Introduction:

Amidst the uncertainty of current times, numerous investors are opting for life insurance policies that provide guaranteed returns.

There is a definite shift in consumer preference towards Guaranteed Savings Plans, also called Guaranteed Income Plans, as they offer capital protection and stable returns. Also, the life cover provides financial security to the family.

In this article, we’re going to explore all the aspects of a Guaranteed Savings Plan so that you can make an informed decision about the best available Guaranteed Income plans if you want to buy one.

What is a Guaranteed Savings Plan?

Guaranteed Savings Plans are traditional non-linked life insurance plans that provide insurance coverage and savings under the same policy. They are categorized as savings or endowment plans.

A guaranteed death benefit is paid if the insured dies during the term. On the other hand, if the life insured survives the policy tenure, Guaranteed Savings Plans pay a maturity benefit (lump sum or recurring payouts).

Usually, the benefits payable under these plans are guaranteed, which is why they are called ‘Guaranteed Savings Plans.’

These plans can be participatory (with bonus) or non-participatory (without bonus).

How does a Guaranteed Savings Investment Plan work?

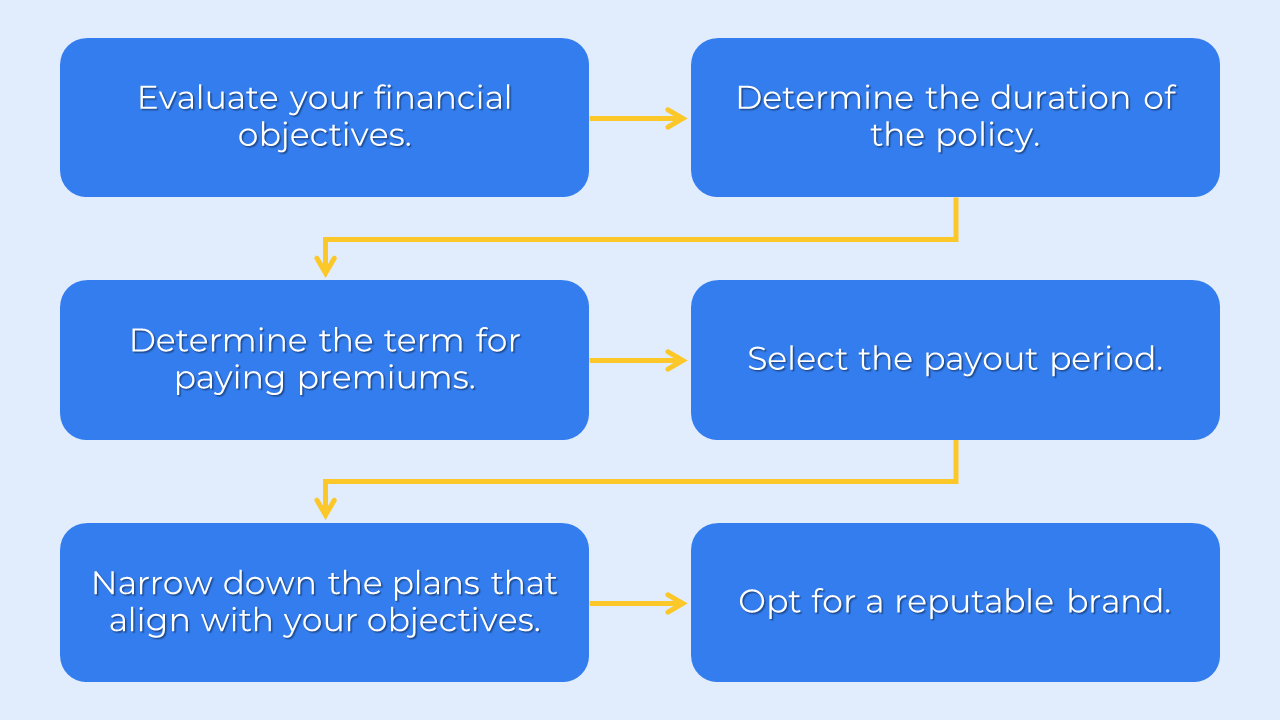

First, the customer needs to assess his financial goals to decide on the duration and payment options of the insurance policy.

Guaranteed Savings Plans have a predefined schedule, and a specified amount is paid to the policyholder if he survives the mentioned tenure. The policyholder can choose to receive the payouts Annually, Quarterly, Semi-Annually, or Monthly.

The policyholder has flexibility when it comes to choosing the Premium Payment Term, Policy Term, and Income Payout Period.

The future payouts under such plans are fixed and explicitly mentioned in the illustration; thus, the applicant knows all the benefits well ahead of purchasing the policy.

Benefits of Capital Guaranteed Insurance Savings Plan:

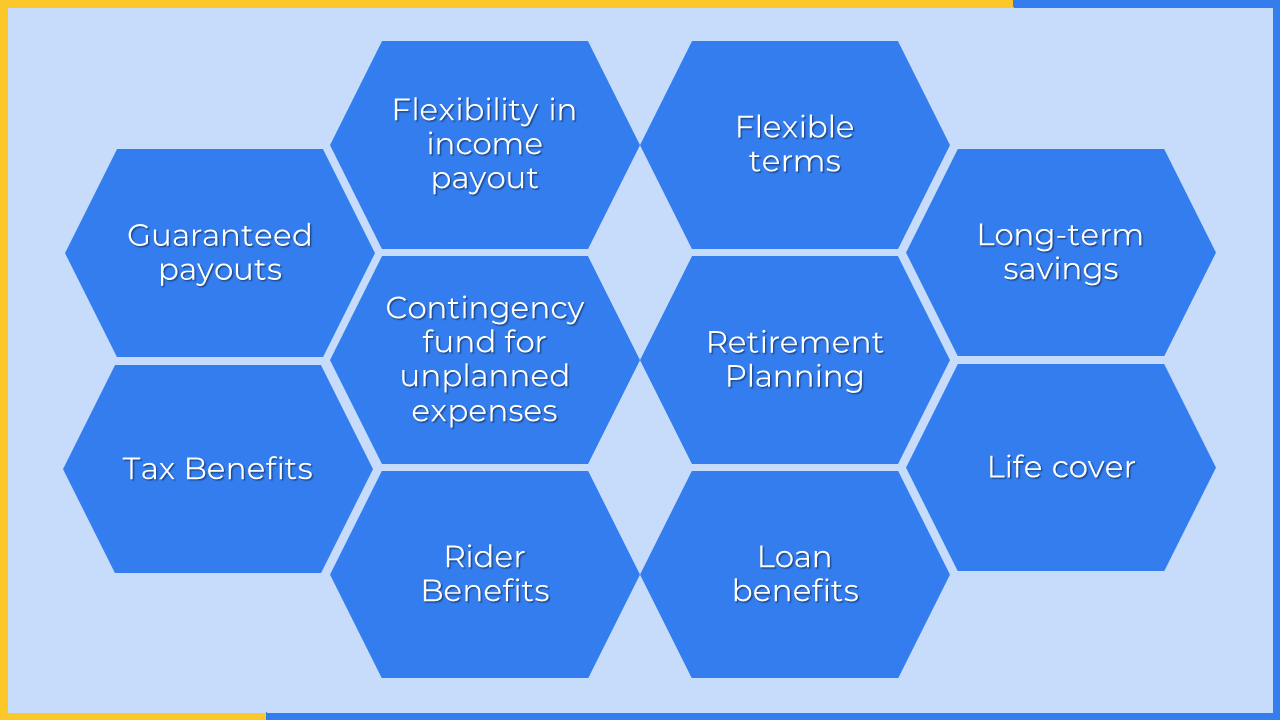

Assured payouts: First and foremost, your earnings are guaranteed. This means you won’t be exposed to market volatility or change in interest rates, so your benefit payouts remain unaffected. This can help investors who are anxious about market fluctuations/changes in interest rates and seek a safe way of investing their money.

Flexibility in Income Payouts: There are many options available that provide income flexibility, allowing the buyer to receive income for a set period of time, for their lifetime, or all at once – depending on their financial needs.

Flexible Terms: The Guaranteed Return Plan is one of the most flexible and customizable investment plans out there. You can modify the terms to make sure they suit all your present and future needs. For example, you can choose the Premium Payment Term, Policy Term, Payout Period, Frequency of Payouts, etc.

Long-Term Savings: Guaranteed Income Plans are long-term life insurance plans that help you save money in a disciplined way. By opting for one of these plans, you can create a sizable corpus to cover your financial needs.

Contingency Fund for Unplanned Expenses: Your current income may be sufficient for your needs at present, but in the future, additional costs may come up that you hadn’t planned for. It could be repaying debts, medical bills, or other financial obligations. A Guaranteed Return Insurance Plan could help you set up a separate source of income to cover these additional expenses.

Retirement Savings: After retiring from work, your primary source of income comes to a halt. Any additional sources of income, like rental earnings or interest on FDs, might not match up to the level of your primary source of income in the past. At these times, a Guaranteed Income Plan can help supplement your post-retirement income and cover your everyday expenses without putting any strain on your finances.

Inbuilt Life Cover: In the event of the death of the policyholder, his loved ones receive a death benefit payout to help them maintain their standard of living.

Loan Availability: You can use Guaranteed Income Plan as collateral to apply for a loan. Typically, you can obtain a loan up to 90% of the surrender value, which means that your Guaranteed Savings Plan can serve as a contingency fund if you ever have a sudden need for money.

Riders for Additional Customization: You can opt for additional riders with these plans to provide extra protection in case of accidental death, critical illness, or hospitalization expenses. With the help of riders, you can ensure that you and your family are covered under one Guaranteed Income Plan.

Drawbacks of Guaranteed Savings Investment Plans:

Low Returns: Although Guaranteed Savings Plans may not offer as high returns as some other market-linked financial products with higher risk, they can be used to mitigate the risk associated with those products. In other words, a Guaranteed Savings Plan’s potential downside can be seen as a positive. So, including a Guaranteed Return Life Insurance Plan in your portfolio can offset the risk of any other high-risk-high-reward product you’re invested in.

Non-payment of premiums may lead to lapsation: If you miss a premium payment, your policy lapses, costing you all or some of the money you’ve already paid as a premium. However, most insurance companies offer a revival period of up to two years.

Low Liquidity: Low liquidity is another drawback of having a Guaranteed Savings Insurance Plan. Just in case an investor wants to withdraw the cash value accumulated before the start of the payout period or before maturity, then the amount they receive back is much lower than what they originally invested.

Who should buy a Guaranteed Savings Investment Plan?

A Guaranteed Savings Plan can be an excellent fit for some people, depending on their needs, risk appetite, financial goals, and investment timeline. For example, they may be a good option for people who:

- Want to create a guaranteed corpus.

- Have a long-term investment horizon.

- Want to know upfront the potential returns.

- Want to avail of insurance coverage on their investments.

- Do not want exposure to market risk.

How to choose the Best Guaranteed Savings Plan?

It’s essential to consider your current financial situation and future needs too. You can also seek advice from an insurance provider representative to make an informed decision based on accurate information.

Select a plan that serves your financial objectives. The product should be flexible enough to meet your changing life conditions and circumstances.

It’s critical to be consistent with premium payments to avoid the lapsation of the policy. Also, make sure to share the insurance coverage details, the process of filing a claim, your insurance advisor’s contact details, the customer care number of the insurance provider, etc., with your spouse or another grown-up family member.

The best way to get the most out of a Guaranteed Savings Plan is to start saving early and remain invested for a longer span.

It is crucial to have the option to receive the payouts monthly, quarterly, or at any frequency as per your needs, and also the option to convert recurring payouts into a lump sum in case of any financial crisis. This way, you can ensure that you have the flexibility to fulfill your financial needs regardless of the challenging conditions you may encounter.

Best Guaranteed Savings Plan in India:

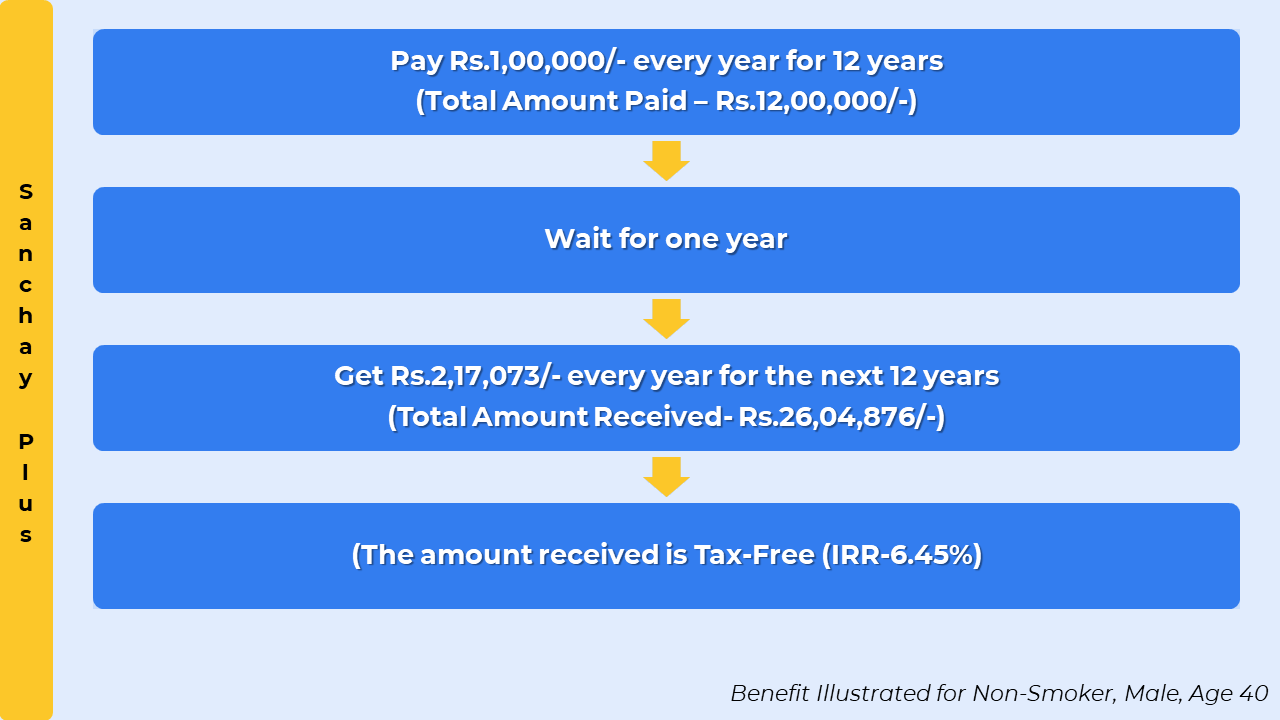

HDFC Life Sanchay Plus

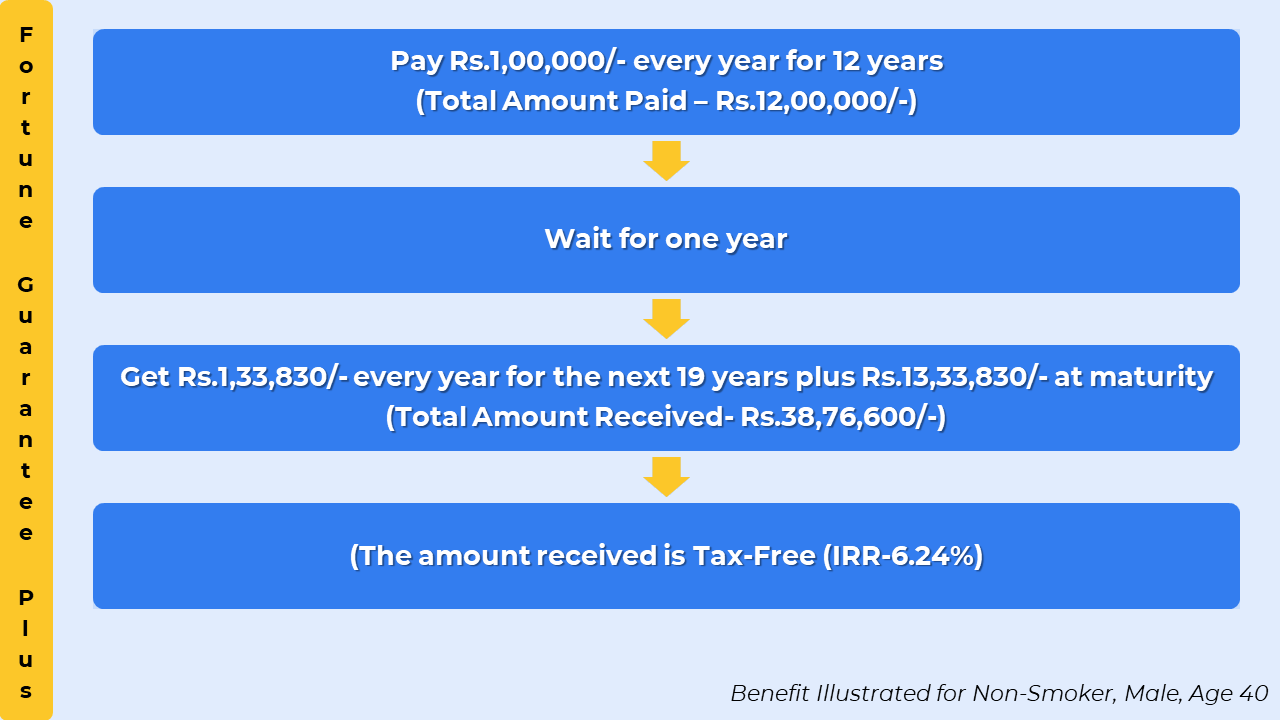

Tata AIA Fortune Guarantee Plus

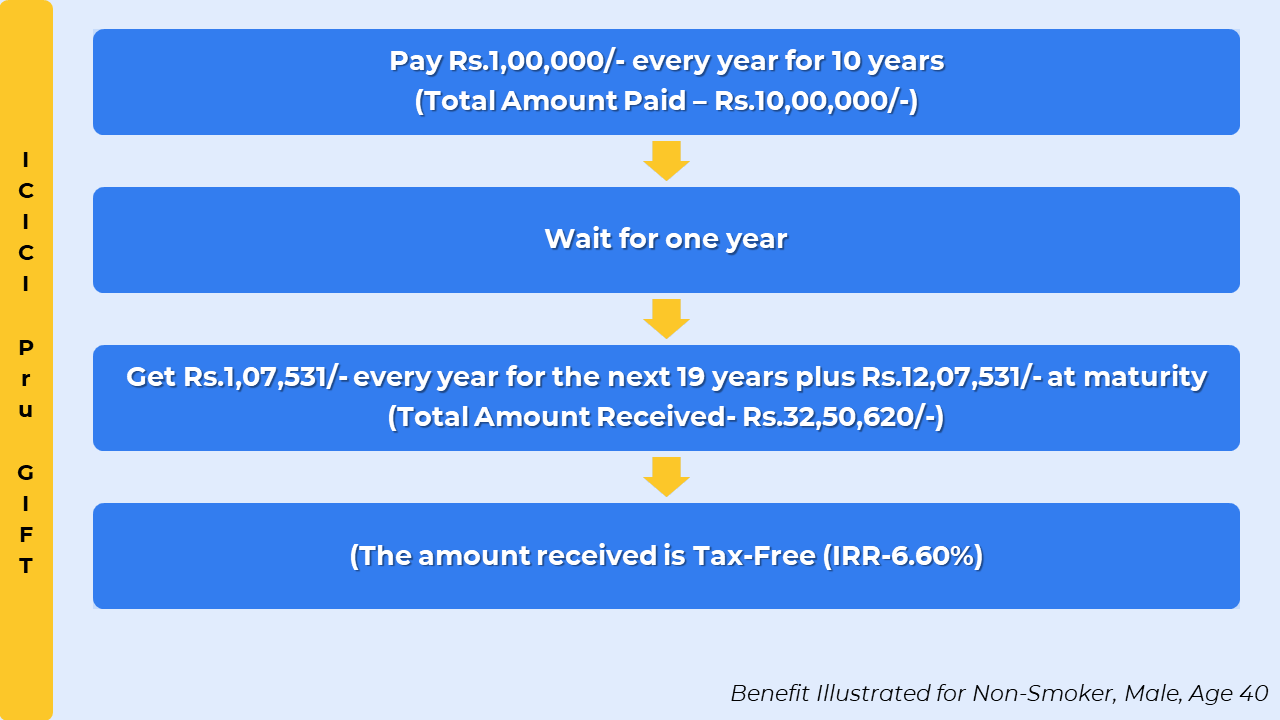

ICICI Pru GIFT

The products listed are not recommendations. Please don’t choose a guaranteed savings plan without doing your own research first. Like any other financial product, you must do your due diligence to ensure it’s the right fit.

Alternatives to Guaranteed Savings Plans:

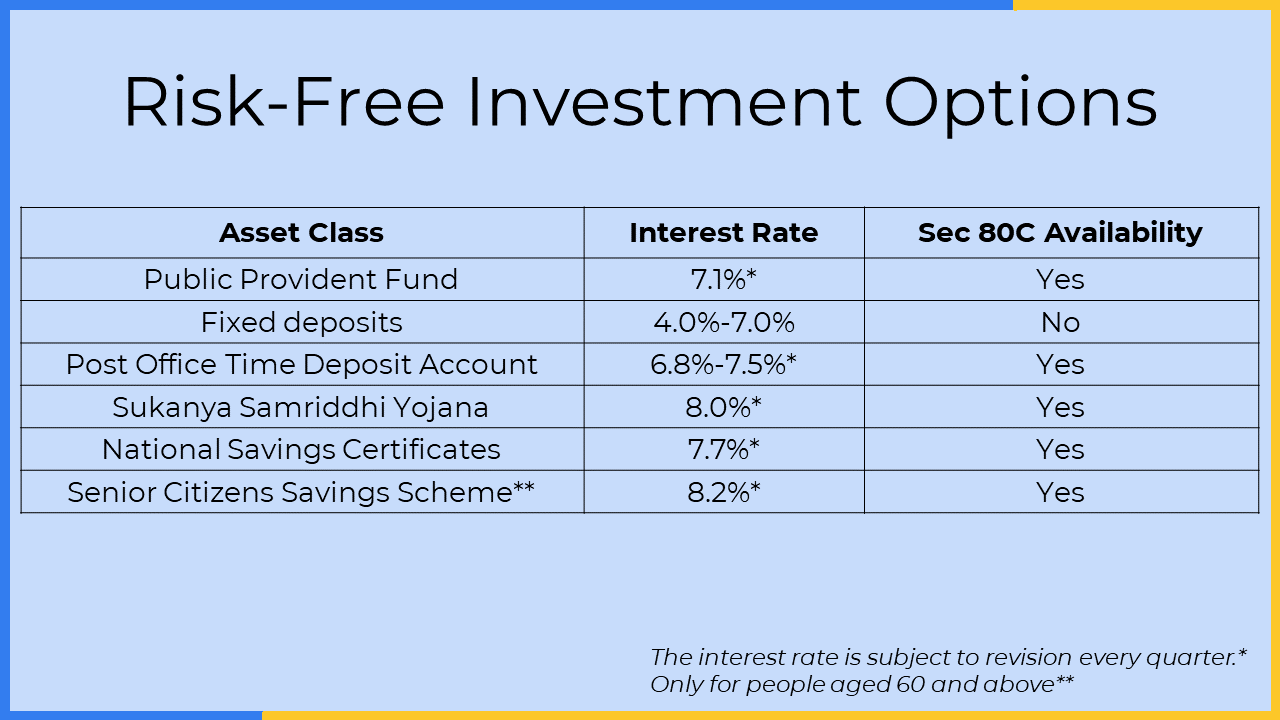

Plenty of options are available if you’re looking to generate a fixed income. Some of these are shown below:

*Only for people aged 60 and above

Public Provident Fund:

PPF is one of the most sought-after savings instruments in India. One can start Public Provident Fund Account with a minimum deposit of ₹500. The maximum permissible deposit is ₹1,50,000 per financial year. A loan option is available from the 3rd to the 6th financial year, and withdrawals are permissible every year from the 7th financial year.

The account matures after completing 15 financial years from the year it was opened, and can be extended for five years with further deposits. The amount in the PPF account is not subject to attachment under any court order or decree.

Current PPF interest rate is 7.1%. (Applicable from 1st Apr 2023 to 30th Jun 2023)

Moreover, PPF contributions qualify for deduction under Section 80C of the Income Tax Act, and interest earned is tax-free under Section 10 of the Income Tax Act.

Fixed Deposits:

A Fixed Deposit (FD) is a financial instrument offered by banks and non-banking financial companies in which a certain amount of money is locked in for a specified span of time, ranging from a few days to several years. In return, FDs pay a fixed rate of interest to the depositor. On maturity, the depositor receives the invested principal sum along with the interest earned.

The interest rates for FDs depend on the tenure of the deposit, and the rates vary from bank to bank.

Various FD schemes are available in India, including Cumulative Fixed Deposits, Non-Cumulative Fixed Deposits, Tax-Saving Fixed Deposits, and Flexi Fixed Deposits. Investors can choose the type of FD that best suits their financial goals.

A loan against an FD is a secured loan in which the FD is used as collateral, and the loan amount is disbursed to the borrower. The loan amount available ranges from 75% to 95% of the FD value, depending on the bank.

Interest earned on FDs is taxable under the Income Tax Act of 1961 and is added to the investor’s income tax slab. Banks deduct TDS if the total interest earned exceeds ₹40,000/- (₹50,000 for senior citizens).

Post Office Time Deposit Account:

Individuals aged ten years or above are eligible to open a Post Office Time Deposit Account at any post office. The minimum amount to be deposited is ₹100/-. There is no maximum limit. Depositors can choose to open a Time Deposit Account for a period of 1, 2, 3, or 5 years. However, income tax benefits are only available for a 5-year Post Office Time Deposit Account.

The interest rates for Post Office Time Deposits range between 6.8% to 7.5%. (These rates are applicable from 1st April 2023 to 30th June 2023). The interest rates can be revised every quarter by the Finance Ministry.

Those who opt for this account can claim income tax exemptions of up to ₹1,50,000/- under Section 80C of the Income Tax Act, 1961.

Sukanya Samriddhi Yojana:

Sukanya Samriddhi Yojana (SSY) is a government scheme launched under the Beti Bachao Beti Padhao campaign to secure the future of a girl child. It offers an 8.00% p.a. interest rate (applicable from 1st Apr 2023 to 30th Jun 2023).

You can start SSY with a minimum investment amount of ₹250/-; the maximum investment amount cannot exceed ₹1,50,000 p.a. The maturity period is 21 years or until the girl child is married after reaching the age of 18.

You can invest in Sukanya Samriddhi Yojana via banks and post offices, and investors can claim tax benefits of up to ₹1,50,000/- under Section 80C of the Income Tax Act, 1961.

National Savings Certificate (NSC):

National Savings Certificate (NSC) is a tax-saving investment option for Indian residents. It can be purchased at any post office. It offers a 7.7% p.a. interest rate (applicable from 1st Apr 2023 to 30th Jun 2023). The total tenure of NSC is five years, and a minimum investment amount of ₹1,000/-. There is no maximum limit.

Investors can claim a tax benefit of up to ₹1,50,000/- under Section 80C of the Income Tax Act.

Senior Citizen Savings Scheme (SCSS):

Senior Citizen Savings Scheme offers fixed returns on a quarterly basis. Eligible individuals can open an SCSS account at certified banks and post offices across India, with a minimum deposit of ₹1,000/- and a maximum deposit of ₹15,00,000/- or the amount received on retirement, whichever is lower.

The Senior Citizen Savings Scheme (SCSS) is a government-supported investment avenue for Indian citizens above 60. However, those who have opted for the Voluntary Retirement Scheme (VRS) or Superannuation can opt for SCSS if they are in the age bracket of 55-60. Also, retired defence personnel between the age bracket 50-60 can invest in Senior Citizen Savings Scheme.

The current SCSS interest rate is 8.2% (applicable from 1st Apr 2023 to 30th Jun 2023). This rate is subject to periodic review and change.

Investors can claim a tax deduction of up to ₹1,50,000/- per annum for their Senior Citizen Savings Scheme investments under Section 80C of the Income Tax Act.

Resources:

https://www.deccanherald.com/business/six-reasons-to-buy-a-savings-insurance-plan-1197690.html

https://www.fisdom.com/guaranteed-savings-plan/

Frequently Asked Questions:

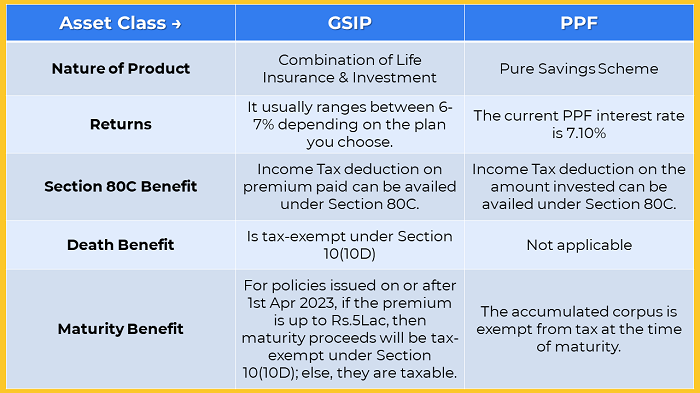

Isn’t PPF better than GSIP, as it generates 7.10% interest?

PPF interest rate is declared by the Finance Ministry every quarter. Once declared, it is guaranteed for the next three months. The current PPF interest rate is 7.10%.

Many believe the PPF interest rate is guaranteed for the entire tenure (15 years). However, that is not the case.

Historical data shows a steady decline in PPF returns over the past two decades, making it highly improbable to generate the same rate for the entire investment period. Hence it is not possible to calculate the exact amount at maturity.

On the other hand, GSIPs provide a fixed maturity amount stated at the time of applying for the policy, eliminating any uncertainty about future returns.

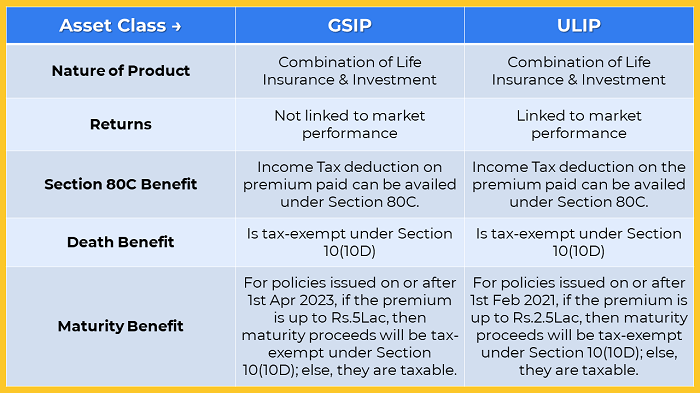

Aren’t ULIPs better than GSIPs, as it generates higher returns?

Unit Linked Insurance Plan (ULIP) is a market-linked product. The portion of the premium paid is invested in various funds, such as Equity Funds, Debt Funds, Balance Funds, Liquid Funds, etc. Thus returns from ULIPs are linked to market performance.

Conversely, payouts of Guaranteed Savings Investment Plans are not linked to the market, and the exact amount of the future payout is known before purchasing the policy.

So your choice of asset class must align with your financial needs and obligations. For example, someone who has just started his career can afford to take a higher risk and can opt for a ULIP. While someone above age 45 may not afford to take any risk and would prefer to invest in a Guaranteed Return Plan.

What is the difference between participatory and non-participatory plans?

A participating policy entitles the policyholder to receive a stake in the profits of the insurance company through bonuses or dividends. Such policies are also called with-profit policies. Whereas non-participating policies do not have any stake in profits, and no dividends are paid to the policyholder.

Guaranteed Savings Plans provide a guaranteed payout, but the extent of guarantee depends on whether the plan is participatory or non-participatory. Non-participatory plans guarantee the entire payout, while participatory plans only guarantee a certain portion of the payout.

For how long does the Guaranteed Savings Insurance Plan provide a death benefit?

Most Guaranteed Savings Insurance Plans provide a death benefit coverage until the end of the Premium Payment Term. However, some plans provide death benefit coverage for the entire tenure of the policy.

Once the payouts are due, which are spread over a period of time, is there an option to receive a lump sum payment in lieu of future payouts?

Yes. However, the lump sum that can be withdrawn in lieu of future payouts differs from one company to another. To know the exact amount available for withdrawal as a lump sum, you can go through the terms and conditions of the policy or get in touch with your insurance provider.

Do I get any tax benefits on life insurance premiums paid?

You can claim tax benefits under Sec 80C of the income tax act for the amount of premium paid for Guaranteed Return Insurance Plans.

Does my nominee have to pay tax on the death benefit received?

The death benefit amount received is tax-free under Income Tax Act, Sec 10(10D).

Is the maturity amount of Guaranteed Savings Insurance Plans taxable?

For all Guaranteed Savings Investment Plans issued before 1st April 2023, the maturity proceeds will be tax-free u/s Section 10 (10D).

For all Guaranteed Savings Insurance Plans issued on or after 1st April 2023, the maturity proceeds will be tax-free u/s Section 10 (10D) only if the aggregate premium of all the policies does not exceed ₹5,00,000/-, else the maturity proceeds will be taxable.

Conclusion:

If you’re looking for an insurance plan with assured returns, a Capital Guaranteed Insurance Savings Plan may be the right option for you. These policies offer multiple benefits, including safeguarding your loved ones and providing you with a long-term income you can count on.

We hope you enjoyed reading this article. If you have any queries, please feel free to Contact Us. We would be more than happy to assist you.

Disclaimer:

This article provides general information only and does not constitute financial advice. Financial regulations, product terms, and industry guidelines are revised from time to time. While we have made efforts to ensure the accuracy of the information presented, we do not guarantee its completeness or accuracy. We disclaim any liability for loss or damage arising from actions taken based on the information provided in this article. To make informed financial decisions, please do your own research and consult with a qualified financial professional.

SPREAD THE WORD WITH YOUR NETWORK