Introduction:

The Post Office Monthly Income Scheme (POMIS), or the National Savings Monthly Income Scheme, is a popular investment option in India, particularly for senior citizens and retired individuals. It offers a fixed monthly income and is backed by the Government of India. This article provides a comprehensive overview of the POMIS scheme, including its features, benefits, eligibility, and taxation implications.

Continue reading to learn more about this attractive investment option and how it can benefit you.

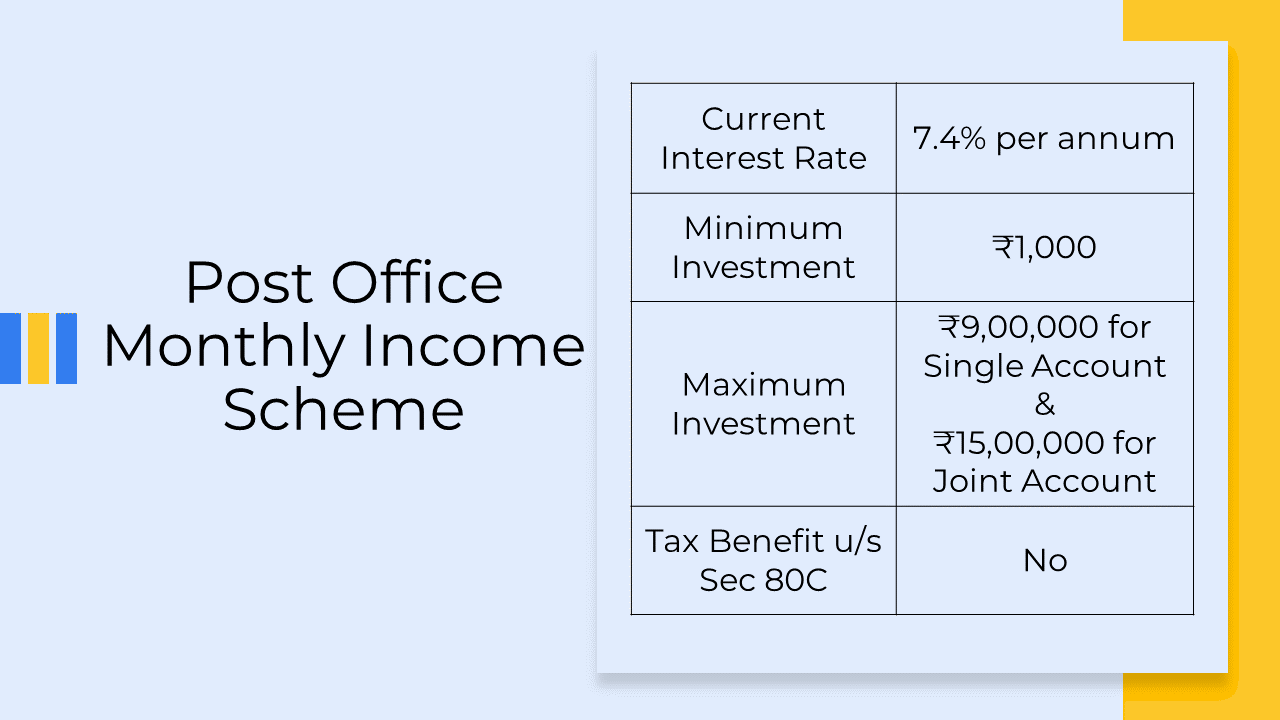

Post Office Monthly Income Scheme – Key Highlights:

Who can invest in Post Office Monthly Income Scheme?

- Single adults

- Joint accounts with a maximum of three adult account holders (Joint A or Joint B)

- Guardians acting on behalf of minors or individuals declared of unsound mind

- Minors above the age of 10 years, in their own name

Deposit Guidelines for Post Office Monthly Income Scheme:

- To open an MIS account, you’ll need to deposit at least ₹1,000/-, and any additional deposits must be in multiples of ₹1,000.

- The maximum you can deposit is ₹9,00,000 for a single account and ₹15,00,000 for a joint account.

- In a joint account, everyone must contribute the same amount.

- You can’t have more than ₹9,00,000 total across all your MIS accounts.

- If you’re opening an account for a minor, the investment limit is separate.

Interest application in Post Office Monthly Income Scheme:

- Interest payment: Starts one month after account opening and continues until maturity.

- Unclaimed interest: Does not earn additional interest.

- Excess deposits: Will be refunded with Savings Account interest from opening to refund date.

- Interest withdrawal:

- Auto-credit to a linked Savings Account at the same post office.

- ECS transfer.

- For CBS Post offices, interest can be credited to any CBS Savings Account.

- Taxation: Interest is taxable for the depositor.

Penalties and Procedures for Premature Closure of POMIS:

- Withdrawals are not permitted within the initial year.

- For closures between 1 year and 3 years after account opening, a penalty of 2% will be deducted from the original deposit.

- For closures between 3 and 5 years, a 1% penalty applies.

- Early closure requires the submission of a prescribed application form along with your passbook at the relevant post office.

Maturity of Post Office Monthly Income Scheme:

- Upon completion of the 5-year term, the account can be closed by submitting a prescribed application form along with the passbook to the concerned Post Office.

- In the event of the account holder’s death before maturity, the account will be closed, and the balance, including interest accrued up to the preceding month, will be refunded to the nominated beneficiary or legal heir.

Who should invest in National Savings Monthly Income Scheme?

The Post Office Monthly Income Scheme is ideal for investors who:

- Seek a fixed monthly income without investment risks.

- Desire a one-time investment for a regular income to maintain their lifestyle.

- Are comfortable with a long-term investment.

How to open a Post Office Monthly Income Scheme?

To open a POMIS Account, follow these steps:

- Ensure you have a Post Office Savings Account. Open one if you don’t already have one.

- Obtain a POMIS Account application form from your Post Office or download it online.

- Complete the application form and submit it along with self-attested copies of the required documents at the Post Office. Bring the original documents for verification.

- Provide details of your nominee(s) (name, date of birth, and mobile number).

- Make the initial deposit (minimum of ₹1,000) via cash or cheque.

Documents required:

- Identity Proof: A photocopy of a government-issued identification document, such as a voter ID card, a passport, a driving license, or an Aadhaar card.

- Address Proof: A government-issued identification document or recent utility bills to verify the applicant’s address.

- Photographs: Two passport-size photographs of the applicant.

Transfer of POMIS account:

You can transfer your Post Office Monthly Income Scheme (POMIS) account from one post office to another for absolutely free. This process is straightforward and can be completed at either the transferring or transferee post office.

Requirements for transferring a POMIS account:

Completed transfer application form: Obtain the prescribed transfer application form (SB 10(B)/NC-32) from either post office.

Original passbook: Present the original passbook of your POMIS account for verification.

KYC documents: Provide copies of your KYC documents, such as valid ID proof and address proof.

Initiation of Transfer Process:

You can initiate the transfer process at either the post office where your account is currently held (transferring office) or the post office where you wish to transfer it to (transferee office).

Completion of formalities:

Once the transfer request is processed and approved, your POMIS account will be transferred to the new post office. You will receive a confirmation and an updated passbook reflecting the change.

Additional notes:

*There is no charge for transferring a POMIS account.

*The transfer process typically takes a few working days.

*You can continue withdrawing interest or principal amounts from your POMIS account as usual during the transfer process.

POMIS Nomination:

The Post Office Monthly Income Scheme (POMIS) allows you to nominate a beneficiary who will receive your accumulated amount in case of your unfortunate demise.

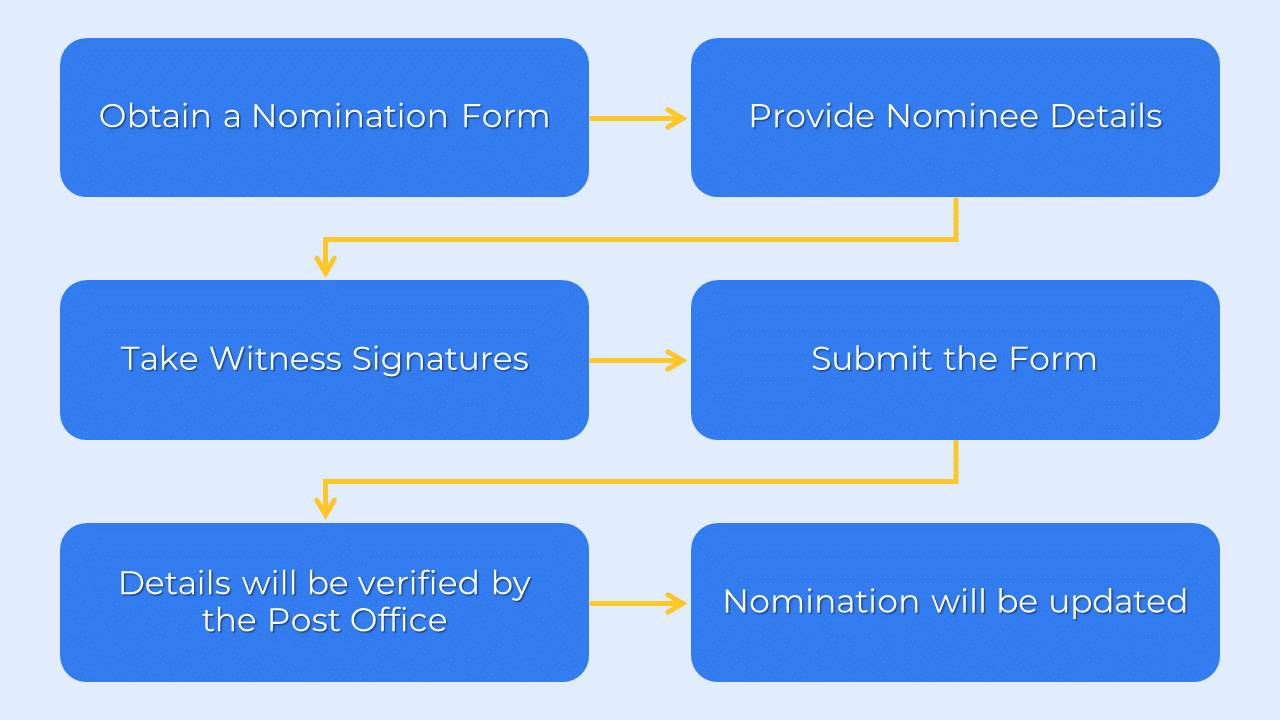

Nomination process:

Obtain a Nomination form: You can obtain a nomination form (SB 10(B)/NC-32) from your post office.

Provide Nominee details: Provide your nominee’s name, date of birth, and address. You can nominate up to three legal heirs.

Witness signatures: Two witnesses must sign the nomination form.

Form Submission: Submit the completed form along with your original passbook to the post office.

Verification and record: The post office will verify your details and update your account with the nominee information.

Benefits of nomination:

Ensures smooth transfer of funds: In case of your untimely demise, your accumulated amount will be directly transferred to your nominated beneficiary without any legal hassles.

Protects family’s financial security: Nomination safeguards your family’s financial interests by giving them access to your POMIS funds.

Peace of mind: Having a nomination in place offers peace of mind, knowing that your dependents will be taken care of in the event of your unfortunate demise.

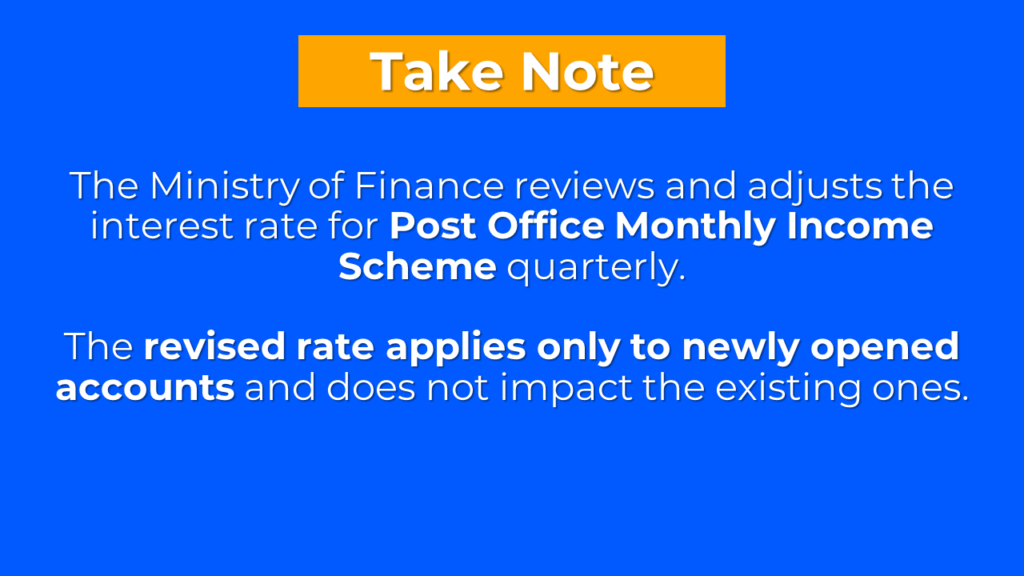

POMIS Taxation:

Interest income: The interest earned on your POMIS account is taxable and must be included in your annual tax return.

Tax rates: The applicable tax rate will depend on your individual tax slab.

Self-Assessment: As TDS is not applicable, you are responsible for self-assessing and paying taxes on the interest earned.

It is advisable to consult with a tax advisor to fully understand the taxation implications of POMIS interest and ensure proper tax compliance.

Frequently Asked Questions:

Is premature withdrawal from the POMIS allowed?

Yes, premature withdrawal is allowed after one year. However, if you withdraw before three years, a deduction of 2% on the deposit is applicable, and after three years, a deduction of 1% on the deposit is applicable.

How can I withdraw money from my POMIS account after the tenure?

After the completion of the five-year tenure, you have two options for withdrawing your funds from your Post Office Monthly Income Scheme (POMIS) account:

Full withdrawal: You can visit your post office and withdraw the entire deposited amount, including the accumulated interest.

Partial withdrawal and ECS: You can opt for partial withdrawals and set up an Electronic Clearing Service (ECS) to have the remaining amount, including the monthly interest, automatically credited to your linked savings account. This allows for a combination of regular income and lump sum withdrawal flexibility.

Remember, you are not obligated to withdraw the entire amount immediately after the tenure. You can choose to let some amount accumulate and withdraw it later as per your convenience. However, keep in mind that the interest earned during the extended period will be taxable as per the Income Tax Act.

What happens if the investor does not withdraw the funds after five years?

If the investor doesn’t withdraw his funds from the National Savings Monthly Income Scheme after the completion of the 5-year tenure, the account continues to earn interest for an additional two years. This interest is calculated at the same rate as the Post Office Savings Account interest rate.

Can I reinvest my accumulated amount in POMIS?

Yes, you can reinvest your accumulated amount in the Post Office Monthly Income Scheme (POMIS) at the end of the tenure. This feature allows you to continue earning regular income from your investment.

Can a senior citizen also invest in POMIS?

Yes, senior citizens are eligible to invest in the Post Office Monthly Income Scheme (POMIS). In fact, POMIS is considered a particularly suitable investment option for senior citizens and retired individuals due to its regular income generation and low-risk profile.

Is there a bonus available for the Post Office Monthly Income Scheme?

No bonus is available for Post Office MIS accounts opened on or after December 1, 2011. Accounts opened before that date were eligible for a 5% bonus on the deposit amount.

Does the scheme offer a tax rebate u/s 80C?

No, the National Savings Monthly Income Scheme does not offer any tax deduction benefits u/s 80C of the Income Tax Act, 1961.

Is there any Tax deduction at the source?

No, there is no Tax Deduction at Source (TDS) for the Post Office Monthly Income Scheme (POMIS). However, the interest earned is taxable under the Income Tax Act.

Conclusion:

The Post Office Monthly Income Scheme presents a compelling investment opportunity for those seeking a steady monthly income with minimal risk. With its government backing, attractive interest rates, and tax benefits, POMIS offers a secure path towards financial stability.

If you have any questions about POMIS or would like to explore personalized investment options, feel free to Contact Us for further guidance.

Disclaimer:

This article provides general information only and does not constitute financial advice. Financial regulations, product terms, and industry guidelines are revised from time to time. While we have made efforts to ensure the accuracy of the information presented, we do not guarantee its completeness or accuracy. We disclaim any liability for loss or damage arising from actions taken based on the information provided in this article. To make informed financial decisions, please do your own research and consult with a qualified financial professional.

SPREAD THE WORD WITH YOUR NETWORK