Introduction:

ULIPs, or Unit Linked Insurance Plans, have been gaining popularity among young investors for their ability to offer both investment and life insurance benefits. So, if you’re wondering what is ULIP and want it to be a part of your investment portfolio, it’s worth understanding what sets them apart from other options like mutual funds and other equity-linked savings plans.

In this article, we’ll discuss everything about ULIP so that you can use it as your go-to guide when making investment decisions. We’ll cover topics like what is ULIP, how ULIPs work, the benefits they offer, and more. So, whether you’re just beginning your research on ULIPs or are ready to start investing, this article will provide the information you need to make informed decisions about your financial future.

What is ULIP?

ULIP stands for Unit Linked Insurance Plan. It’s an insurance policy that provides the dual benefit of investment and life cover. The premium you pay for a ULIP is divided into two parts. One part goes towards your life cover, and the rest is invested in the fund of your choice. You can choose to invest in equity, debt, or a combination of both as per your risk appetite and goals. This makes ULIPs a flexible investment option for you and your family’s long-term goals.

How does ULIP Work?

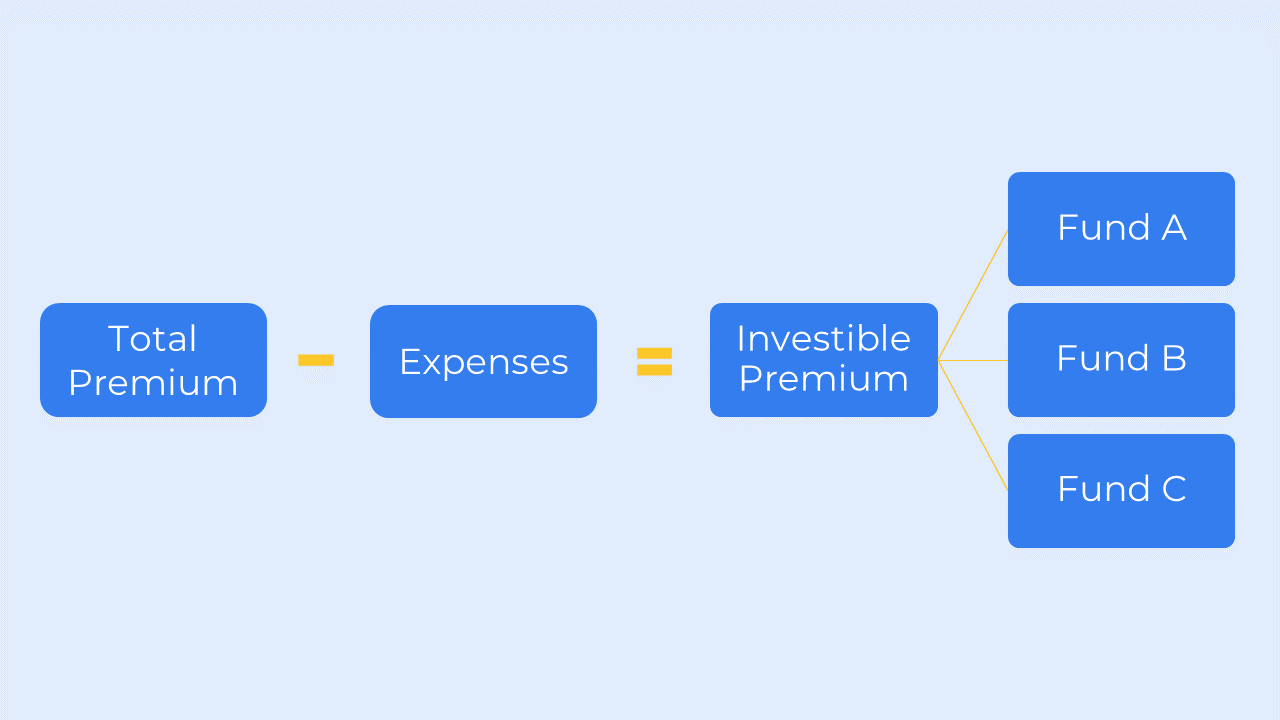

When you purchase a ULIP, the premium amount you pay is allocated to the funds of your choice after the insurance company has deducted various charges.

Your funds are managed by a team of dedicated fund managers whose only focus is to help you achieve your specific investment objectives. As an investor, you have the option to diversify your investments across several different funds. In addition, you can track the performance of the funds and switch between them to maximize profit and deal with market volatility.

If the policyholder dies during the policy term, his nominee gets either the fund value or the sum assured – whichever is higher. And, if he survives the policy term, he gets the fund value plus any bonuses that have accrued.

Some common ULIP Terms & Phrases:

Here are some key terms to know about ULIPs.

Fund Value: The total monetary value of the fund units owned by the policyholder.

Sum Assured: The amount guaranteed to the policyholder after the policy term is over.

Premium Payment Term: The duration for which you are supposed to pay the premium.

Top-up Premium: An additional amount you can pay over and above your regular premium amount.

Partial Withdrawal: The act of withdrawing funds from your policy before it matures.

Fund Switch: The act of moving your money from equity to debt or vice versa, depending on how the markets perform. Before you use this feature, it’s a good idea to check with your insurer whether there are any fund-switching charges.

Maturity Benefit: The benefit amount you receive once the policy term has been completed.

Death Benefit: The amount of money your beneficiaries receive from the insurance company in the event of your death.

Policy Surrender: Surrendering or canceling a life insurance policy before it matures.

Surrender Value: The amount you receive in the event of policy surrender.

ULIP Charges: The various charges levied by the insurer. We will discuss these charges in detail in the section below.

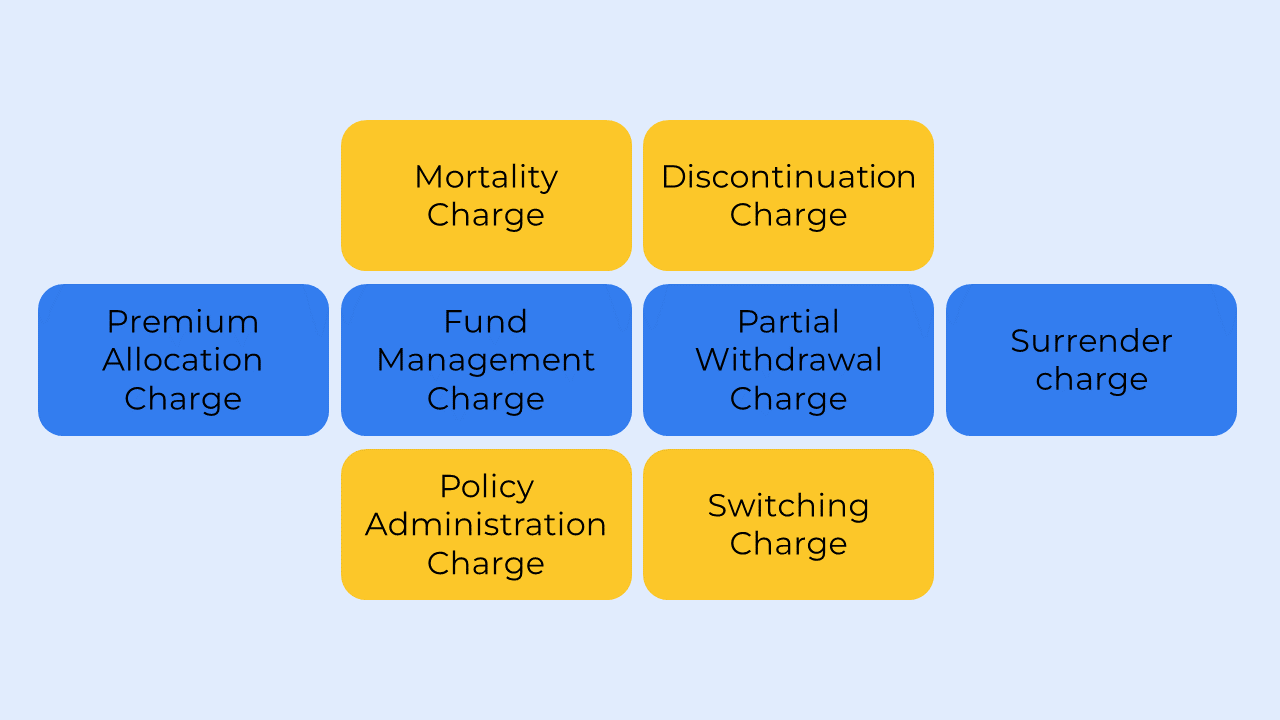

ULIP Charges:

In Unit Linked Insurance Plans, policyholders need to pay different types of charges, some of which are as mentioned below.

Premium Allocation Charge:

This is a fixed amount that is deducted from the premiums paid. In most cases, premium allocation charges are higher in the first few years of the policy. However, this amount can vary depending on whether the policy is a single premium plan or a regular plan, premium amount, premium frequency, premium payment mode, etc.

Policy Administration Charge:

This monthly charge is to cover the costs of administering your policy. This is generally deducted by canceling units proportionately from the fund you have chosen to invest in. This charge can either be levied at a fixed rate or as a percentage of your premium.

Fund Management Charge:

This is the fee that the insurance company imposes for managing the various funds in the ULIP. This is a daily charge that’s deducted before arriving at the NAV figure. In most cases, insurers charge higher fees for equity funds, while the charge on non-equity funds is relatively lower.

Mortality Charge:

This charge goes towards the insurance coverage under the plan. The mortality charge is based on factors such as age and sum assured and is deducted monthly.

Switching Charge:

You can switch your funds for free up to a specific limit per year, but any switches beyond that may come with a charge. This charge is deducted by canceling units from the fund you have chosen to invest in.

Partial Withdrawal Charge:

You are allowed to make a partial withdrawal from your ULIP after the five-year lock-in period is completed. Some insurers will allow you to make unlimited partial withdrawals, while others may only allow up to 2-4 free withdrawals.

Discontinuation Charge:

A policyholder who discontinues the ULIP scheme before the lock-in period of 5 years would have to pay this charge.

Surrender charge:

This charge is applied when someone withdraws from their ULIP prematurely – either in full or partially. The charges are a percentage of the fund’s value and change depending on how many years have passed since the policy was purchased.

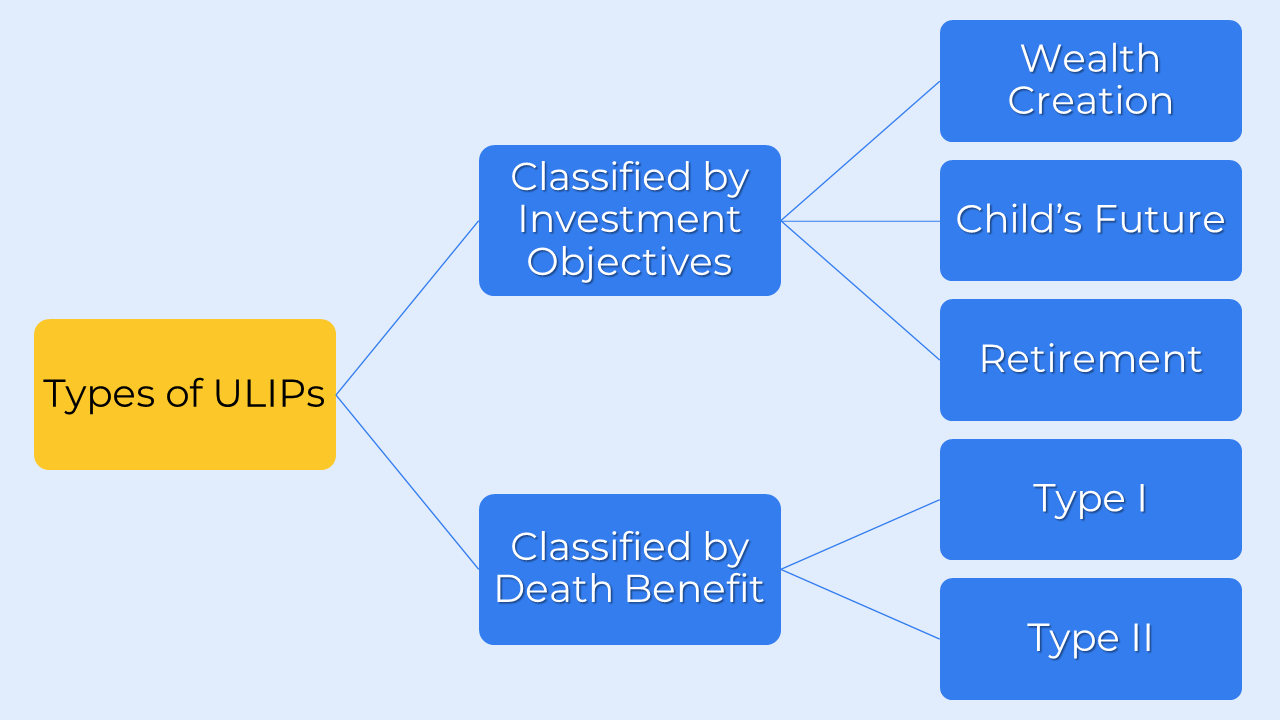

Types of ULIPs:

ULIPs can broadly be categorized based on the following parameters.

- The funds that you invest in

- Investment objectives

- Death benefit

Let’s discuss each category in detail below.

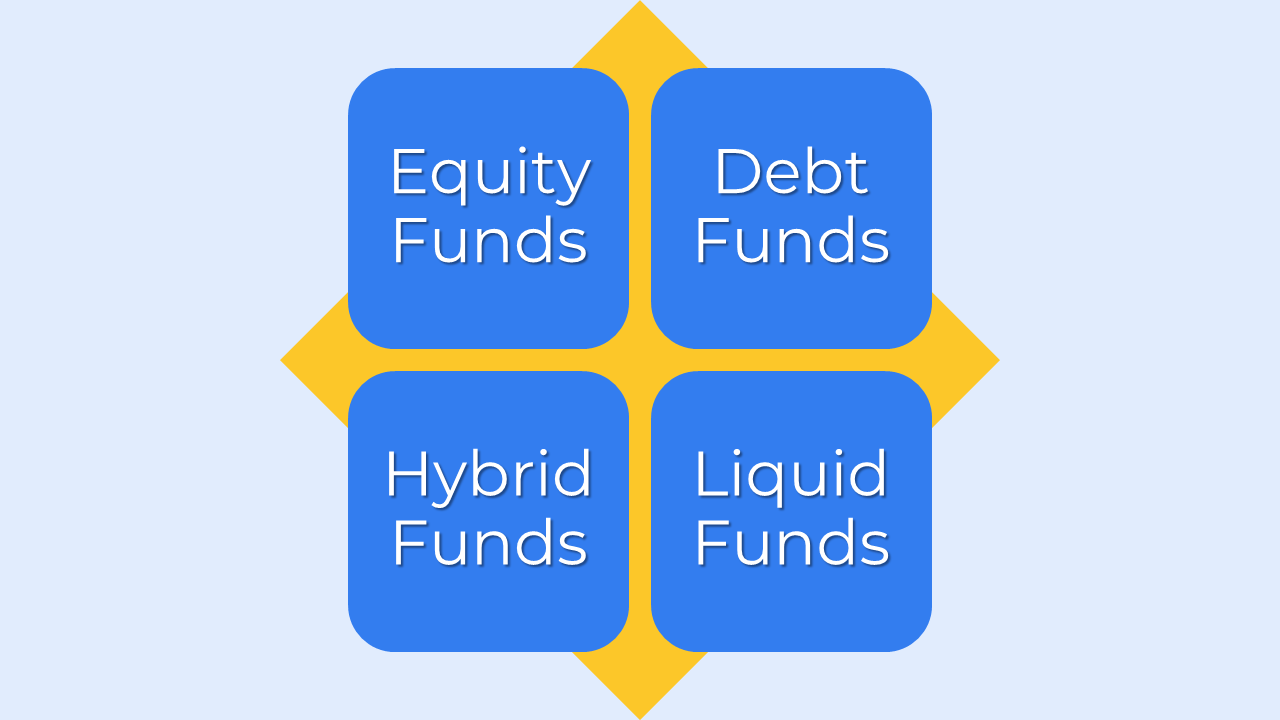

Types of ULIPs Categorised by the funds that you invest in:

Equity Funds: Equity-oriented funds are best suited for investors who don’t mind high risk and whose primary goal is capital appreciation. Here, the primary investment made is in company stocks and equity.

Debt Funds: In this type, the premium is invested in debt instruments, such as corporate bonds and government securities. The return is lower than other types, but the risk is also lower.

Balanced or Hybrid Funds: These funds are a combination of equity-oriented funds and fixed-interest instruments. Your invested capital is distributed between high-risk equities and low-risk funds.

Liquid Funds: These are also known as money market funds or cash funds. Here the premium is invested in Money Market Funds like investment in bank deposits, money market instruments, treasury bills, commercial paper, etc. It involves low risk.

Types of ULIPs Categorised by Investment Objectives:

Wealth Creation: The wealth creation ULIP is designed to help you achieve your long-term financial goals. This type of life insurance policy is ideal for young adults who want to invest in their future. By buying this Unit Linked Insurance Plan, you will be able to fund your future goals flexibly.

Child’s Future: Child insurance ULIPs offer money in installments at particular intervals to ensure that all child’s financial requirements are taken care of, even in the absence of the parents.

Retirement: In this plan, the insured individual needs to make regular payments while he is still in employment. These payments are gradually accumulated into a corpus, which is then used to provide annuities after the person retires.

Types of ULIPs Categorised by Death Benefit:

Type I ULIP: In the event of the policyholder’s death, this plan pays out the greater of the sum assured or the fund value to the nominee.

Type II ULIP: In the event of the policyholder’s death, this plan pays out the sum assured plus the fund value to the nominee. It is important to keep in mind that the premium amount for Type II ULIPs is higher than that of Type I ULIPs.

Benefits of ULIPs:

A Unit Linked Insurance Plan is a hybrid insurance product that offers many benefits. Some of these benefits include:

Tax Benefits:

The premium paid (including top-up premium) towards the Unit Linked Insurance Plans is eligible for tax deduction under Section 80C of income tax 1961, up to a maximum of ₹1,50,000.

The maturity benefit received under the Unit Linked Insurance Plan is also tax-exempt under Section 10(10D) of the Income Tax Act 1961. Under this section, any sum received by the policyholder as a maturity benefit from a life insurance policy is exempt from income tax. However, for ULIPs issued after February 1, 2021, maturity benefit will be classified as capital gains if the annual premium exceeds ₹2.5 lac. Such policies will be taxed at 10% upon maturity.

Partial withdrawals are also tax-exempt under Section 10(10D) of the Income Tax Act as long as the premium amount does not exceed 10% of the sum assured, and the amount you withdraw is less than or equal to 20% of the fund value.

The death benefit amount your nominee receives is tax exempted under section 10(10D) of the income tax act.

Switching between debt-equity funds does not incur any tax liability.

Market Linked Returns:

ULIPs offer the opportunity to earn market-linked returns by allocating a portion of the premium invested into market-linked instruments such as debt and equity instruments in varying proportions.

Liquidity:

Unit Linked Insurance Plans have a lock-in period of 5 years, after which the policyholder can make partial withdrawals to fulfill short-term financial objectives, like a child’s education or buying a home. This helps the insured take care of immediate expenses. Partial withdrawals are usually free of cost.

Flexibility to optimize Debt to Equity Ratio:

ULIPs are a type of investment that allows the policyholder to have complete freedom in choosing how to invest their money. With ULIPs, you can invest in equity funds, debt funds, or even a mix of both, depending on your preference and risk level. ULIPs also have a fund-switching option which allows you to move your money between two funds during the policy period.

Moreover, depending on your financial conditions, you can invest additional capital into your existing premiums whenever you need or want to.

Freedom to choose your Life Cover:

ULIPs offer policyholders the ability to choose the amount of life cover they want, with most Unit Linked Insurance Plans offering a minimum life insurance cover of 10 times the annualized premium. However, the life cover amount can differ from policy to policy and be as high as 40 times the annual premium or even higher.

Transparency:

Before investing in a ULIP, the insurance company will share important indicators with you, such as the charge structure, the value of the investment, and the estimated rate of return. This way, you can make an informed decision about whether or not a Unit Linked Insurance Plan is right for you.

Dual Benefit of Insurance and Investment:

ULIPs are a great investment option because they offer you the best of both worlds – security, and growth potential. The insurance portion of the plan provides you with a protective life cover. If you survive the entire term of the plan, you receive maturity benefits. Whereas if you do not survive the policy term, your beneficiaries receive death benefits that can help them cope with any financial crises following your demise.

Provides Opportunity for Goal-Based Planning:

ULIPs are designed with the individual’s long-term financial goals in mind. The plan helps the individual to achieve financial objectives such as savings for the child’s education, retirement planning, wealth creation, etc.

Who should invest in ULIP?

ULIPs are versatile investments with many features that make them suitable for investors who fall into the specific classes mentioned below.

You understand what ULIP is: A ULIP is an investment product that allows you to invest in different asset classes and enjoy tax-free growth.

You understand the correlation between risk and return: When it comes to investing, risk and return are two sides of the same coin. You get stable returns if you can manage your investment risk well. ULIPs help you do that automatically.

You need to invest for a long-term financial goal: ULIPs not only offer you the potential for aggressive growth with your savings, but you also have the option to protect your goal.

You want an investment with high liquidity: ULIPs allow you to make partial withdrawals after the five-year lock-in period. This means you can access some of your money if you need it without having to cash in the entire policy.

You want investment transparency: ULIPs are very transparent when it comes to investment portfolios. You can always check where your money is being invested and how it is performing.

How to choose the right ULIP?

There are many insurance providers that offer Unit Link Investment Plans, so it can be challenging to choose the best one for you. However, here are some key points to remember while making your decision.

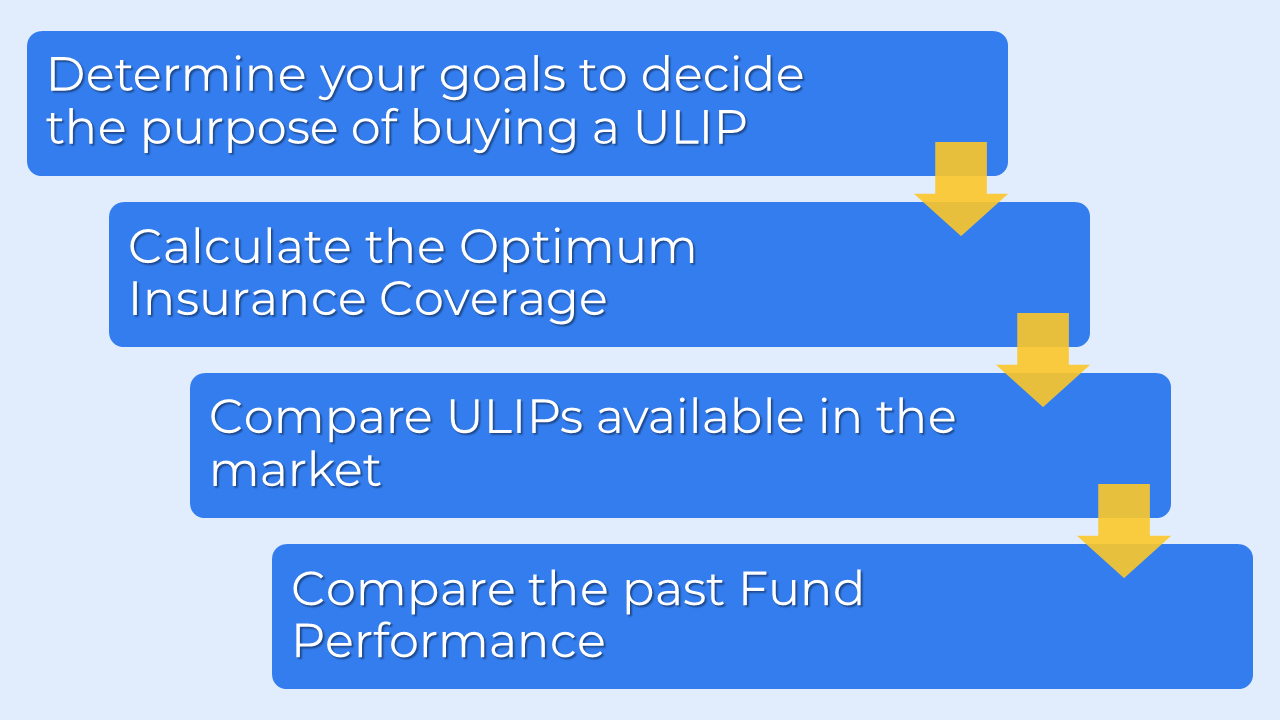

Determine your goals for buying a ULIP:

You need to be clear about the purpose of investing in ULIP. That is why the goals you want to achieve should be clear to you. For example, you may have goals of starting your own venture, your child’s higher education, retirement corpus, and more. You should ask yourself questions like:

- What are my short-term financial obligations?

- What are my long-term financial commitments?

- What are my recurring monthly expenses?

- What is my current savings?

The answers to these questions will help you decide which ULIP suits you most.

Calculate the Optimum Insurance Coverage:

Apart from investment, ULIPs also include a life insurance component. If you die during the policy term, your beneficiaries receive a death benefit. This ensures that your family is taken care of financially in your absence.

When choosing the ULIP, it’s essential to consider your future needs and costs. Financial experts generally recommend that your insurance coverage be 20-25 times your annual income. You can also use a Human Life Value (HLV) calculator to help determine the ideal sum assured of your policy. If you want to be more precise, you can compare your current liquid assets against your current and future liabilities/goals. The difference between the two would be the amount of coverage you need to purchase.

Compare ULIPs Available in the Market:

Once you know your financial goals and the insurance coverage you need, the next step is to do some comprehensive market research. With so many providers offering similar ULIPs today, choosing the right one you can trust is more complex than ever. To compare ULIPs from different providers, consider the features and benefits mentioned below.

- A life cover range offered

- Premium Payment Options available (Single/Regular/Limited)

- Premium Payment Modes available (Annual/Semi-Annual/Quarterly/Monthly)

- An option to switch funds (Number of free switches – higher the better)

- A top-up option to invest surplus money over and above the regular premium

- Various ULIP charges (Lower the better)

- Partial withdrawal of funds in times of need

- Availability of Premium Waiver Benefit (In case of death, future premiums due are waived off.)

You should evaluate the features and benefits offered by each plan and select the one that best suits your needs.

Compare the past Fund Performances:

All insurance companies publish the NAV history of every single fund they invest in on their respective website. You should spend some time researching the historical data available to choose the most suitable fund. When looking at the data, consider both returns and fluctuations/volatility to get a well-rounded idea of the company’s performance.

How to maximize ULIP returns?

Here are a few things you can do to maximize the returns from a ULIP.

Start early:

Starting early is crucial for several reasons. First, it gives your money more time to grow and gives you better returns. Second, a longer investment duration helps to reduce the risk of short-term volatility in the market. Third, since a ULIP is also a life insurance policy, starting early ensures that your loved ones have a life cover to rely on from an early age.

Be disciplined with your investments:

It’s important to invest regularly and be consistent if you want to see greater returns on your investment over time. You can set up standing instructions for automatic premium payments to make sure your Unit Linked Insurance Policy remains active and continues to provide returns.

Rebalance your funds in line with market conditions:

A ULIP allows you to invest in several different types of funds, depending on your risk appetite. You can choose to invest in equity, debt, or balanced funds and switch between them as your needs change. This flexibility allows you to make the most of market conditions and get better returns. For example, you might want to invest in low-risk debt funds when the markets are volatile and in equity funds when the markets are favorable.

Review your portfolio from time to time:

Reviewing your portfolio regularly enables you to monitor your investments and make decisions accordingly to get the most out of your ULIP investments.

Stay invested for a longer duration:

Though the lock-in period for ULIPs is only five years, it’s recommended that you stay invested for a much more extended period of time to get the most out of compounding. Compounding starts to work its magic after about 10-15 years, so if you can, hold onto your investment for a longer duration.

ULIP Myths & Facts:

There are some common myths regarding ULIPs. Some of them are mentioned below.

Myth: ULIPs are costly.

Fact: You can choose how much you want to invest in a ULIP. ULIPs allow you to opt for a premium amount to suit your convenience and needs. ULIPs also offer you the convenience and flexibility to start with a small premium and increase your investment as your circumstances change. Some of the ULIPs in the market don’t have a Premium Allocation Charge.

Myth: ULIPs are risky.

Fact: When you invest in a ULIP, the level of risk you’re exposed to depends on the specific funds you choose to invest in. Equity funds may offer high returns, but they also come with a higher level of risk. If you want to reduce your risk, you can opt for debt or balanced funds. You can choose to invest according to your own risk appetite.

Myth: ULIPs are inflexible.

Fact: ULIPs offer a lot of flexibility to investors. You can choose how much you want to pay as a premium, the premium payment term, and even the frequency at which you wish to pay (monthly, half-yearly, yearly, or all at once). You can also choose the investment funds that you want to invest in and switch between them as per your requirements.

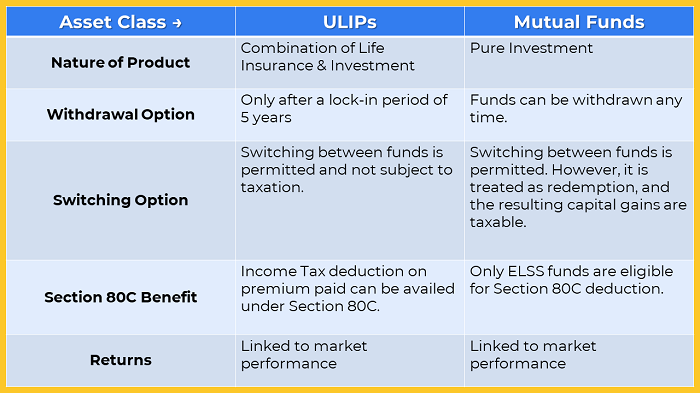

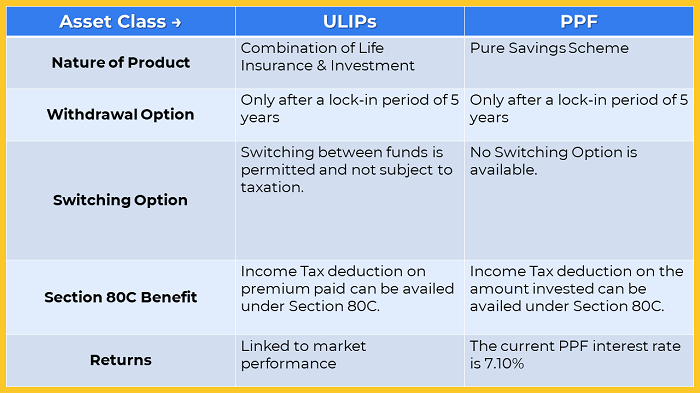

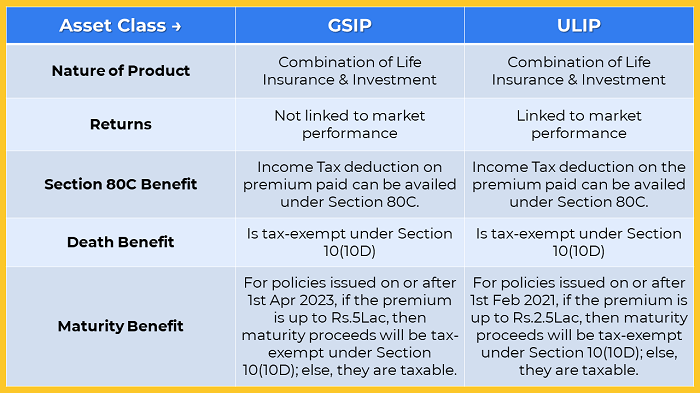

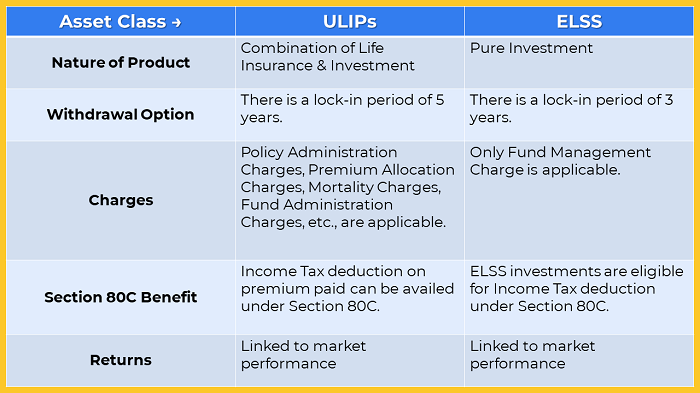

Comparing ULIPs with other Investments:

Kindly refer to the images below to assess and compare NSC with other options.

Best ULIPs to Invest in 2024:

- Aditya Birla Sun Life Fortune Elite Plan

- Bajaj Allianz Future Gain

- HDFC Life Click 2 Wealth

- HDFC Life ProGrowth Plus

- ICICI Prudential Signature

- Max Life Platinum Wealth Plan

- PNB Metlife Smart Platinum

- SBI Life Smart Wealth Assure

Resources:

https://www.policybazaar.com/life-insurance/ulip-plans/

https://groww.in/p/unit-link-insurance-plan-ulip

Frequently Asked Questions:

Is ULIP a good investment option?

Yes, ULIP is a great investment option because it offers both insurance and investment benefits. This makes it ideal for people who want to save money over the long term while also getting insurance coverage.

Are ULIPs risky?

Risk is a subjective concept, and different people have different risk appetites. The good thing about ULIPs is that you can optimize your fund allocation to suit your risk appetite. ULIPs are market-linked products, so there is inherent market risk. However, you can minimize your risk by opting for debt-oriented funds. Always keep in mind that risk and estimated returns are directly proportional to each other.

What is the Sum Assured in ULIP?

The Sum Assured for ULIP is the minimum guaranteed death benefit amount offered by ULIP to the policyholder’s nominee in the event of the policyholder’s death.

What is Fund Value in ULIP?

The Fund Value is the total monetary worth of the units owned by the policyholder. You can calculate the Fund Value on a particular day by multiplying the net asset value (NAV) of each unit on that particular day by the number of units held by the policyholder. The Fund Value can vary based on changes in the NAV.

How to Calculate Fund Value in ULIP?

The Fund Value is calculated by multiplying the Net Asset Value (NAV) of an asset by the number of units held.

Fund Value = NAV X No. of units

What is a Unit in ULIP?

An insurer collects premiums from policyholders and invests the money in selected funds. The total amount of money invested is divided into units, with each Unit having a specific face value. Investors are allocated units based on the amount they have invested. The value of each unit is called the Net Asset Value (NAV).

How to calculate the NAV of ULIP?

Here is the formula to calculate the NAV of ULIP:

NAV = [(Value of Current Assets + Market Value of Investments Held) – (Value of Current Liabilities & Provisions)] / Total number of outstanding units on the date

How much of the premium paid is used to purchase units in ULIPs?

The percentage of your premium that goes towards purchasing units varies from insurer to insurer. ULIPs have various charges, such as Premium Allocation Charges, Policy Administration Charges, etc., that are deducted from your total premium. Once these charges have been deducted, a small percentage of the premium is used to purchase life insurance, and the remaining premium goes towards purchasing units.

What is the Maturity Benefit payable if a ULIP matures?

ULIPs have a Maturity Benefit, which is the amount paid to the policyholder by the insurer if the policyholder survives beyond the policy’s maturity period. This benefit is equal to the fund value of the policy at maturity plus any bonuses.

How to track ULIP performance?

There are two critical parameters to track ULIP performance.

Absolute returns: You can calculate the absolute returns on ULIP by finding the scheme’s current NAV and the initial NAV. This method is best for figuring out ULIP performance over a shorter period of time.

Absolute Returns = [(Current NAV – Initial NAV) / Initial NAV]*100

Compounded Annual Growth Rate (CAGR): This measures the annual growth of an investment over a specific period of time.

CAGR = {[(Current NAV/Initial NAV)^(1/Number of Years)] – 1}*100

When is the right time to invest in ULIPs?

There is no single best time to invest in ULIPs. Individuals with long-term financial plans for wealth growth and insurance should consider Unit Linked Insurance Plans. ULIPs help you grow your money and keep your family secure against emergencies, so whether you are planning for retirement, children’s education, or other long-term financial goals, ULIP can be beneficial.

What is the lock-in period for ULIPs?

ULIPs have a lock-in period of five years.

Is there any withdrawal limit for ULIPs?

The withdrawal limit for ULIPs usually differs from insurer to insurer and is commonly 10-20% of the premium amount. However, if you withdraw a significant amount from your ULIP, your life insurance coverage is more likely to be terminated.

Can I stop ULIP before the completion of the lock-in period?

If you plan to terminate your ULIP investment before the end of the lock-in period, you will have to pay surrender charges. However, you will only receive the payout once the lock-in period is over.

How to stop/cancel/surrender a ULIP?

You can initiate a surrender request with your insurer to cancel your Unit Linked Insurance Policy, but be aware that some charges will be applied. The surrender value offered to you will be based on the fund value at the date of surrender, but you will only receive this amount after the policy’s lock-in period of five years is completed. Even though it’s possible to cancel during the term, experts advise staying invested for at least ten years to get the most benefits from the policy.

When were ULIPs introduced in India?

Unit Trust of India (UTI) first introduced Unit Linked Insurance Products in 1971. Life Insurance Corporation of India (LIC) followed suit by introducing more ULIPs in 1989.

Does LIC have Unit Linked Insurance Plans?

Life Insurance Corporation (LIC) offers three Unit Linked Insurance Plans.

Nivesh Plus

SIIP

New Endowment Plus

Conclusion:

We hope you have found this article on ULIPs beneficial. We try to provide the best content to help you understand all the aspects of life insurance plans and to help educate you on the different options available to you in the market. If you have any questions about ULIPs or other insurance products, please feel free to Contact Us anytime!

Disclaimer:

This article provides general information only and does not constitute financial advice. Financial regulations, product terms, and industry guidelines are revised from time to time. While we have made efforts to ensure the accuracy of the information presented, we do not guarantee its completeness or accuracy. We disclaim any liability for loss or damage arising from actions taken based on the information provided in this article. To make informed financial decisions, please do your own research and consult with a qualified financial professional.

SPREAD THE WORD WITH YOUR NETWORK