, etc., to ensure that the policy meets your needs.

Premium Rates: Different insurers charge varied premiums based on their underwriting standards. So, you’ll need to ask for premium quotes from various insurers and choose a policy with an affordable price.

Riders Available: Many insurance providers offer policy riders to help buyers customize their base policy coverage. When comparing policies, make a note of the different riders that are offered.

Brand Reputation: When choosing an insurance provider, it’s essential to check their reliability by looking at their claim settlement ratio, persistency ratio, solvency margin, etc.

Who should opt for Whole Life Insurance Policy?

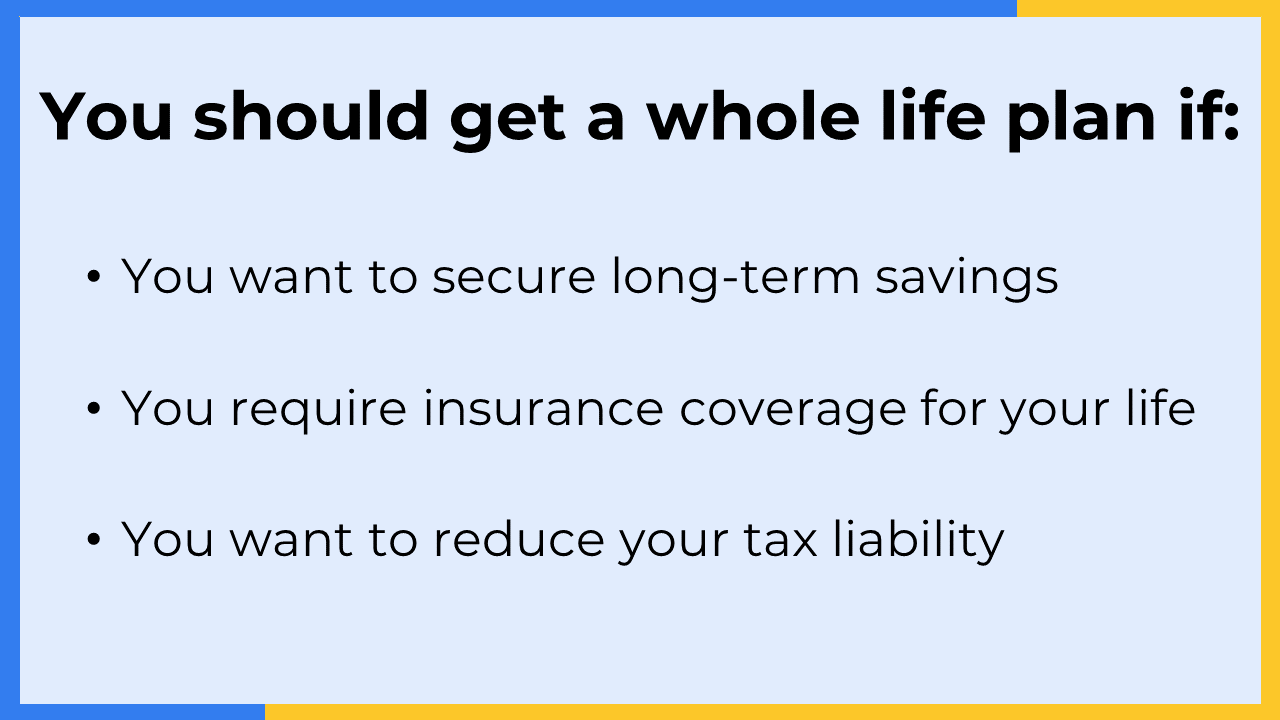

You should choose a Whole Life Insurance Policy if:

- You have dependents who would need financial protection even when your earning stops.

- You wish to build up a cash value through your insurance plan – sort of like a savings account.

- You are an individual with a high net worth who needs to invest in order to reduce taxes.

- You have long-term goals to achieve. Then, if something happens to you, the death benefit from your Whole Life Insurance Policy can cover the financial commitment to your long-term goals.

- You wish to leave behind a legacy for your loved ones. You can easily do that by contributing regularly to Whole Life Insurance Plans.

Best Whole Life Insurance Plans in India:

There is no shortage of options when it comes to Whole Life Insurance Policies in India. These policies have been designed to suit diverse consumer profiles, so depending on your specific requirements, you can select from a range of different policy types. Some of the best Whole Life Insurance Policies currently available on the market have been listed below for your convenience.

- Max Life Whole Life Super

- HDFC Life Sampoorn Samridhi Plus

- ICICI Pru Whole Life

- IDBI Federal Life Insurance Whole Life Savings Insurance Plan

- LIC Whole Life Policy

- SBI Life – Shubh Nivesh

Spend some time researching various policies and comparing their features so that you can make an informed decision about which one is right for you and your family.

Resources:

https://www.policybazaar.com/life-insurance/general-info/articles/whole-life-insurance-policy/

https://www.coverfox.com/life-insurance/whole-life-insurance/

Frequently Asked Questions:

Why should I buy a Whole Life Insurance Policy?

If you need a life insurance policy that provides insurance coverage for your entire lifespan, you should get a Whole Life Insurance Policy.

How much Sum Assured should I opt for while buying Whole Life Insurance Plan?

Before you select a life cover, it’s essential to estimate the amount required to cover not only your family’s cost of living and household expenses but also any future expenses and your unpaid loans (if any) to ensure your loved ones don’t have to bear any financial burden. You should also factor in inflation before making a final decision.

Financial experts typically suggest opting for a life insurance coverage equal to 10-12 times your annual income. You can also use a human life value calculator to get a more accurate estimate of the adequate amount.

Can a Whole Life Insurance Policy supplement post-retirement income?

Yes, a Whole Life Insurance Policy can be a great way to supplement your income during retirement. The cash value of the policy can provide you with the extra funds you need to cover your expenses.

Can Whole Life Insurance Policy help me create a legacy?

Yes, Whole Life Insurance Policy can be a great way to leave behind a legacy or inheritance for your family. This is because Whole Life Insurance Policies cover you until the age of 99. If the insured person dies before this age, the beneficiaries of his life insurance policy will get the sum assured. Insurance payouts are also exempt from tax under Section 10(10)(D).

Can I take a loan against a Whole Life Insurance Plan?

Yes. Most insurance companies will allow you to take out a loan against their Whole Life Insurance Policy if it has already accrued a surrender value. However, in most cases, the loan amount will only be a certain percentage of the surrender value.

Should I buy Whole Life Insurance Policy for my child?

A life insurance policy acts as a financial shield for your family in the event of your death. A Whole Life Insurance Policy pays the death benefit amount to your chosen beneficiary when you die, so you need to consider if your child will need financial support when you’re no longer around. If they do, then you can buy a Whole Life Insurance Policy with your child as the beneficiary. This way, they’ll be taken care of financially even when you’re gone.

Can I purchase a Whole Life Insurance Plan online?

Many insurance providers offer several life insurance policies online, either through their official website or third-party websites. However, it’s important to research before purchasing any policy online. Read through the policy brochure, check the premium quote, and compare the terms and conditions of at least a few different policies. This way, you can be sure you’re getting the best deal possible.

Will my premium rate increase as I get older?

No, the premium for the Whole Life Policy usually stays the same for the duration of the plan.

Can I nominate more than one person to receive the benefits from my Whole Life Insurance Policy?

This usually depends on the insurance provider, but you can nominate multiple beneficiaries in most cases.

Can I surrender my Whole Life Policy for its cash value?

Yes, most companies allow you to surrender your Whole Life Policy. When you surrender your policy, you will receive the cash value or a portion of the cash value. However, any outstanding loan amount and other charges may be deducted from the total cash value.

What are the Riders available in Whole Life Plan?

Whole Life Insurance Policies come with various riders that help enhance the protection the policy provides. Standard riders include Critical Illness, Accelerated Sum Assured, Partial / Permanent disability, Waiver of Premium, Accidental Death & Dismemberment, and more.

Can I convert my existing Term Insurance Plan into a Whole Life Plan?

Only if the Term Insurance Plan you own is a convertible one, however, you will have to pay a higher premium if you convert the plan.

How can I evaluate the various Whole Life Insurance Plans available?

Various websites can help you compare prices and premiums for different Whole Life Policies. You can also check the features and benefits of multiple policies to help you narrow down your choices. In the end, this will help you purchase a policy that is most suitable for you.

How many years do I need to pay premiums for a Whole Life Insurance Plan?

Most Whole Life Insurance Plans require policyholders to pay premiums for a certain number of years, after which the policyholder’s coverage will be guaranteed for their lifetime. This can be helpful for budgeting and ensuring that you and your loved ones are covered for the long term.

What should be the minimum age to be eligible to buy a Whole Life Policy?

Whole Life Insurance Policies usually offer coverage to individuals 18 years of age or older, but some policies also cover children as young as 30 days old. The eligibility criteria for a particular policy will vary depending on the specific terms and conditions.

When does a Whole Life Policy lapse?

If a policyholder doesn’t pay the premium for their Whole Life Insurance Policy within the grace period, it will either lapse or be converted into a paid-up policy. If the policy has not acquired a surrender value, it will lapse. If the policy has acquired a surrender value, it will be converted into a paid-up policy.

Do I get any tax benefits on premiums paid for Whole Life Policies?

You can claim tax benefits under Sec 80C of the income tax act for the amount of premium paid for any Whole Life Policy.

Does my nominee have to pay tax on the death benefit received?

The death benefit amount received is tax-free under Income Tax Act, Sec 10(10D).

Is the maturity amount of Whole Life Insurance Plans taxable?

For all Whole Life Insurance Plans issued before 1st April 2023, the maturity proceeds will be tax-free u/s Section 10 (10D).

For all Whole Life Insurance Plans issued on or after 1st April 2023, the maturity proceeds will be tax-free u/s Section 10 (10D) only if the aggregate premium of all the traditional life insurance policies does not exceed ₹5,00,000/-, else the maturity proceeds will be taxable.

Conclusion:

In conclusion, Whole Life Insurance Plan can be a powerful tool to secure your retirement years and leave behind a lasting legacy. We hope this article has helped you understand how a Whole Life Insurance Policy works and whether it meets your financial requirements.

Please feel free to Contact Us if you have any further questions about Whole Life Insurance Plan. We will be more than happy to assist you.

Disclaimer:

This article provides general information only and does not constitute financial advice. Financial regulations, product terms, and industry guidelines are revised from time to time. While we have made efforts to ensure the accuracy of the information presented, we do not guarantee its completeness or accuracy. We disclaim any liability for loss or damage arising from actions taken based on the information provided in this article. To make informed financial decisions, please do your own research and consult with a qualified financial professional.

SPREAD THE WORD WITH YOUR NETWORK