Introduction:

In a significant move to promote financial inclusion and empower women and girls, Union Finance Minister Nirmala Sitharaman introduced the Mahila Samman Savings Certificate in her 2023-24 Budget Speech. The Mahila Samman Savings Certificate (MSSC) was launched to commemorate the Azadi ka Amrit Mahotsav, and it specifically caters to the needs of women and girls, offering a secure and lucrative avenue for saving money.

Let’s delve into the intricacies of MSSC and explore its potential to transform the financial landscape for women and girls across India.

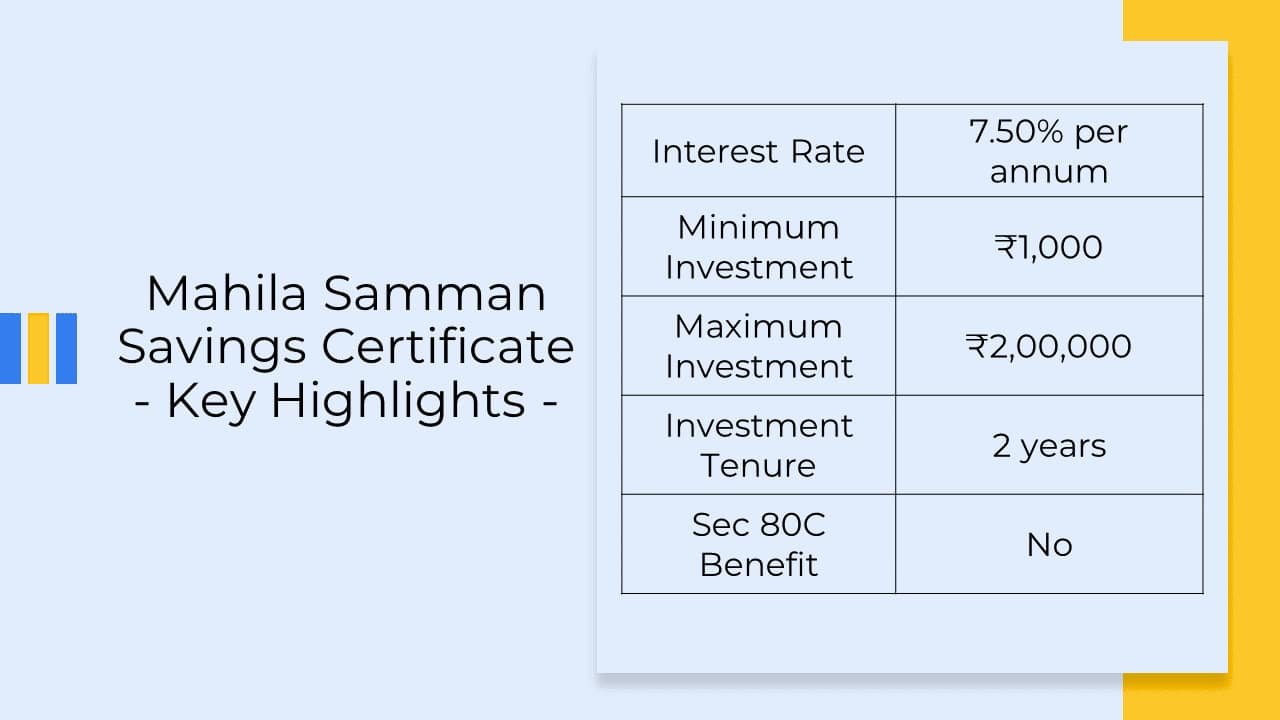

Mahila Samman Savings Certificate – Key Highlights

Who can invest in Mahila Samman Savings Certificate?

The Mahila Samman Savings Certificate can be purchased by:

- Women of all ages can purchase MSSC in their own name.

- Guardians can buy MSSC on behalf of their minor daughters.

Deposit details for the Mahila Samman Savings Certificate:

Minimum Deposit: The minimum deposit amount is ₹1,000.

Maximum Deposit: The maximum deposit amount is ₹2,00,000. This applies to each account individually, as well as the total amount across all MSSC accounts held by the same account holder.

Additional Account Opening: An account holder can open a second MSSC account after a minimum gap of three months from the opening of the existing account.

Interest Rate Structure & Terms for Mahila Samman Savings Certificate:

Interest Rate: A fixed interest rate of 7.5% per annum applies to MSSC.

Interest Compounding: Interest is compounded quarterly, which means it is calculated every three months.

Interest Payment: The accumulated interest is credited to the account holder’s account and paid at the time of account closure.

Non-compliant Accounts: A standard Post Office Savings Account interest rate will be applicable for an account opened or a deposit made in violation of the scheme’s rules.

Does MSSC offer a partial withdrawal option?

The Mahila Samman Savings Certificate offers a partial withdrawal facility, allowing account holders to withdraw up to 40% of their eligible balance one year after the account opening date. This enables account holders to access their funds when needed while still maintaining a significant portion of their savings.

Premature closure of the Mahila Samman Savings Certificate:

The Mahila Samman Savings Certificate allows for premature closure under specific circumstances:

Death of the account holder: In the unfortunate event of the account holder’s death, the account can be prematurely closed, and the accumulated interest will be paid on the principal amount at the scheme’s interest rate of 7.5%.

Life-threatening illness of the account holder: If the account holder is diagnosed with a life-threatening illness, the account can be prematurely closed, and the accumulated interest will be paid on the principal amount at the scheme’s interest rate of 7.5%.

Death of the guardian: If the guardian of a minor account holder passes away, the account can be prematurely closed, and the accumulated interest will be paid on the principal amount at the scheme’s interest rate of 7.5%.

Premature closure without reason: After six months of account opening, the account holder can prematurely close his account without providing a specific reason. However, in this case, the interest rate will be reduced by 2% from the scheme’s interest rate, resulting in an interest rate of 5.5%.

What do I get on the Maturity of MSSC?

Upon completion of the two-year tenure, the Mahila Samman Savings Certificate matures, and the eligible balance, encompassing the principal amount and accrued interest, is paid to the depositor.

How to invest in Mahila Samman Savings Certificate?

Women and guardians of minor girls can apply for MSSC at post offices and authorised scheduled banks.

Applying for MSSC at a Post Office:

Download the application form: You can either download the “Application for purchasing the certificate” form from the official Indian Post website or obtain it from your nearest post office branch.

Fill in the details: Fill out the post office address under the “To The Postmaster” section. Provide your name and specify the account as “Mahila Samman Savings Certificate.”

Complete account information: Enter the account type, payment details, and personal information.

Provide declaration and nomination details: Fill out the declaration and nomination sections as required.

Submit the application and documents: Submit the completed application form along with the necessary documents to the post office.

Make the deposit: Deposit the initial amount, which must be at least ₹1,000, in cash or through a cheque.

Receive the certificate: Upon successfully completing the application process and deposit, a certificate will be issued that will serve as proof of your investment in the MSSC.

Applying for MSSC at a Bank:

Download the application form: Visit the official website of the participating bank or visit your nearest bank branch to obtain the “Mahila Samman Savings Certificate Application” form.

Complete the application form: Fill out the required details on the application form, including your personal information, contact details, and nominee information.

Provide declaration and nomination details: Carefully fill out the declaration and nomination sections as required.

Submit the form and documents: Submit the duly filled application form along with the necessary documents to the bank branch.

Make the initial deposit: Deposit the minimum initial amount of ₹1,000 into the scheme opening account. You can make the deposit in cash, cheque, or other acceptable modes of payment.

Receive the certificate: Upon successfully completing the application process and deposit, you will receive a certificate that will serve as proof of your investment in the MSSC.

Additional Notes:

- The specific documents required for opening an MSSC account at a bank may vary. It is advisable to check with your bank for the latest requirements.

- Joint accounts can be opened in the names of two or three women.

Documents Required for Opening MSSC Account:

- Duly filled Application Form

- KYC Form

- KYC Documents (Aadhaar card, Voter ID, driver’s license, or PAN card etc.)

- Pay-in-Slip with Deposit Amount or Cheque

For Joint accounts, where two or three women can hold the account together, may require additional documentation. Please inquire with your post office or bank for specific requirements.

Banks Offering Mahila Samman Savings Certificate:

The Mahila Samman Savings Certificate scheme was officially authorized for operation by all public sector banks and qualified private sector banks through an e-gazette announcement issued on June 27, 2023, by the Department of Economic Affairs, Ministry of Finance.

The following is a list of qualified banks offering this scheme:

- State Bank of India

- Canara Bank

- Bank of India

- Punjab National Bank

- Union Bank of India

- Central Bank of India

- Bank of Baroda

- Indian Bank

- UCO Bank

- IDBI Bank

- Bank of Maharashtra

- Oriental Bank of Commerce

- Syndicate Bank

- Dena Bank

- Vijaya Bank

- Indian Overseas Bank

- United Bank of India

- HDFC Bank

- ICICI Bank

- Axis Bank

- Kotak Mahindra Bank

- YES Bank

- IDFC First Bank

- RBL Bank

- AU Small Finance Bank

- Bandhan Bank

Please note that this list may not be exhaustive and may be subject to change. It is always advisable to check with the bank directly to confirm their eligibility criteria and procedures for opening an MSSC account.

TDS Deduction on Maturity Amount of MSSC:

Unlike other fixed deposit schemes, TDS is not deducted from the maturity amount of the MSSC. This is because the interest earned on the Mahila Samman Savings Certificate is below the threshold for TDS deduction, which is ₹40,000 per annum for individuals and ₹50,000 per annum for senior citizens.

Taxation of Interest Earned on MSSC:

The interest earned on MSSC is taxable under the Income Tax Act. However, since TDS is not deducted at source, account holders are responsible for self-assessment and payment of tax on their interest income.

Additional Considerations:

Taxation of Joint Accounts: In the case of joint accounts, the interest income is split equally among the account holders for tax purposes.

Taxation of Minors: If the account holder is a minor, the interest income is taxed in the hands of the parent or guardian who opened the account.

Clubbing of Income: If the account holder has other sources of income, the interest earned on the Mahila Samman Savings Certificate will be clubbed with other taxable income for calculating the overall tax liability.

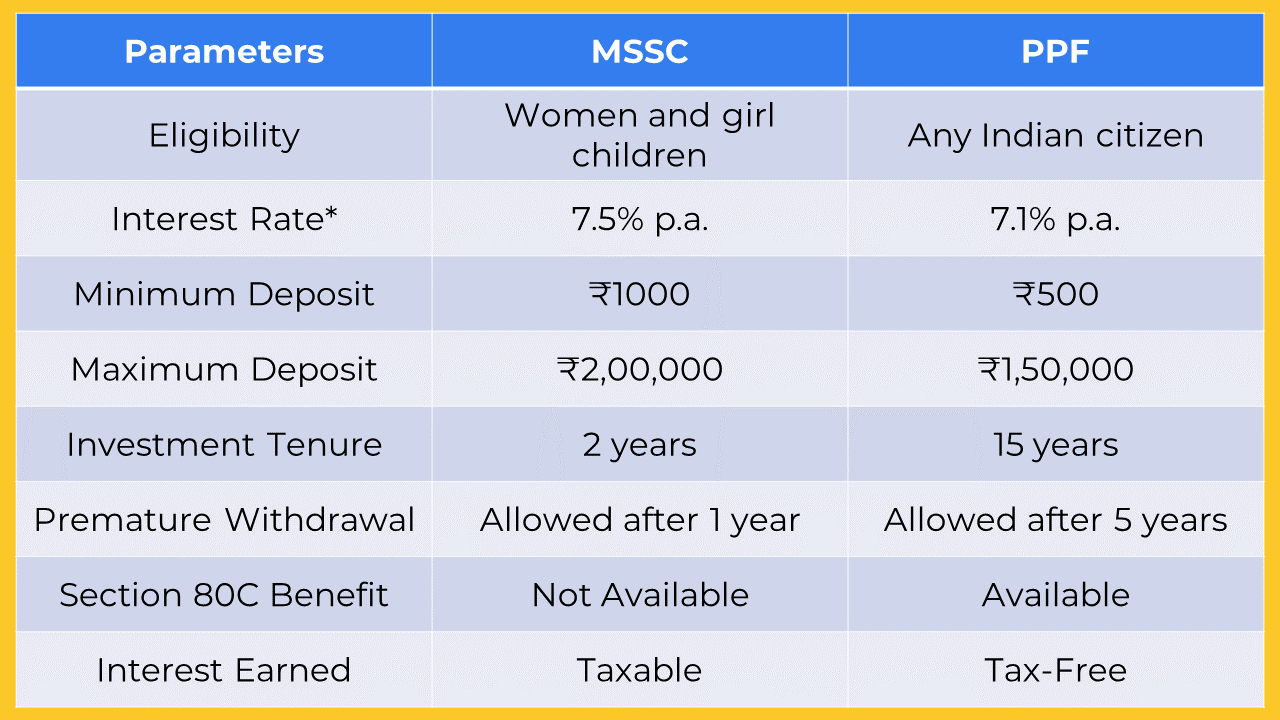

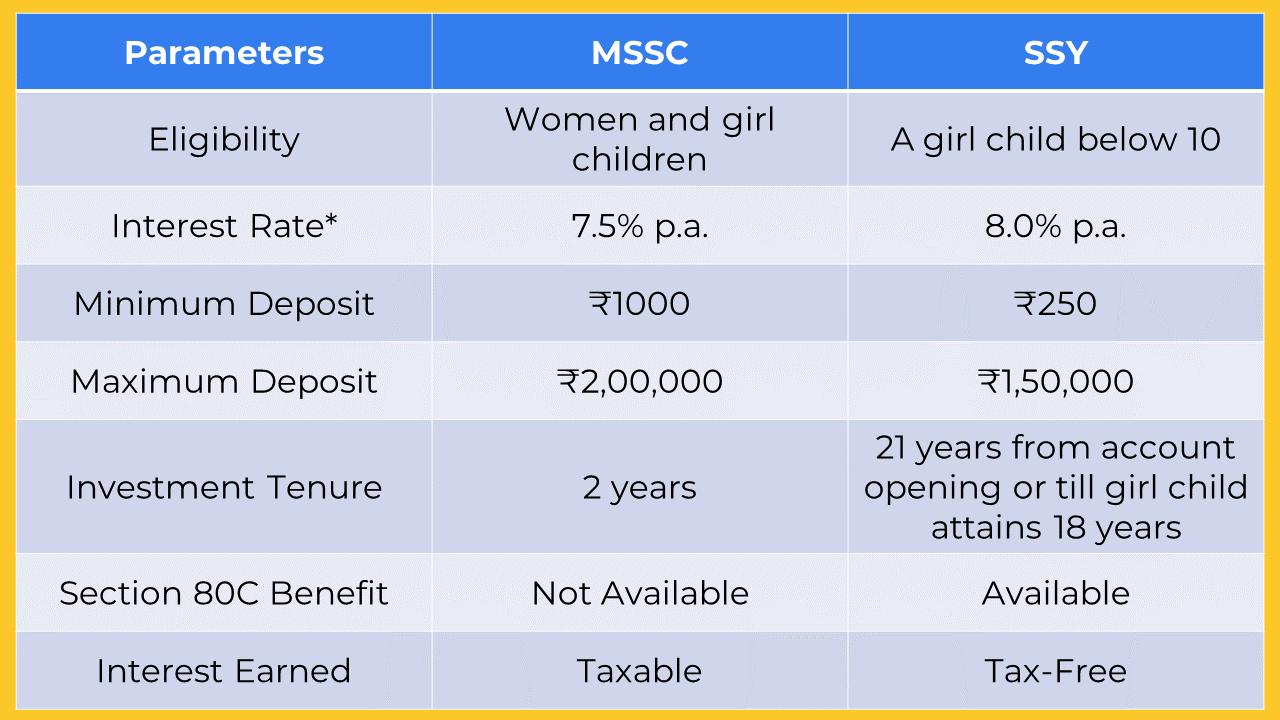

Difference between MSSC and other popular Savings Schemes:

The images below illustrate the key differences between MSSC and other small savings schemes.

Frequently Asked Questions:

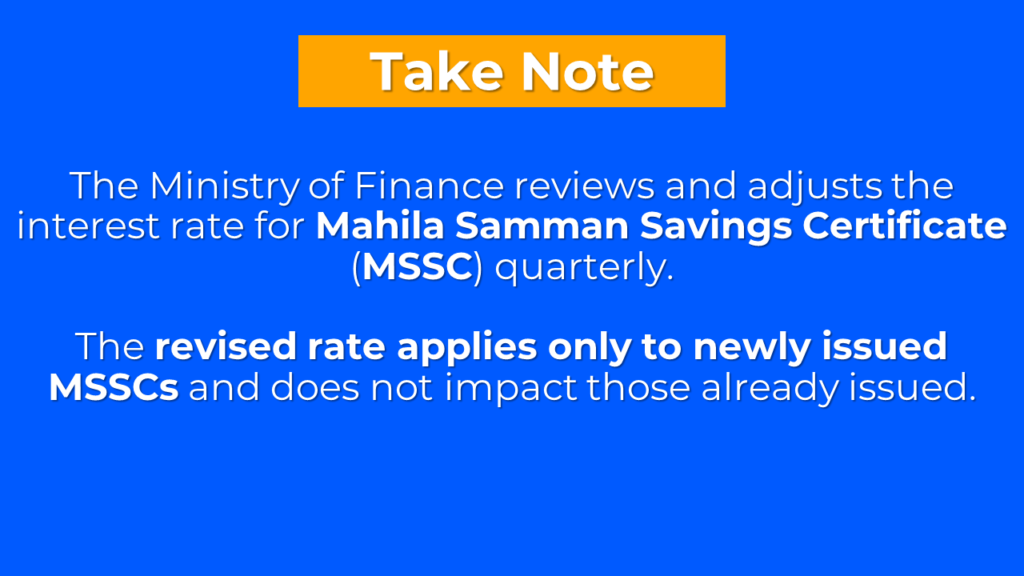

Who decides the interest rate for the Mahila Samman Savings Certificate?

The rate of interest for the Mahila Samman Savings Certificate is decided by The Ministry of Finance, specifically the Department of Economic Affairs.

Can the interest rate for the Mahila Samman Savings Certificate I have purchased may change in future?

No, the interest rate for the MSSC you own is fixed at 7.5% per annum for the entire tenure of two years.

Can the interest rate for MSSC be revised in future?

Yes. The rate of interest for the MSSC could be revised in the future. However, any change in the interest rate will not impact the interest rate earned by existing buyers.

Are contributions to the Mahila Samman Savings Certificate eligible for tax deduction u/s 80C of the IT Act?

No, contributions to the Mahila Samman Savings Certificate are not eligible for tax deduction u/s 80C.

Conclusion:

The Mahila Samman Savings Certificate emerges as a compelling financial instrument promoting financial security and empowerment among women and girls. Its attractive features and fixed interest rate make it a worthwhile investment choice.

Please feel free to Contact Us for any clarification you may require. We are committed to guiding you towards making informed financial decisions that align with your long-term goals.

Disclaimer:

This article provides general information only and does not constitute financial advice. Financial regulations, product terms, and industry guidelines are revised from time to time. While we have made efforts to ensure the accuracy of the information presented, we do not guarantee its completeness or accuracy. We disclaim any liability for loss or damage arising from actions taken based on the information provided in this article. To make informed financial decisions, please do your own research and consult with a qualified financial professional.

SPREAD THE WORD WITH YOUR NETWORK