Introduction:

Looking for a safe and rewarding way to grow your savings? The National Savings Recurring Deposit Account (NSRD), also known as the Post Office Recurring Deposit Account, is a government-backed scheme that offers a simple and effective approach to building wealth over time.

This easy-to-understand guide will walk you through the ins and outs of Post office Recurring Deposit Accounts, empowering you to make an informed decision about whether it’s the right fit for your financial goals.

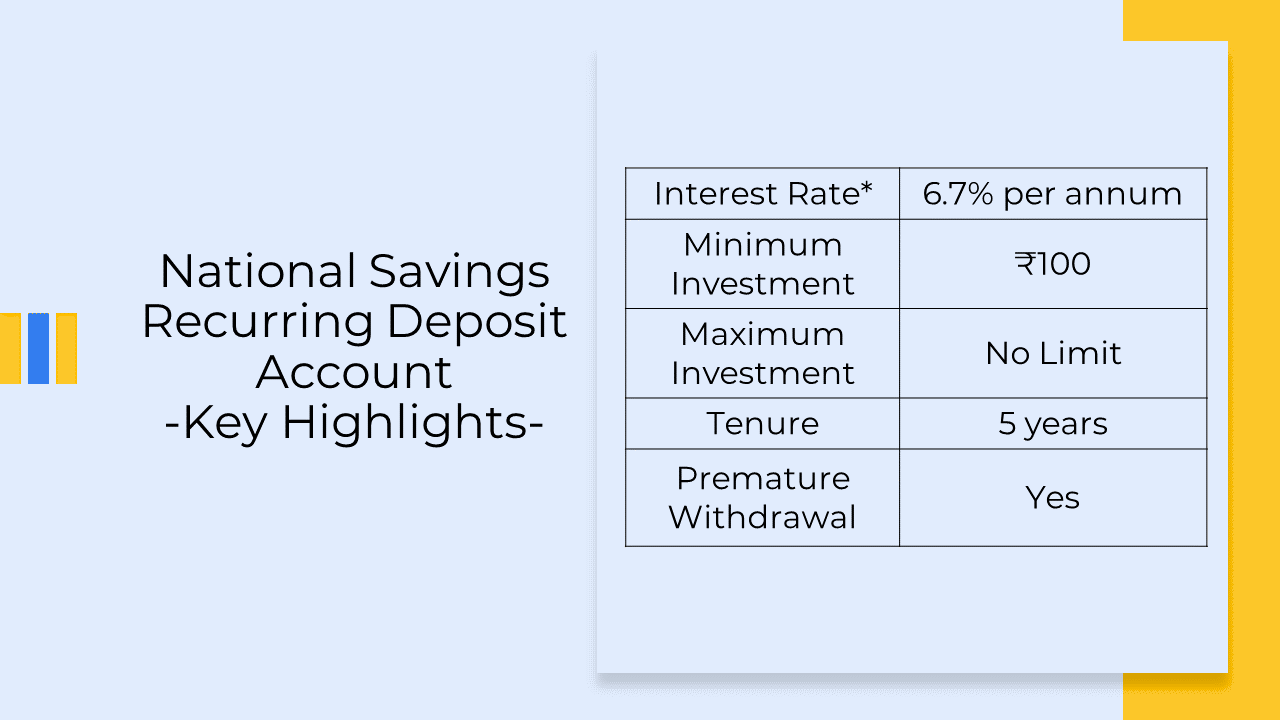

National Savings Recurring Deposit Account: Key Features

Eligibility for National Savings Recurring Deposit Account:

- An adult can open an account in his own name.

- Up to three adults can open a National Savings Recurring Deposit Account jointly. This type of account is known as a Joint A account.

- A guardian can open an account on behalf of a minor.

- A guardian can also open an account on behalf of a person who has been declared to be of unsound mind.

- A minor above the age of 10 can open an account in his own name.

Individuals can open any number of National Savings Recurring Deposit Accounts.

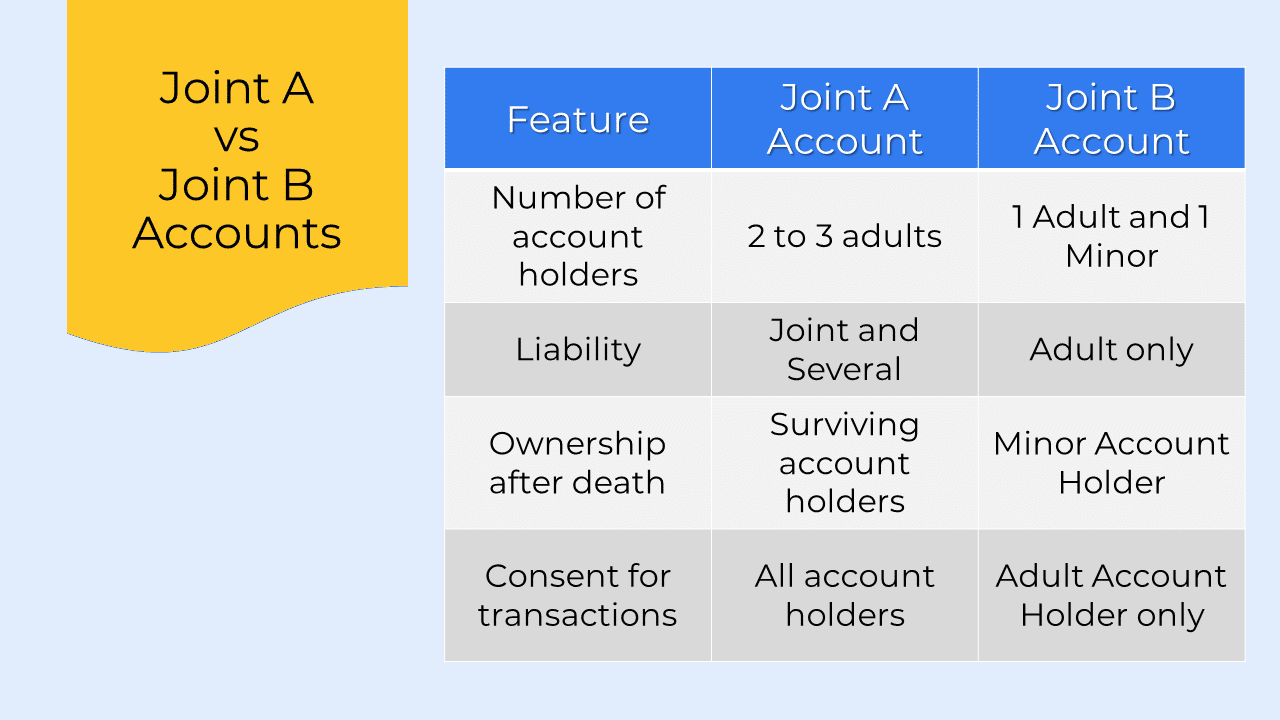

How does Joint A and Joint B National Savings Recurring Deposit Account work?

Joint A Account:

A Joint A account can be opened by two or three adults. All the account holders are jointly and severally liable for the account. This means that each account holder is responsible for the entire account balance, and the bank can collect the entire balance from any of the account holders.

In the event of the death of one account holder, the surviving account holders automatically become the sole owners of the account.

Joint B Account:

A Joint B account can be opened by a single adult and a minor. The adult account holder is responsible for the account, and the minor account holder cannot make any withdrawals or deposits without the adult’s consent.

In the event of the death of an adult account holder, the minor account holder becomes the sole owner of the account.

The below table summarizes the key difference between Joint A and Joint B accounts in Post Office Recurring Deposits.

Rate of Interest:

The National Savings Recurring Deposit Account offers an attractive interest rate of 6.7% per annum, compounded quarterly. This competitive interest rate, coupled with the benefit of quarterly compounding, allows investors to earn significant returns on their savings over time.

The quarterly compounding process ensures that interest is earned on both the principal amount as well as the accumulated interest, leading to a steady growth in the account balance.

Interest Calculation:

The interest on the Post Office RD account is calculated using the compound interest formula. Compound interest is a type of interest where interest is earned not only on the principal amount but also on the accumulated interest. This means that the interest earned grows exponentially over time.

Compound Interest Formula: M = D * {[(1 + i)^n] – 1} / i

Where:

M = Maturity amount

D = Recurring amount (monthly deposit)

n = Tenure in months

i = Monthly interest rate (which is the annual interest rate divided by 12)

Example:

Let’s say you open an RD account with a monthly deposit of ₹1,000 and a tenure of 5 years. The interest rate is 6.7% per annum, compounded quarterly.

Using the Compound Interest Formula, we get:

M = 1,000 * {[(1 + 0.00558)^60] – 1} / 0.00558

M ≈ 71,082.16

Therefore, the maturity amount after 5 years will be approximately ₹71,082.16/-*.

The compound interest formula is a powerful tool for calculating the long-term growth of your savings. By making regular deposits and taking advantage of compound interest, you can accumulate a significant amount of wealth over time.

*The actual maturity amount may vary a bit due to rounding.

#The interest rate is subject to change from time to time.

How to open Post Office Recurring Deposit Account online?

To open a Post Office Recurring Deposit Account online, you need to have an existing Post Office Savings Account and should be registered for Indian Post Office Internet banking services. Given below is a step-by-step guide to so:

- Go to the Indian Post eBanking website

- Enter your registered “User ID” and captcha code and click “Log In”.

- Under the General Services tab, click the ‘Service Request’ option.

- Follow the on-screen directions to initiate the National Savings Recurring Deposit Account opening request.

How to open Post Office Recurring Deposit Account offline?

Follow the steps given below to open a National Savings Recurring Deposit account offline, follow the steps given below:

- Download the Post Office RD application form online or collect one from the nearest post office.

- Submit the duly filled form and the documents mentioned above, along with a minimum deposit of ₹100, at the post office to open your RD account.

Deposits for National Savings Recurring Deposit Account:

Deposit Methods: Accounts can be opened with cash or cheque. Cheque deposits are credited on the date of clearance of the cheque.

Minimum Monthly Deposit: The minimum monthly deposit is ₹100, and subsequent deposits must be made in multiples of ₹10.

Deposit Deadlines: For accounts opened before the 16th of a calendar month, subsequent deposits must be made by the 15th of each month. For accounts opened between the 16th and the last working day of a calendar month, subsequent deposits must be made by the last working day of each month.

Advance Deposits:

Eligibility for Advance Deposits: Advance deposits can be made up to five years in advance for an active RD account.

Rebate on Advance Deposits: A rebate is offered for advance deposits of at least six instalments (including the month of deposit).

For a ₹100 denomination account, the rebate is:

- ₹10 for a six-month advance deposit

- ₹40 for a twelve-month advance deposit

For other denominations, the rebate amount is proportionate to the rates specified for the ₹100 denomination account.

Rebate Payment: The rebate is typically paid at the time the advance deposit is made.

If advance deposits are made for a period of less than six months, no rebate will be allowed.

For example, if a person is depositing ₹1,000 for a total tenure of 7 months as an advance in his Post Office RD account, under this rebate system, the person will be entitled to get a rebate of ₹10 for every ₹100, which has been deposited in advance. Hence, for the total sum of ₹1,000, he will get a rebate of ₹100.

Timing of Advance Deposits: Advance deposits can be made at the time of account opening or anytime thereafter.

Maturity Tenure, Extention, & Retention of Post Office RD Account:

Maturity Tenure:

The maturity period for a National Savings Recurring Deposit Account is five years (60 monthly deposits) from the date of opening.

Account Extension:

- National Savings Recurring Deposit Account can be extended for an additional five years (60 monthly deposits) beyond the initial five-year term.

- Account holders must submit an application at the concerned post office to extend the Post Office RD account.

- The interest rate at which the account was originally opened will be applicable during the extension period.

Early Closure of Extended Account:

- An extended Post Office RD account can be closed anytime during the extension period.

- For an extension period of more than a year, the Post Office RD interest rate will be applicable for the account balance.

- For an extension period of less than a year, the Post Office Savings Account (PO Savings Account) interest rate will be applicable.

Account Retention without Deposits:

- National Savings Recurring Deposit Account can be retained for up to five years from the date of maturity without making further deposits.

- During this retention period, the interest rate applicable to the account balance will be the Post Office RD interest rate.

Loan against Post Office RD Accounts:

To apply for a loan, account holder has to submit a loan application form along with their passbook at the concerned post office.

Eligibility: After completing at least 12 instalments and maintaining the RD account for one year without discontinuation, the account holder becomes eligible to apply for a loan.

Maximum Loan Amount: The maximum loan amount is 50% of the balance credit in the RD account.

Loan Repayment: The loan can be repaid in either a single lump sum or in equal monthly instalments.

Rate of Interest: The interest rate for the loan is 2% plus the interest rate applicable to the RD account.

Interest Calculation: Interest on the loan will be calculated from the date of withdrawal to the date of repayment.

Deduction of Unpaid Loan: If the loan is not repaid by the maturity date of the RD account, the balance loan amount plus applicable interest will be deducted from the maturity amount of the RD account.

Premature Closure of National Savings RD Accounts:

Eligibility: National Savings Recurring Deposit Account can be closed prematurely after three years from the date of account opening.

Withdrawal Limit: An account holder can withdraw up to 50% of the balance accumulated in his National Savings Recurring Deposit Account.

Application Process: To close an RD account prematurely, the account holder must submit a prescribed application form at the concerned post office.

Applicable Interest Rate: If the National Savings Recurring Deposit Account is closed prematurely, even one day before maturity, the Post Office Savings Account interest rate will be applied to the account balance.

Restrictions on Premature Closure: Premature closure of a Post Office RD account is not permitted until the period for which advance deposits have been made has elapsed. This means that if an account holder has made advance deposits, they must wait until the end of the advance deposit period before they can prematurely close the account.

Default Charges and Account Discontinuation:

Default Charges:

- If a deposit is not made within the prescribed timeframe, a default fee will be charged for each defaulted month.

- The default fee for ₹100 denomination account is ₹1 (proportionate amounts apply for other denominations).

Payment of Defaulted Deposits:

- In case of a monthly default, the account holder must first pay the defaulted monthly deposit along with the default fee before making the current month’s deposit.

Account Discontinuation and Revival:

- After four consecutive defaults, the National Savings Recurring Deposit Account will be discontinued.

- The discontinued account can be revived within two months from the fourth default by paying all outstanding dues.

- If the account is not revived within this two-month window, no further deposits can be made, and the account will remain discontinued.

Extension of Maturity Period:

- If there are four or fewer defaults in monthly deposits, the account holder has the option to extend the maturity period by the same number of months as the number of defaults.

- During this extended period, the account holder must make the defaulted instalments along with the regular monthly deposits.

It’s crucial to make regular payments for your National Savings Recurring Deposit Account to avoid penalties and account discontinuation. Remember, timely payments are essential for ensuring the growth of your savings and achieving your financial goals.

Nomination in Post Office RD Account:

The National Savings Recurring Deposit Account holders can designate a nominee to receive the account balance in the event of their demise. This ensures that the accumulated savings are passed on to the intended recipient without any hassles.

Nomination can be made either at the time of account opening or any time thereafter by submitting the prescribed form at the concerned post office.

Claim Procedure in Case of RD Account Holder’s Death:

Claim Submission: In the event of the death of the account holder, the designated nominee or claimant can submit a claim to the relevant post office to receive the eligible balance of the RD account.

Continuation of RD Account: Upon the approval of the claim, the nominee or legal heir can opt to continue the RD account until its maturity by submitting an application at the concerned post office. This ensures that the benefits of the National Savings Recurring Deposit Account are not lost and that the accrued funds continue to grow.

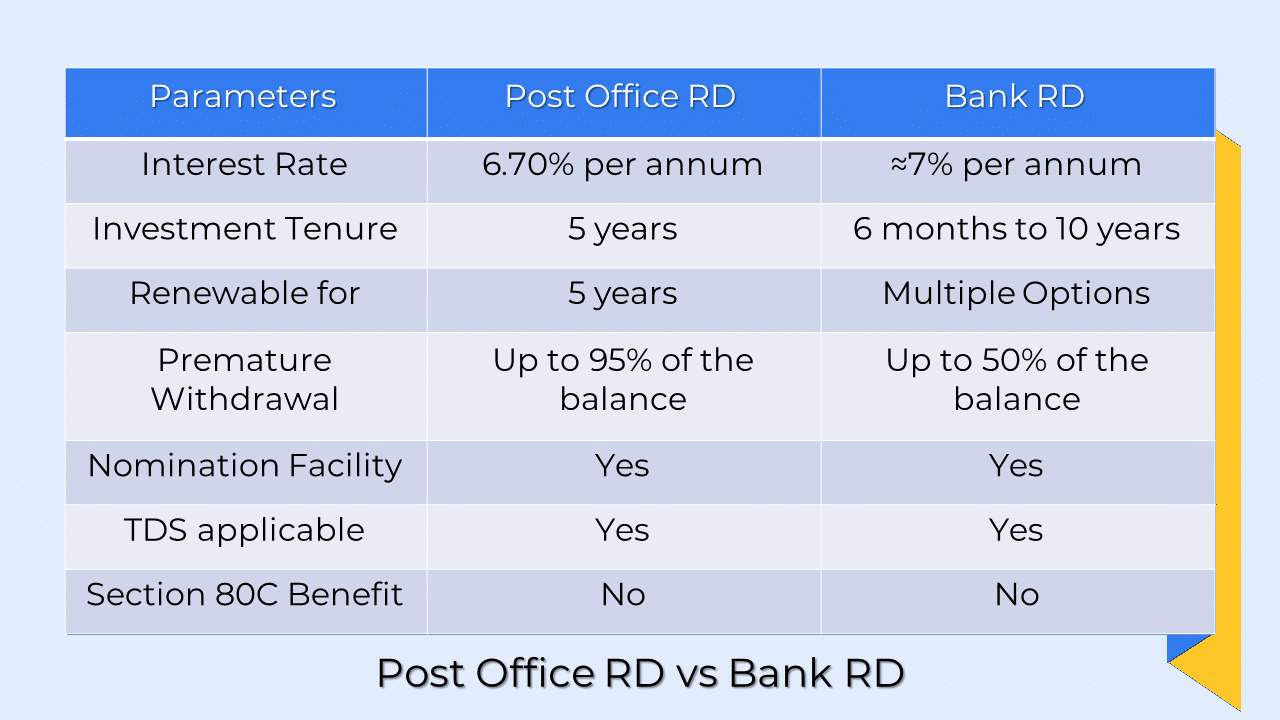

Post Office RD vs Bank RD

There are several key differences between opening an RD account with a bank and the post office. Here’s a breakdown of the main distinctions:

Interest Rates:

- Interest rates offered by banks may vary depending on the institution and market conditions. They can potentially reach up to 7% per annum.

- The post office offers a fixed interest rate of 6.70% per annum for RD accounts.

Investment Tenure:

- Banks typically allow RD accounts with tenures ranging from six months to ten years.

- The post office limits RD account tenures to a maximum of five years.

Renewal Options:

- Upon reaching the maturity of an RD account, you can renew it for a new tenure of your choice.

- Renewal of an RD account at the post office is restricted to a five-year term.

Premature Withdrawal:

- Banks generally allow premature withdrawals of up to 95% of the RD account balance.

- In the case of the post office, premature withdrawals are permitted only for up to 50% of the RD account balance.

Nomination Facility:

Nomination facilities are available for both banks and the post office, allowing you to designate a beneficiary to receive the account balance in case of your demise.

Interest Calculation and TDS:

- The rate of interest is calculated quarterly for both banks and the post office.

- TDS (Tax Deducted at Source) at the rate of 10% is applicable if the annual RD interest accrued exceeds ₹10,000, regardless of whether the account is with a bank or the post office.

In summary, the choice between opening a Recurring Deposit account with the bank or the post office depends on your specific needs and preferences. Consider factors such as interest rates, investment tenure flexibility, premature withdrawal options, and overall convenience when making your decision.

Frequently Asked Questions:

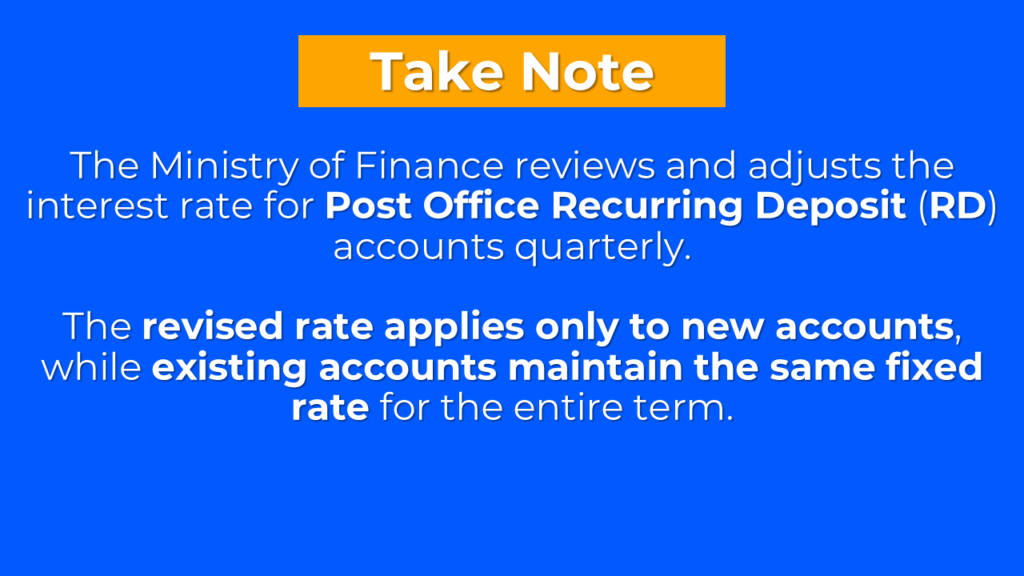

Who decides the interest rate for the National Savings Recurring Deposit Account?

The interest rate for the National Savings Recurring Deposit Account is decided by the Ministry of Finance, Government of India. The government periodically reviews and revises the interest rates based on various economic factors, including market conditions, inflation rates, and overall financial scenario.

Can NRIs open the National Savings Recurring Deposit Account?

No. Only resident Indians can own and operate a National Savings Recurring Deposit Account.

Is the interest rate for the post office recurring deposit account fixed for the entire duration?

Yes. The interest rate for the post office recurring deposit account is fixed for the entire account duration, typically five years.

Will changes in interest rates made by the Ministry of Finance affect my existing National Savings Recurring Deposit Account?

No. Changes in interest rates made by the Ministry of Finance will not impact the interest rate on your existing National Savings Recurring Deposit Account. The interest rate on your account will remain fixed for the entire account duration, regardless of any subsequent changes in interest rates made by the Ministry of Finance. This ensures that your savings continue to grow at a predetermined rate.

Can one claim tax deduction u/s Section 80C for the National Savings Recurring Deposit Account?

No

Is TDS applicable to the interest earned on the Post Office Recurring Deposit Account?

Yes. TDS is applicable to the interest earned on Post Office Recurring Deposit Account. In case the interest earned on the Post Office Recurring Deposit Account is more than ₹10,000 in a financial year, TDS at the rate of 10% is deducted by the Post Office before crediting the interest to your account.

Is interest earned on the National Savings Recurring Deposit Account taxable?

Yes. Interest earned on a National Savings Recurring Deposit Account is taxable at the individual’s income tax slab rate. This interest income must be declared under the “Income from Other Sources” section of your Income Tax Return (ITR).

Conclusion:

The Post Office Recurring Deposit (RD) account is a secure and promising savings option for individuals seeking to accumulate wealth without venturing into the risks associated with the market. Backed by the government, the Post Office RD guarantees a steady interest rate and protects your funds from market fluctuations. This account is particularly well-suited for those new to investing and those seeking a low-risk, consistent approach to wealth-building.

If you have any questions or need further clarification, please feel free to Contact Us. We’re always happy to help.

Disclaimer:

This article provides general information only and does not constitute financial advice. Financial regulations, product terms, and industry guidelines are revised from time to time. While we have made efforts to ensure the accuracy of the information presented, we do not guarantee its completeness or accuracy. We disclaim any liability for loss or damage arising from actions taken based on the information provided in this article. To make informed financial decisions, please do your own research and consult with a qualified financial professional.

SPREAD THE WORD WITH YOUR NETWORK