Introduction:

In the world of investments, there are plenty of options to choose from, each with its own set of features and benefits. Among these, the Post Office Time Deposit Account (POTD), also known as the National Savings Time Deposit Account, stands out as a popular and well-established choice. While it’s open to everyone, the POTD has found particular favour in rural and remote areas of India, where access to traditional banking and investment options may be limited.

Keep reading if you’re curious about the Post Office Time Deposit Account and how it can fit into your investment strategy. This comprehensive guide will delve into the details of this scheme, explaining its features, benefits, and eligibility criteria in a way that’s easy to understand so that you’ll gain valuable insights into this secure and rewarding investment option.

Who can open a Post Office Time Deposit Account?

Individuals: Any adult aged 18 years or older can open a Post Office Time Deposit Account in his own name.

Joint Account Holders: Up to three adults can open a Post Office Time Deposit Account jointly. This can be a Joint A account, where all account holders must sign for transactions, or a Joint B account, where any account holder can sign for transactions.

Guardians on Behalf of Minors: Guardians can open Post Office Time Deposit Accounts on behalf of minors. The minor can take ownership of the account upon reaching the age of 18.

Guardians on Behalf of Persons of Unsound Mind: Guardians can open Post Office Time Deposit Accounts on behalf of individuals who have been declared of unsound mind by a court.

Minors Above 10 Years of Age: Minors above the age of 10 can open Post Office Time Deposit Accounts in their own name with the consent of their guardian.

*Individuals can open any number of Post Office Time Deposit Accounts.

Who cannot open a Post Office Time Deposit Account?

The Post Office Time Deposit Account is a great investment option for individuals seeking secure and rewarding returns. However, certain entities are not eligible to open a POTD account:

Institutional Account Holders: Organizations, businesses, and other institutional entities cannot open POTD accounts. This scheme is exclusively designed for individual investors.

Trust Funds: Trust funds, which are financial arrangements managed for the benefit of designated beneficiaries, are not eligible for POTD accounts.

Regimental Funds: Regimental funds, which are collective funds maintained by military regiments, are not allowed to open POTD accounts.

Welfare Funds: Welfare funds, established to provide financial assistance or support to specific groups or causes, are not eligible for POTD accounts.

If you fall into any of these categories, you will not be able to open a Post Office Time Deposit account. However, there are numerous other investment options available that may be suitable for your financial needs. Consult with a financial advisor to explore your options and make informed investment decisions.

Understanding Post Office Time Deposit Account Interest Rates:

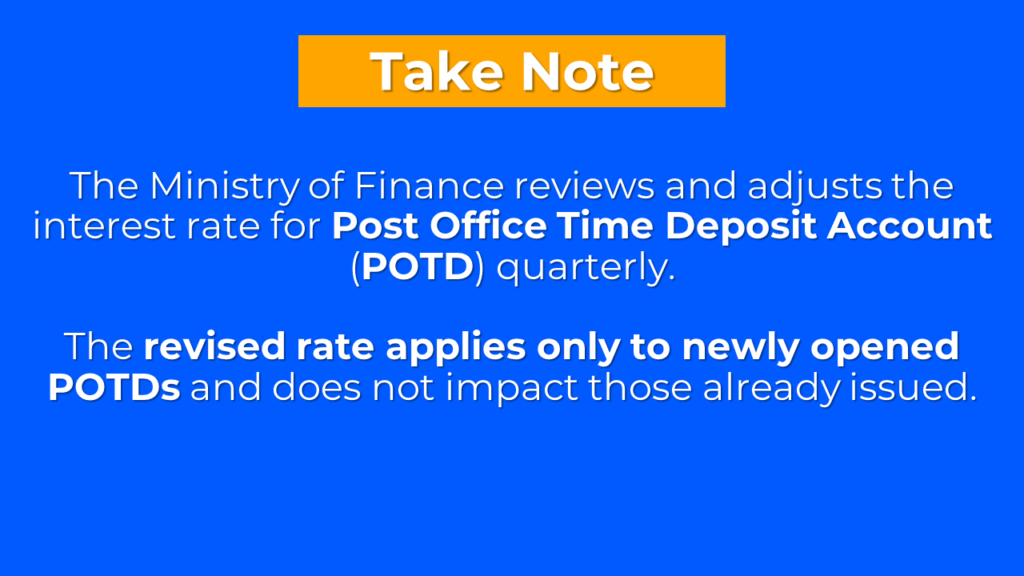

The interest rates for the Post Office Time Deposit Account are determined by the Indian Finance Ministry at the beginning of each financial year’s quarter. This decision is based on the yield of government securities and typically includes a spread over the government-sector yield.

Here’s a breakdown of the interest rates applicable for Post Office Time Deposit accounts from October 1, 2023, to December 31, 2023:

Keep in mind that these interest rates are subject to quarterly reviews by the Finance Ministry. This ensures that the POTD remains an attractive and competitive investment option while aligning with current market conditions.

If you prefer not to withdraw the interest earned on your Post Office Time Deposit Account (POTD) annually, you have a couple of convenient options:

Redistribute to Your Savings Account: You can instruct the post office to automatically transfer your POTD interest to your Post Office Savings Account, where it will continue to earn interest at the current savings account rate, which is currently 4% per annum. However, this option is not available for POTD accounts with a 1-year tenure.

Direct Interest to a Recurring Deposit: Alternatively, you can choose to redirect your POTD interest to a 5-year recurring deposit account in the same post office or bank. This option essentially allows you to use your earned interest to make regular monthly instalments towards a recurring deposit. To opt for this option, you’ll need to submit a fresh application to the post office or bank before the interest payment due date.

These flexible options give you control over how you handle the interest earned on your Post Office Time Deposit Account, allowing you to maximize your savings potential and align with your financial goals.

Key Features of National Savings Time Deposit Accounts:

Flexible tenure options: Choose from 1, 2, 3, or 5-year account terms to suit your savings goals.

Investment range: Open an account with a minimum deposit of ₹1,000/-, in multiples of ₹100. There is no maximum investment limit, allowing you to invest as much as you need.

Annual interest payments: Receive yearly interest payments on your invested amount. However, additional interest will not be accrued on unpaid interest amounts.

Convenient interest crediting: Opt to have your annual interest credited directly to your savings account for hassle-free management.

Tax benefits: Investments under 5-year Time Deposit Accounts qualify for tax deductions under Section 80C of the Income Tax Act, 1961.

When does a Time Deposit Account mature?

Your deposit amount will be repaid to you upon the completion of the chosen account term, which can be 1, 2, 3, or 5 years from the date of account opening.

Account Extension:

Upon maturity, depositors can choose to extend their Time Deposit (TD) account for another term of the same duration as the initial account period.

Extension timeframe: TD accounts can be extended within the following prescribed periods from the date of maturity:

- 1-year TD: Within 6 months of maturity

- 2-year TD: Within 12 months of maturity

- 3-year/5-year TD: Within 18 months of maturity

Extension request at account opening: Depositors can request an extension at the time of opening the account.

Extension process after maturity: Submit the prescribed application form along with your passbook at the concerned Post Office to extend an account after maturity.

Applicable interest rate: The interest rate applicable to the respective TD account on the day of maturity will continue to apply for the extended period.

Premature Account Closure:

Early withdrawal restriction: Deposits can only be withdrawn after the completion of six months from the date of deposit.

Interest calculation for premature closure after 6 months: If the TD account is closed prematurely after six months but before one year, interest will be calculated at the Post Office Savings Account interest rate.

Interest calculation for premature closure of 2/3/5-year TD accounts: For 2/3/5-year TD accounts closed prematurely after one year, interest will be calculated as follows:

- For completed years: 2% less than the TD interest rate for the respective tenure (1/2/3 years)

- For the remaining part of the year: Post Office Savings Account interest rate

Premature closure procedure: To close a TD account prematurely, submit the prescribed application form along with your passbook at the concerned Post Office.

Pledging of Post Office Time Deposit Account:

Pledging or transferring a TD account: Depositors can pledge or transfer their National Savings Time Deposit Accounts as security by submitting the prescribed application form at the concerned Post Office along with an acceptance letter from the pledge.

Eligible pledgees: TD accounts can be pledged or transferred to the following entities:

- The President of India/Governor of the State

- RBI/Scheduled Bank/Co-operative Society/Co-operative Bank

- Corporation (public/private)/Government Company/Local Authority

- Housing Finance Company

How to open a Post Office Time Deposit Account Online?

If you’re already a Post Office Savings Account holder registered for Indian Post Office Internet banking services, you can conveniently open a Post Office Time Deposit Account online. Here’s a straightforward guide to walk you through the process:

Step 1: Visit the Indian Post eBanking Website

Launch your web browser and head to the official Indian Post eBanking website:

Step 2: Log In Using Your Registered Credentials

On the eBanking homepage, locate the “Log In” button. Enter your registered “User ID” and the captcha code provided on the screen. Once you’ve entered the correct details, click “Log In” to proceed.

Step 3: Access the Service Request Option

Once you’ve successfully logged in, navigate to the “General Services” tab. Within this tab, you’ll find the “Service Request” option. Click on this option to initiate the POTD account opening process.

Step 4: Follow On-Screen Instructions

The eBanking portal will guide you through the remaining steps of opening a POTD account. Carefully follow the on-screen instructions, providing the necessary information and selecting the desired account tenure and deposit amount.

Step 5: Complete the Application Process

Review the details carefully to ensure accuracy once you complete the online application form. Then, submit the application by clicking on the designated button.

Before embarking on the online application process, ensure you have the following:

- An active Post Office Savings Account

- Registration Credentials for Indian Post Office Internet Banking Services

- A valid government-issued ID proof (e.g., Aadhar card, PAN card)

- Your mobile number linked to your registered Post Office Savings Account

With these prerequisites in place, you can seamlessly open a Post Office Time Deposit Account online and start enjoying the benefits of this secure and rewarding investment option.

How to open a Post Office Time Deposit Account Offline?

If you prefer the traditional approach to opening a Post Office Time Deposit Account (POTD), follow these simple steps:

Step 1: Acquire the POTD Application Form

You can obtain the POTD application form in two ways:

- Conveniently download the form from the Indian Post website.

- Visit your nearest post office and request a physical copy of the form.

Step 2: Gather Required Documents

Along with the completed application form, you’ll need to provide the following documents:

- Valid Government-Issued ID Proof: Aadhar card, PAN card, or Voter ID

- Recent Passport-Size Photograph: Attach two recent passport-size photographs

- Proof of Address: Utility bill, rent agreement, or bank statement

Step 3: Submit the Application and Make Initial Deposit

With the duly filled application form and supporting documents, head to your preferred post office. Submit the application and make the initial deposit of a minimum of ₹1,000.

Step 4: Account Opening Confirmation

Once you’ve completed the application process and made the initial deposit, you’ll receive confirmation of your POTD account opening. The post office will provide you with an account passbook and any necessary account details.

Additional Considerations:

- Ensure you have all the required documents before visiting the post office.

- Carry the initial deposit amount in cash or a valid cheque.

- Keep your account passbook safe for future reference and transactions.

By following these simple steps, you can seamlessly open a National Savings Time Deposit Account offline and start earning attractive returns on your investment.

Tax implications of Post Office Time Deposit Accounts:

Post Office Time Deposit Accounts offer a unique blend of secure savings and potential tax benefits. Let’s break down the tax implications of this investment option:

Tax Deduction at Source (TDS): Unlike other investment options, POTD accounts do not involve tax deductions at source (TDS). This means that the interest earned on your POTD account is not subject to automatic tax withholding, allowing you to receive the full amount of interest.

Taxation of Interest Income: The interest earned on your POTD account is added to your total annual income in the year of receipt. This means that you’ll need to include it in your tax return and pay taxes as per your applicable tax slab.

Tax Benefits for 5-Year Deposits: A significant advantage of POTD accounts is the tax benefit available for 5-year deposits. Under Section 80C of the Income Tax Act, you can claim a tax deduction of up to ₹1,50,000 per annum on the amount invested in a 5-year POTD account. This deduction can reduce your overall taxable income, potentially lowering your tax liability.

By understanding these tax implications, you can make informed decisions about your POTD investments and maximize the potential benefits.

Who should consider Post Office Time Deposit Accounts?

Post Office Time Deposit Accounts offer a compelling combination of security, competitive interest rates, and potential tax benefits, making them an attractive option for a wide range of investors. Here’s a breakdown of who can particularly benefit from POTD investments:

- Seeking Alternatives to Bank Fixed Deposits: POTD accounts are worth considering if you’re looking for alternatives to traditional bank fixed deposits. They often offer higher interest rates than comparable bank fixed deposits, allowing you to earn more on your invested funds.

- Risk-Averse Investors with a Preference for Guaranteed Returns: POTD accounts are particularly suitable for ultra-conservative investors prioritizing security and guaranteed returns over high-risk investment options. The fixed interest rates and government backing of POTD accounts provide stability and assurance that appeal to risk-averse investors.

- Long-Term Investors Seeking Tax Benefits: POTD accounts with a 5-year tenure offer tax benefits under Section 80C of the Income Tax Act. This means you can claim tax deductions on your 5-year POTD investments, potentially reducing your overall tax liability.

- Individuals Seeking Diversification: Diversifying your investment portfolio is crucial for managing risk and potentially enhancing returns. POTD accounts can serve as a valuable component of a diversified portfolio, balancing safety and potential growth.

- Rural and Remote Residents with Limited Banking Access: POTD accounts are particularly accessible in rural and remote areas where traditional banking options may be limited. This makes them an attractive option for individuals in these regions who want to invest their savings securely and earn competitive returns.

- Investors Seeking Government-Backed Security: POTD accounts are backed by the Government of India, providing a high level of security for your investments. This government backing offers peace of mind and reduces the risk of potential losses.

Post Office Time Deposit Accounts cater to a wide range of investors, from those seeking alternatives to bank fixed deposits to risk-averse investors prioritizing guaranteed returns. With their competitive interest rates, potential tax benefits, and government backing, POTD accounts offer a secure and rewarding investment option.

Frequently Asked Questions:

Is the nomination facility available with POTD?

The nomination facility is available for Post Office Time Deposit Accounts. This allows you to designate one or more individuals to receive your account balance in case of your untimely demise.

Are Post Office Time Deposit investments as safe as FDs?

POTD investments are generally considered safer than traditional fixed deposits (FDs) due to the sovereign guarantee provided by the Government of India. This means that your principal investment amount and the interest earned are backed by the government, offering a higher level of security compared to regular bank FDs.

Can I avail of tax benefits by investing in Post Office Time Deposit?

Yes. Tax benefits are available for POTD investments but only for those with a tenure of 5 years. Under Section 80C of the Income Tax Act, you can claim a tax deduction of up to ₹1,50,000 per annum on the amount invested in a 5-year POTD account. This deduction can reduce your overall taxable income, potentially lowering your tax liability.

Can I transfer my POTD Account from one post office to another?

Yes. You can transfer your POTD Account from one post office to another. You can either submit a manual application form at the post office or use the prescribed SB10(b) form. The process is relatively straightforward and ensures the seamless transfer of your account details and funds to the new post office.

Conclusion:

In conclusion, the Post Office Time Deposit Account stands out as a secure and rewarding investment option, offering competitive interest rates with government backing. If you’re seeking a safe and reliable avenue for your savings, consider exploring the POTD. For any further inquiries or clarifications, please feel free to Contact Us.

Disclaimer:

This article provides general information only and does not constitute financial advice. Financial regulations, product terms, and industry guidelines are revised from time to time. While we have made efforts to ensure the accuracy of the information presented, we do not guarantee its completeness or accuracy. We disclaim any liability for loss or damage arising from actions taken based on the information provided in this article. To make informed financial decisions, please do your own research and consult with a qualified financial professional.

SPREAD THE WORD WITH YOUR NETWORK