When it comes to investing, many of us wonder how long it takes for our invested money to double. If you’re one of those curious minds, then the Kisan Vikas Patra might have the answers you seek. In this article, we’ll break down everything you need to know about the Kisan Vikas Patra. By the end, you’ll have a clear picture of whether this investment option is right for you.

What is Kisan Vikas Patra?

In 1988, India Post launched the Kisan Vikas Patra (KVP), a small saving certificate scheme, with the core aim of instilling long-term financial discipline in individuals. Currently, the scheme has been updated to feature a tenure of 115 months, equivalent to 9 years and 7 months.

Investors can start with a minimum amount of ₹1,000/-, and there’s no upper investment limit. By investing a lump sum today, you’re positioned to receive double the amount at the end of the 115-month term. Originally designed for farmers to foster long-term savings, the scheme is now open to all.

Offering a secure savings platform, KVP allows you to securely allocate your funds for a specified duration.

Kisan Vikas Patra Eligibility:

The following individuals are eligible to invest in Kisan Vikas Patra:

- Single adult Indian citizens

- Up to 3 adults jointly*

- Guardians have the authority to invest on behalf of minors or individuals of unsound mind.

- Minors aged ten years and above can invest in their own name.

*Previously, Kisan Vikas Patra (KVP) offered two types of joint certificates: Joint Type A and Joint Type B. In Joint Type A, ownership was shared jointly, and upon the demise of an account holder, the remaining account holders or the sole survivor retained ownership. Conversely, in Joint Type B, any account holder or survivor could access the funds.

In July 2023, the Post Office simplified joint account rules by introducing a single type: Joint Tenancy With a Right Of Survivorship (JTWROS), ensuring equal ownership among account holders. Upon the death of an account holder, the remaining account holders automatically become the sole owners, streamlining the process and eliminating potential disputes.

The new Joint ‘A’ type certificate aligns with the JTWROS account structure, offering a simpler and more convenient option for joint holders of KVPs. It provides clear ownership rights and facilitates a smooth transfer of ownership in the event of an account holder’s death.

What documents are required for Kisan Vikas Patra?

To obtain a KVP certificate, the applicant is required to provide the following documents:

- Form A: This form should be duly filled out and submitted at an India Post Office branch or designated bank.

- Form A1: If the application is being processed through an agent, Form A1 needs to be submitted.

- KYC Documents: Acceptable identification proofs include KYC documents such as Aadhaar Card, PAN card, Passport, Voter’s ID, and Driving License, among others.

Process of investing in Kisan Vikas Patra:

Investing in Kisan Vikas Patra is a straightforward process, detailed below:

- Obtain the application form, Form A, and complete it by providing the necessary information.

- Submit the completed Form A to either the post office or the designated bank.

- In case the investment is facilitated through an agent, the agent should complete Form A1. Both these forms can be downloaded from online sources.

- Compliance with the Know Your Customer (KYC) protocol is essential. This entails furnishing a copy of your identification and address proof, such as a PAN card, Aadhaar card, Voter’s ID, Driver’s License, or Passport.

- After the verification of documents, proceed to make the deposit. This can be done using cash, a locally executed cheque, a pay order, or a demand draft.

- A KVP certificate will be issued immediately unless payment is made via cheque, pay order, or demand draft. Safeguard this certificate, as it will be required during maturity. If preferred, you can request to receive the certificate by email.

How to purchase Kisan Vikas Patra online?

To initiate the online opening of a KVP account, kindly follow the steps below:

- Log in to DOP internet banking.

- Navigate to the “Service Requests” tab located within the “General Services” category, and choose the “New Requests” option.

- Opt for “KVP Account – Open a KVP Account (For KVP)” from the list.

- Specify the minimum deposit amount for KVP and designate the debit account associated with your PO Savings account.

- Access and review the terms and conditions by clicking “Click Here,” accept the stipulations, and proceed to submit the application online.

- Input the transaction password, subsequently selecting “Submit” to finalize the process.

- View or download the deposit receipt for your records.

KVP Nomination:

When it comes to safeguarding the interests of your investments, having a clear understanding of the nomination guidelines is crucial. Here’s a breakdown of the nomination guidelines for KVP.

- Whether you’re a single holder or a joint holder of a KVP certificate, you can designate a nominee during the purchase process by filling out the required details in Form C. This step ensures that in the unfortunate event of the demise of the single holder or all joint holders, the nominee will be entitled to the benefits of the certificate.

- You can also nominate a person at any time after the purchase but before the maturity of the certificate. You just need to complete Form C and submit it to the postmaster or bank officer responsible for the certificate’s registration.

- Notably, nominating someone is not permitted if the certificate is held by or on behalf of a minor. Any such nomination made under these circumstances will be nullified or altered using Form D.

- If you possess multiple KVP certificates registered on varying dates, each nomination, cancellation, or variation requires a separate application. Such applications take effect upon registration and are duly recorded on the respective certificates.

- Initial nominations come at no cost. However, subsequent nominations or cancellations are subject to a fee of ₹20 per application.

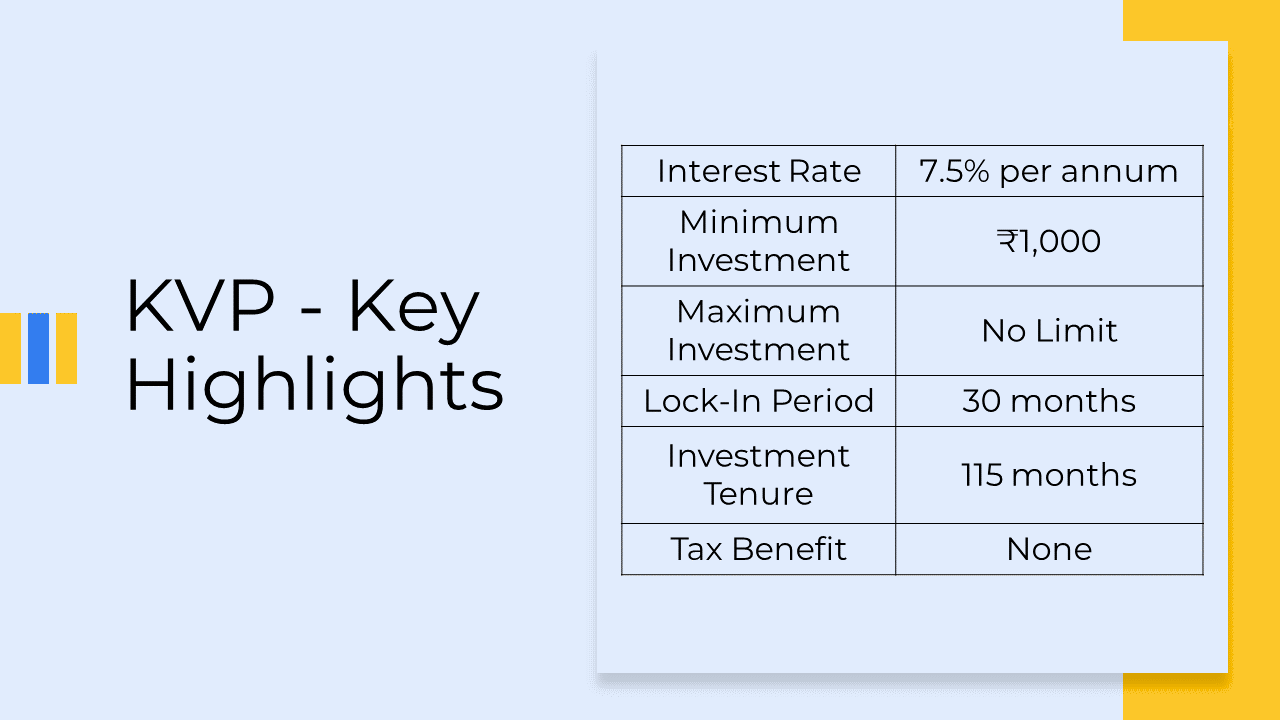

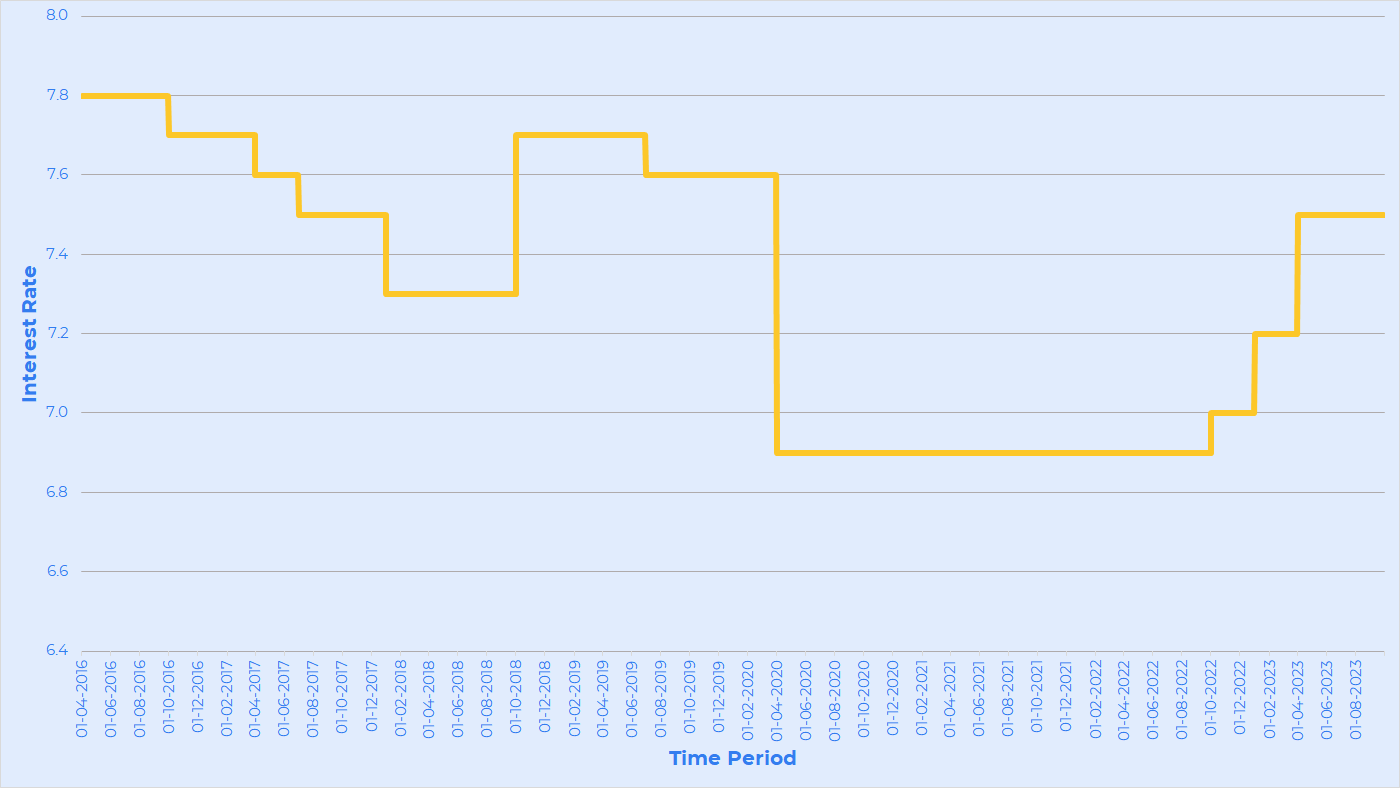

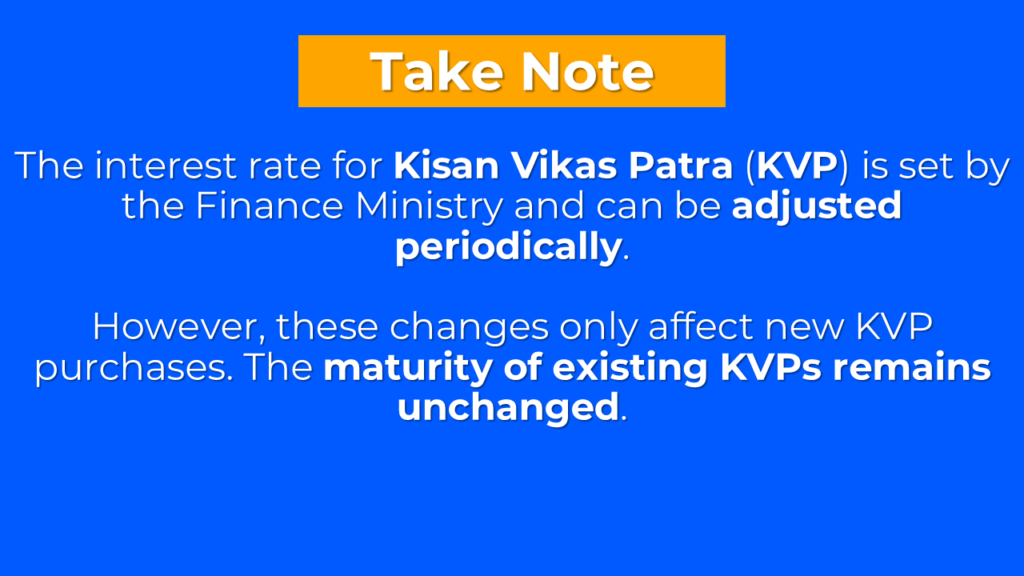

Kisan Vikas Patra Interest Rates:

The interest rate for KVP is subject to periodic adjustments in accordance with announcements from the Finance Ministry. It’s important to note that any alterations in the interest rate do not affect the maturity value of previously issued KVPs. Changes in the interest rate are only applicable to new purchasers of KVP certificates.

The prevailing interest rate for KVP stands at 7.5% per annum, compounded annually. This rate has the potential to double your investment in 115 months. Below are the historical interest rates for the KVP scheme.

| Date Range | Interest Rate (% per annum) |

| 01-Apr-2023 to 30-Sep-2024 | 7.50 |

| 01-Jan-2023 to 31-Mar-2023 | 7.20 |

| 01-Oct-2022 to 31-Dec-2022 | 7.00 |

| 01-Apr-2020 to 30-Sep-2022 | 6.90 |

| 01-Jul-2019 to 31-Mar-2020 | 7.60 |

| 01-Oct-2018 to 30-Jun-2019 | 7.70 |

| 01-Jan-2018 to 30-Sep-2018 | 7.30 |

| 01-Jul-2017 to 31-Dec-2017 | 7.50 |

| 01-Apr-2017 to 30-Jun-2017 | 7.60 |

| 01-Oct-2016 to 31-Mar-2017 | 7.70 |

| 01-Apr-2016 to 30-Sep-2016 | 7.80 |

Benefits of Kisan Vikas Patra:

Outlined below are the key benefits associated with KVP:

- Guaranteed Returns: The scheme assures individuals of a fixed sum, irrespective of market fluctuations. This feature serves as an incentive for increased savings.

- Compounded Interest: The KVP offers an annual compounding interest rate of 7.5%, contributing to the augmentation of the overall returns on the invested sum.

- Flexible Investment Range: Individuals can invest as little as ₹1,000 and scale up as desired. However, amounts exceeding ₹50,000 require PAN details and processing through a city’s head post office.

- Pre-Defined Tenure: With a fixed tenure of 115 months, the KVP matures after this period, providing a lump sum to the holder. If withdrawals are made after maturity, the amount continues to accumulate interest until withdrawn.

- Loan Against Certificate: The KVP allows individuals to secure loans against their investment, using the certificate as collateral. This avenue provides access to lower interest rates for secured loans.

- Nomination Facility: Nominees can be designated by filling out a nomination form, with the option to include minors as well.

- No TDS: Post-maturity withdrawals are exempt from Tax Deducted at Source (TDS), although the KVP doesn’t qualify for tax deductions under Section 80C.

Drawbacks of Kisan Vikas Patra:

Although KVP may provide a twofold increase in the invested sum within 115 months, some factors make it less than an optimal choice for investment, despite the appealing returns it promises.

A significant disadvantage of opting for KVP as an investment is its lack of tax benefits. In contrast to other Post Office Savings Schemes, such as the Public Provident Fund (PPF) or National Savings Certificate (NSC), KVP does not offer any tax deductions under Section 80C of the Income Tax Act. Furthermore, the interest accrued on KVP is liable to taxation, leading to decreased overall returns.

Moreover, although the appealing annual yield of 7.5% might catch one’s attention, it’s crucial to take into account that comparable returns can be attained via alternate investment avenues like bank-offered fixed deposits (FDs). Nevertheless, unlike FDs, Kisan Vikas Patra exhibits relative illiquidity, tying up funds for a predetermined duration. This absence of liquidity can present a notable drawback, particularly during circumstances demanding urgent access to funds.

Kisan Vikas Patra Maturity Period:

As per the latest updates, the KVP matures in 9 years and 7 months, which is 115 months.

After this time, the amount you put in becomes twice as much. For instance, if you invested ₹1,00,000/-, it becomes ₹2,00,000/- when it matures.

Premature Closure of Kisan Vikas Patra:

When it comes to managing your investments wisely, understanding the avenues for early closure of financial instruments is crucial. In the case of KVP, the opportunity for premature closure before the maturity date is available. However, it’s essential to be aware of the specific conditions governing this process.

Sole Account Holder’s Demise and Joint Account Closure: If you hold a KVP in your name alone or jointly with others, the premature closure can be triggered by the unfortunate event of your demise or that of any or all the account holders in a joint account.

Forfeiture by a Gazette Officer Pledgee: A unique provision allows for the premature closure of KVP if it has been pledged as collateral and is forfeited by a pledgee who holds the designation of a Gazette officer.

Legal Intervention and Court Orders: Sometimes, legal matters might lead to the need for early closure. A court order can serve as a directive for the closure of the KVP account.

Time-Dependent Early Closure: After a span of 2 years and six months from the initial deposit date, you gain the option to initiate early closure. This provides a degree of flexibility to address evolving financial needs.

Account Transfer Facilitating Early Closure: The transfer of a KVP account from one individual to another also presents an opportunity for premature closure.

KVP Transfer from one person to another:

Transfer of KVP from one individual to another is permissible solely under the following circumstances:

- Upon the demise of the account holder, the transfer can occur to the nominee or legal heirs.

- In the event of the account holder’s passing, the transfer is allowed to joint holder(s).

- Transfer can transpire upon a court-issued directive.

- Account pledging to the designated authority also warrants a transfer.

Pledging of Kisan Vikas Patra:

To pledge KVP as collateral, complete the designated application form at the relevant Post Office and provide an acceptance letter from the pledgee.

Transfers or pledges can be made to the following entities:

- The President of India or Governor of the State.

- RBI, Scheduled Bank, Co-operative Society, or Co-operative Bank.

- Corporation (public or private), Government Company, or Local Authority.

- Housing finance company.

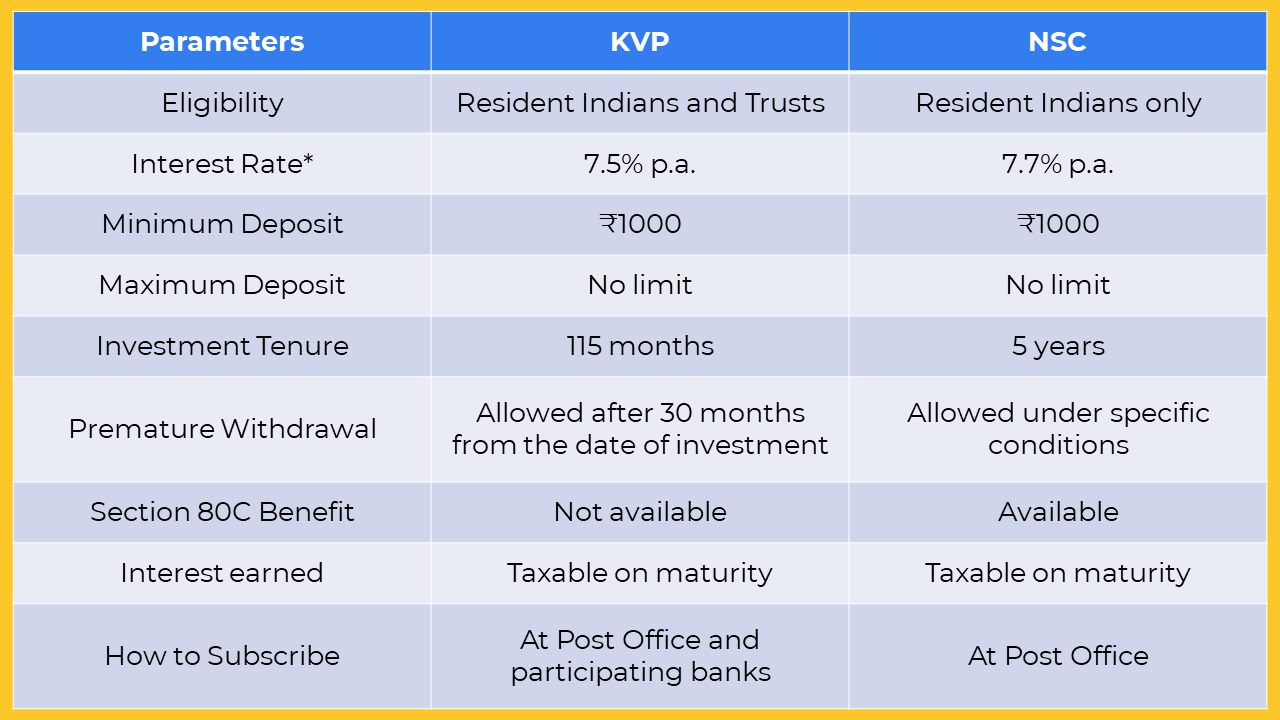

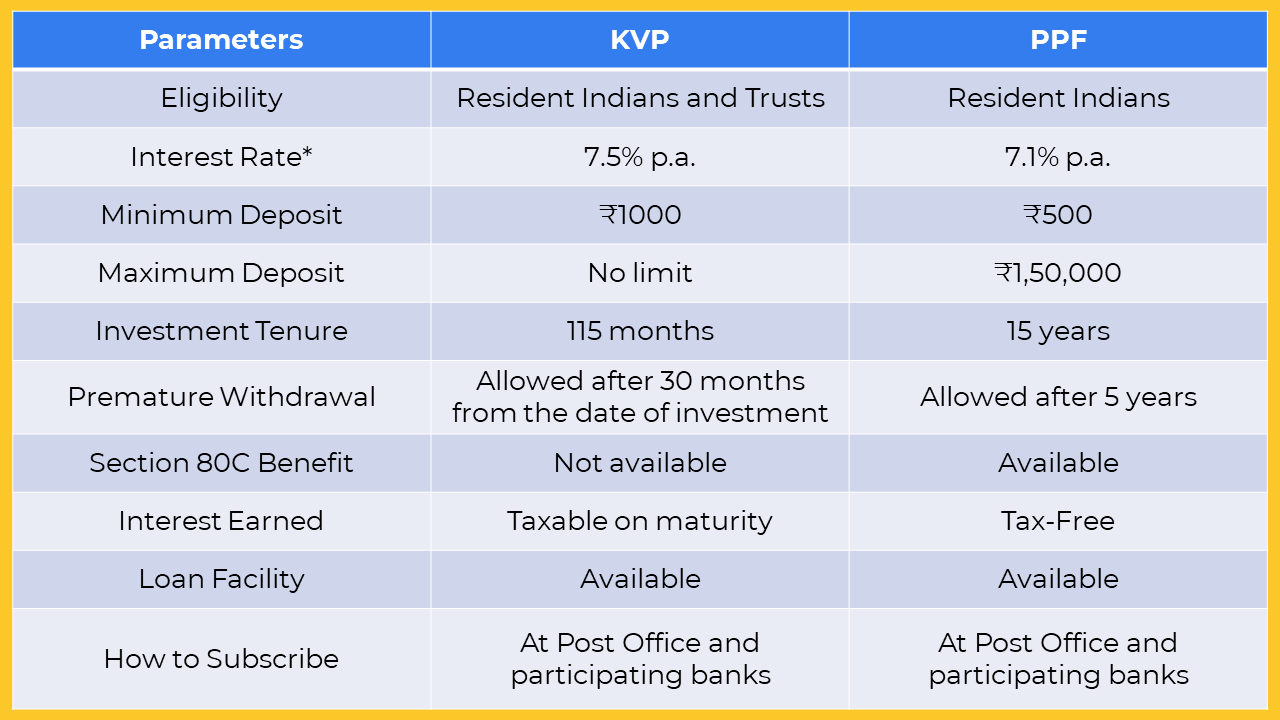

Comparing KVP with other Post Office Schemes:

Kindly refer to the images below to assess and compare KVP with other Post Office Schemes.

*The interest rates for the respective scheme are subject to periodic revisions. Prior to investing, please verify the prevailing interest rate.

Resources:

https://fintra.co.in/english/calculator/21

https://www.indiapost.gov.in/VAS/DOP_PDFFiles/form/AccountopeningCertificate.pdf

Frequently Asked Questions:

What is the launch date of Kisan Vikas Patra?

The KVP scheme was initially introduced in April 1988; however, it was halted in 2011. The Government of India revived the scheme on November 18, 2014.

Can NRIs invest in Kisan Vikas Patra?

No

Can HUFs invest in Kisan Vikas Patra?

No

Can Co-operative Banks/Co-operative Societies invest in Kisan Vikas Patra?

As per Rule 6 of Kisan Vikas Patra, Co-Operative Banks/Co-Operative societies are prohibited from investing in this scheme.

Is it mandatory to have a PAN card and Aadhar card for applying for Kisan Vikas Patra?

According to the recent notification from the Finance Ministry, it is now essential to furnish your Aadhaar number and PAN (Permanent Account Number) when initiating a new KVP account.

Are there any limitations on the investment quantum for Kisan Vikas Patra?

There are no stipulated constraints on the investment amount for KVP account. However, a minimum threshold of ₹1,000/- is obligatory. Subsequently, investments can be made in denominations of ₹1,000/-, ₹5,000/-, ₹10,000/-, and ₹50,000/-. Furthermore, there is no ceiling on the permissible quantity of certificates an individual is entitled to possess.

How long is the lock-in period for Kisan Vikas Patra?

While the KVP account matures in 115 months, the lock-in period for the scheme is 30 months (2 years and six months).

Can I encash Kisan Vikas Patra at any Post Office?

KVP certificates can be conveniently encashed at the post office that issued them. In urgent situations, the holder has the option to encash them at alternate post offices. However, during the encashment process, both the KVP certificate and the identity slip must be presented by the holder.

Is the interest from Kisan Vikas Patra taxable?

The interest earned on Kisan Vikas Patra is subject to taxation on an accrual basis each financial year, categorized as ‘Income from other sources.’ Nevertheless, withdrawals made after the scheme matures are not subject to Tax Deducted at Source (TDS).

What happens if the maturity of a Kisan Vikas Patra is not withdrawn?

If the KVP certificate is not redeemed upon maturity, you will receive the post office savings interest applicable to the entire maturity amount at that time. However, no interest will be paid if the certificate is encashed within a month after maturity.

How to get duplicate Kisan Vikas Patra?

In the event of a loss, mutilated, or stolen Kisan Vikas Patra, the individual can request a duplicate copy from either the post office or the bank where the original certificate was issued. If the application is submitted to a location other than where the certificate was initially issued, it will be redirected to the correct location. The application must include details such as the certificate number, amount, date of issuance, and the circumstances surrounding its loss, defacement, or destruction. The duplicate certificate, once issued, holds the same validity as the original for all intents except that it cannot be encashed without prior verification.

Can I transfer my Kisan Vikas Patra (KVP) from a post office to a bank?

Certainly, your KVP certificate can be transferred between post offices or banks. To initiate the transfer, you need to complete an application using Form B. This form can be submitted at either your current post office or bank. The application needs to be signed by the certificate holder(s), unless it’s a Joint ‘A’ type certificate where one of the joint holders can sign if the other holder is deceased.

What is KVP Customer Care Number?

1800 266 6868

Conclusion:

Kisan Vikas Patra offers guaranteed returns and a chance to double your investment in a specified timeframe. From its flexible investment range to the ease of documentation and nomination, KVP comes with numerous advantages.

Feel free to reach out if this has piqued your interest or left you with questions. We’re here to guide you through the intricacies and help you make informed decisions. Your financial journey matters, and we’re eager to be a part of it.

Disclaimer:

This article provides general information only and does not constitute financial advice. Financial regulations, product terms, and industry guidelines are revised from time to time. While we have made efforts to ensure the accuracy of the information presented, we do not guarantee its completeness or accuracy. We disclaim any liability for loss or damage arising from actions taken based on the information provided in this article. To make informed financial decisions, please do your own research and consult with a qualified financial professional.

SPREAD THE WORD WITH YOUR NETWORK