The Senior Citizen Savings Scheme (SCSS) is a viable solution, providing regular monthly payouts customized to ensure a comfortable retirement, even in the face of economic fluctuations.

Explore how this scheme can actively safeguard your financial future within the dynamic demographic landscape of India. Please delve further to acquire insights to strengthen your retirement plans.

What is Senior Citizen Savings Scheme?

The Senior Citizen Savings Scheme is a savings vehicle endorsed by the government, tailored for those aged 60 and above. Introduced by the Indian Government in 2004, its primary aim is to furnish senior citizens with a dependable and safe income stream during their post-retirement years.

Distinguished as one of India’s most financially rewarding savings schemes, it presents its participants with notably attractive yields. Adding to its appeal, it enjoys government support, consequently minimizing the potential for any loss of invested capital.

Applications for the Senior Citizen Savings Schemes can be submitted through both postal services and various public or private banks.

SCSS Eligibility:

If you belong to any of the following categories, you meet the criteria for participating in the Post Office Senior Citizen Savings Scheme:

- Indian residents aged 60 years or above.

- Individuals aged between 55 and 60 years who have chosen the Voluntary Retirement Scheme (VRS) or Superannuation.#

- Retired military personnel aged above 50 years but below 60 years.#

#Please ensure that your investment is initiated within one month of receiving retirement benefits.

Documents required for SCSS:

Below are the documents required to open an SCSS account.

- Two recent passport-size photographs.

- Valid proof of identity, including options like PAN Card, Voter ID, Aadhaar Card, or Passport.

- Proof of address, which can be established with documents like an Aadhaar Card or Telephone Bill.

- Verification of age, supported by documents like PAN Card, Voter ID, Birth Certificate, or Senior Citizen Card.

Kindly ensure that all provided documents are self-attested.

How to invest in SCSS?

Steps to Initiate Senior Citizen Savings Scheme:

- Approach the nearest bank branch or post office.

- Complete the application form and furnish the necessary Know Your Customer (KYC) documents.

- Ensure the deposit amount by submitting a corresponding cheque.

- It’s possible to designate nominees for the account.

This outlines the procedure for opening a Senior Citizens Savings Scheme (SCSS) account at a bank or post office.

SCSS Nomination Rules:

Individuals have the choice to appoint a nominee during the SCSS account initiation process or subsequently.

Should the unfortunate demise of the account holder occur before the account reaches maturity, the nominated individual will be entitled to receive the rightful amount.

SCSS Interest Rates:

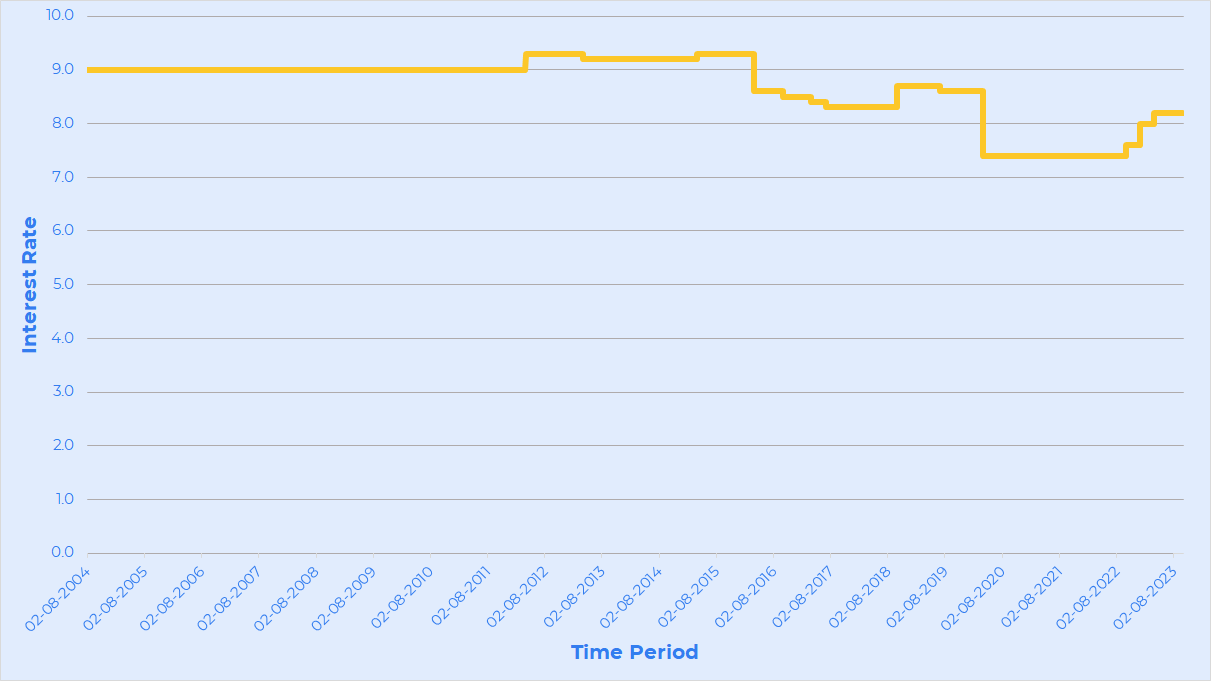

The interest rate for the Senior Citizen Savings Scheme (SCSS) during the second quarter (July-September) of the fiscal year 2023-24 stands at 8.2% per annum. This rate ranks among the most competitive ones provided by fixed-income small savings schemes.

The SCSS interest rate undergoes a quarterly review and is subject to potential modifications. It’s important to note that any alterations in the interest rate exclusively impact new applicants, leaving existing investors unaffected. Interest accrual and disbursement occur on a quarterly basis.

Payments of interest on a quarterly basis are scheduled for the first working day of April, July, October, and January. However, this option for receiving quarterly interest payments is solely available at post offices equipped with Core Banking facilities.

Displayed below are the historical interest rates for the Senior Citizen Savings Schemes.

| Date Range | Interest Rate (% per annum) |

| 01-Apr-2023 to 30-09-2023 | 8.20 |

| 01-Jan-2023 to 31-Mar-2023 | 8.00 |

| 01-Oct-2022 to 31-Dec-2022 | 7.60 |

| 01-Apr-2020 to 30-Sep-2022 | 7.40 |

| 01-Jul-2019 to 31-Mar-2020 | 8.60 |

| 01-Oct-2018 to 30-Jun-2019 | 8.70 |

| 01-Jul-2017 to 30-Sep-2018 | 8.30 |

| 01-Apr-2017 to 30-Jun-2017 | 8.40 |

| 01-Oct-2016 to 31-Mar-2017 | 8.50 |

| 01-Apr-2016 to 30-Sep-2016 | 8.60 |

| 01-Apr-2015 to 31-Mar-2016 | 9.30 |

| 01-Apr-2013 to 31-Mar-2015 | 9.20 |

| 01-Apr-2012 to 31-Mar-2013 | 9.30 |

| 02-Aug-2004 to 31-Mar-2012 | 9.00 |

SCSS Benefits:

Below are the main reasons why the Senior Citizen Savings Scheme is the preferred investment choice for senior citizens.

Assured Returns: As the Senior Citizen Savings Scheme (SCSS) is a government-backed savings initiative, it stands out as one of the most secure and dependable investment alternatives for senior citizens.

Attractive Interest Rate: Boasting an interest rate of 8.2% per annum, the Senior Citizen Savings Schemes emerges as a highly advantageous investment avenue. This interest rate is notably favourable compared to more conventional savings methods like Fixed Deposits (FDs) and Savings Accounts.

Tax Advantages: Senior Citizen Savings Scheme qualifies for a tax deduction under section 80C of the Income Tax Act, permitting individuals to claim up to ₹1,50,000 per annum as a deduction.

Straightforward Investment Process: The process of investing in Senior Citizen Savings Scheme is straightforward. One can initiate an SCSS account at any authorized bank or post office across India.

Regular Interest Disbursement: Senior Citizen Savings Scheme offers the benefit of quarterly interest payouts to account holders, ensuring periodic income additions to your investment. Interest payments are scheduled for the first day of April, July, October, and January in each financial year.

Nationwide Account Portability: The SCSS account can be seamlessly transferred to different locations within India, ensuring flexibility and convenience for account holders.

Extension of Account Tenure: Account holders have the option to extend the initial 5-year tenure of the SCSS account for an additional three years, providing extended investment opportunities.

Disadvantages of Senior Citizen Savings Scheme:

Listed below are the drawbacks of the Senior Citizen Savings Scheme.

Age Requirement: The scheme is exclusively for senior citizens aged 60 and above. This means it’s not available for those wanting to retire early.

Time Limit on Investment: A key downside of the Senior Citizen Savings Scheme is its restricted investment duration. Seniors can invest for up to five years, extendable by three years. This limits their potential for long-term savings growth.

Investment Ceiling: The scheme sets a maximum investment limit of ₹30,00,000/-. This hampers the ability to invest larger amounts, potentially curbing potential earnings.

Returns vs Inflation: The scheme offers relatively low interest rates compared to market-linked options. Although higher than traditional investments, these returns might not outpace inflation or cover rising expenses, affecting seniors’ quality of life.

Taxation on Interest: Interest earned is fully taxable, adding to retirees’ financial burden. This reduced post-tax return affects their stability and retirement planning.

Non-Transferable: Investments can’t be transferred between individuals, even within families. This might pose issues for changing financial circumstances.

Withdrawal Restrictions: Emergency withdrawals can be made only after one year, with penalties. This limits immediate access to funds, which is unsuitable for those needing liquidity.

Limited Accessibility: The scheme is accessible only through specific banks and post offices, posing challenges for remote areas or individuals with mobility concerns.

SCSS Maturity Period:

The Senior Citizen Savings Scheme has a maturity period of 5 years. This can be prolonged by an additional three years, making the total period eight years. To extend the period by three years, individuals should complete Form B and submit it. Such an extension is allowed just once. Following the extension, the prevailing interest rates for that quarter will apply.

For example, let’s consider an individual who invested ₹7,00,000 in Senior Citizen Savings Scheme in April 2012, when the interest rate was 9.3%. When she chose to extend the scheme in April 2017, her applicable interest rate became 7.4%.

Premature Closure of SCSS:

You have the flexibility to withdraw your Senior Citizen Savings Scheme Deposit at any time after opening the account, subject to applicable penalties. The penalty varies depending on when the withdrawal is made.

No interest will be payable if you exit the scheme before completing one year from the account opening date. Also, any interest credited to the account will be deducted from the principal.

If an exit occurs before completing two years from the account opening date, a penalty of 1.5% of the deposit amount will be applied.

If an exit occurs between two years and less than five years from the account opening date, a penalty of 1% of the SCSS deposit will be deducted.

However, it’s important to note that no penalties apply if you close an extended account after one year from the date of extension.

Comparing SCSS with other Post Office Schemes:

Take a look at the pictures below to compare Senior Citizen Savings Scheme with other Post Office Schemes.

*Note that the interest rates for each scheme can change over time. Prior to making an investment, it’s advisable to confirm the current interest rate.

Resources:

https://www.bankbazaar.com/saving-schemes/senior-citizen-saving-scheme.html

https://www.indiapost.gov.in/VAS/DOP_PDFFiles/form/AccountopeningCertificate.pdf

Frequently Asked Questions:

Is it possible for both spouses to open individual SCSS accounts?

Certainly, separate SCSS accounts can be opened for each spouse, as long as the total deposit across these accounts does not exceed ₹30,00,000/-. This, of course, must follow the guidelines of the Senior Citizen Savings Scheme.

How is the joint account holder’s share determined in an SCSS account?

The complete amount is attributed to the primary depositor or applicant. Adding a spouse as a joint account holder doesn’t affect this distribution.

Does the Senior Citizen Savings Scheme qualify for 80C benefits?

Certainly, investments made in the Senior Citizen Savings Scheme are eligible for income tax deduction benefits under Section 80C of the Income Tax Act, 1961.

Is Tax Deducted at Source (TDS) applicable to the interest earned from the SCSS account?

Yes, TDS is applicable on the interest if it surpasses ₹50,000 per annum. Nevertheless, if the interest remains below ₹50,000 in a financial year, TDS will not be deducted provided you submit Form 15G/15H to the post office.

Is it possible for an individual with Power of Attorney to sign on behalf of the nominee in the nomination form?

No, an individual with Power of Attorney is not authorized to sign on behalf of the nominee in the nomination form.

If the first holder or depositor of a joint account passes away before maturity, can the SCSS account be continued?

Certainly, if the demise occurs, the nominee can maintain the account of the deceased depositor as long as it aligns with the regulations of the Senior Citizen Savings Scheme (SCSS).

Is there a prescribed fee for nomination, or for making changes or cancellations to a nomination?

No, there is no fee associated with these processes.

Can funds be withdrawn prematurely from accounts held under the SCSS?

Yes, premature withdrawals are permissible. However, the early closure of a savings account is only allowed after one year, subject to a charge of 1.5% of the Senior Citizen Savings Scheme. This charge decreases to 1% if the withdrawal occurs after two years.

Can Non-resident Indians (NRIs) and Hindu Undivided Families (HUFs) invest in the SCSS?

No, it is not possible for NRIs and HUFs to invest in the Senior Citizen Savings Scheme.

Are Persons of Indian Origin (PIOs) eligible to invest in the SCSS?

No, PIOs are not eligible to invest in the SCSS.

What about an Indian citizen who is moving abroad? Can they continue to maintain their SCSS account?

Yes, if an Indian citizen moves abroad, they can continue to maintain their SCSS account despite being overseas.

Is it possible to transfer an SCSS account from one post office to another?

Yes, an SCSS account can be transferred from one post office to another by utilizing Form G.

Is it possible to extend an SCSS account?

Certainly, a depositor has the option to extend their SCSS account for a period of three years within one year after its maturity.

What happens if an account is opened in violation of the SCSS Rules?

In such a scenario, the account will be closed, the interest will be deducted, and the deposited amount will be returned to the depositor.

What happens to my account in the event of my demise?

If you have an individual SCSS account (with no joint investor) and you unfortunately pass away, your SCSS account will be prepared for closure. To initiate this closure, the nominee of the account holder needs to submit an application in Form ‘F’. The Annexures II & III of this form should be attested by a public notary or the Oath Commissioner.

Is it possible for me to cancel or modify my nomination?

Upon applying for the SCSS account, you have the option to nominate an individual. This can also be done after your account has been operational for a specific period. If you wish to cancel or update the nomination you have previously made, you can achieve this by submitting a new nomination using Form-C to the bank or post office where your SCSS account is held.

My wife is only 47 years old; can I add her as a joint account holder?

Given that you already hold an SCSS account, you have the option to include your spouse as a joint account holder. In this case, your age is what matters for eligibility, not your wife’s. Her age doesn’t impact her ability to be a joint partner in the account. However, the opposite scenario is not feasible, as your wife is currently 47 years old, and the minimum age requirement for owning an SCSS account is 60 years.

What should I consider before opening an SCSS Account?

Prior to opening a Senior Citizens Savings Scheme (SCSS) account, it’s important to ensure that you provide all the required information accurately. If it is determined that the information you have provided is inaccurate or false, the account will be promptly closed. In such a case, the deposited amount will be refunded to you after deducting the interest that has already been credited to the account.

Is it possible to open a SCSS account online?

No, an online application facility is not available for Senior Citizen Savings Scheme. To open an SCSS account, you need to personally visit the post office or bank branch. There, you will need to complete the relevant form and attach it along with KYC documents, age proof, ID proof, address proof, and a cheque for the deposit amount.

How many accounts can I open under SCSS?

You can make a deposit into your SCSS account in a single payment. As an account holder, you have the option to manage multiple accounts under the scheme, with the stipulation that the combined deposits across all accounts must not exceed the maximum limit of ₹30,00,000/-. Additionally, it’s important to note that you cannot initiate the opening of more than one SCSS account within the same deposit branch in a single calendar month.

What is the upper age limit for opening a SCSS account?

Any individual aged 60 or above can open a SCSS account, provided they submit all the necessary documents.

Can a joint SCSS account be opened with any family member?

A joint SCSS account can only be opened by investing with a spouse.

What are the eligibility criteria for a joint SCSS account?

When opening a joint SCSS account, the first depositor should be 60 years or above. There is no age limit for the second applicant. A joint account can only be created with a spouse. However, it’s important to note that the entire amount in a joint account will be attributed solely to the first account holder.

Is it possible for both spouses to open separate SCSS accounts?

Certainly, both spouses can each open individual SCSS accounts, given that both of them are aged above 60 years.

In the case of a joint account, if the first account holder expires before maturity, can the account be continued?

Yes, in the case of a joint account, the spouse can continue the account after the death of the first account holder only if the spouse is above 60 years and does not have another SCSS account. If the spouse is below 60 years, the nominee can continue the account until its maturity, and the account will earn interest till maturity.

Conclusion:

The Senior Citizen Savings Scheme stands out as an excellent investment choice for retirees due to its superior interest rates in comparison to other post office schemes. Moreover, it becomes even more advantageous for individuals seeking tax savings as it qualifies under section 80C.

If you have any questions, don’t hesitate to Contact Us. SecureMyWIsh is committed to help you with unbiased and sound advice.

Disclaimer:

This article provides general information only and does not constitute financial advice. Financial regulations, product terms, and industry guidelines are revised from time to time. While we have made efforts to ensure the accuracy of the information presented, we do not guarantee its completeness or accuracy. We disclaim any liability for loss or damage arising from actions taken based on the information provided in this article. To make informed financial decisions, please do your own research and consult with a qualified financial professional.

SPREAD THE WORD WITH YOUR NETWORK