Introduction:

Recently, we have seen an influx of term insurance ads focused only on the price point. For example, you might see an ad that reads, “Buy a 1Cr cover for the price of a cup of coffee” or “Get a 1Cr term insurance for the price of a slice of pizza.” However, cost should not be the only factor you consider when choosing the Best Term Insurance Plan.

In this article, we will explore all the crucial elements of Term Insurance Plan so that you can make an informed decision while choosing one.

What is Term Insurance?

Term insurance is an uncomplicated form of life insurance that offers financial protection in the event of the death of the policyholder. In simpler terms, it compensates for the financial loss due to the untimely death of the proposer and prevents his family from being pushed into poverty. And it is also the most cost-effective method to have sufficient insurance coverage.

A Term Insurance Plan provides coverage for the stipulated term of the policy. Typically, Term Insurance Policies cover you for 10, 20, 30 years, or up to age 99, depending on your chosen Policy Term (PT). Term Insurance provides insurance for a fixed period, and the proposer must renew the policy as and when due for a pre-decided Premium Payment Term (PPT).

Term Life Insurance Policies are usually “pure risk” policies, which means that if the policyholder survives the entire Policy Term, then no maturity amount is due. However, some insurance companies have come up with a variant of Term Life Insurance that returns the total premium amount paid if the policyholder survives the entire Policy Term. These plans are called “Term Life Insurance with Return of Premium.” The premium for these policies is slightly higher than Regular-Term Policies.

Why is Term Insurance important?

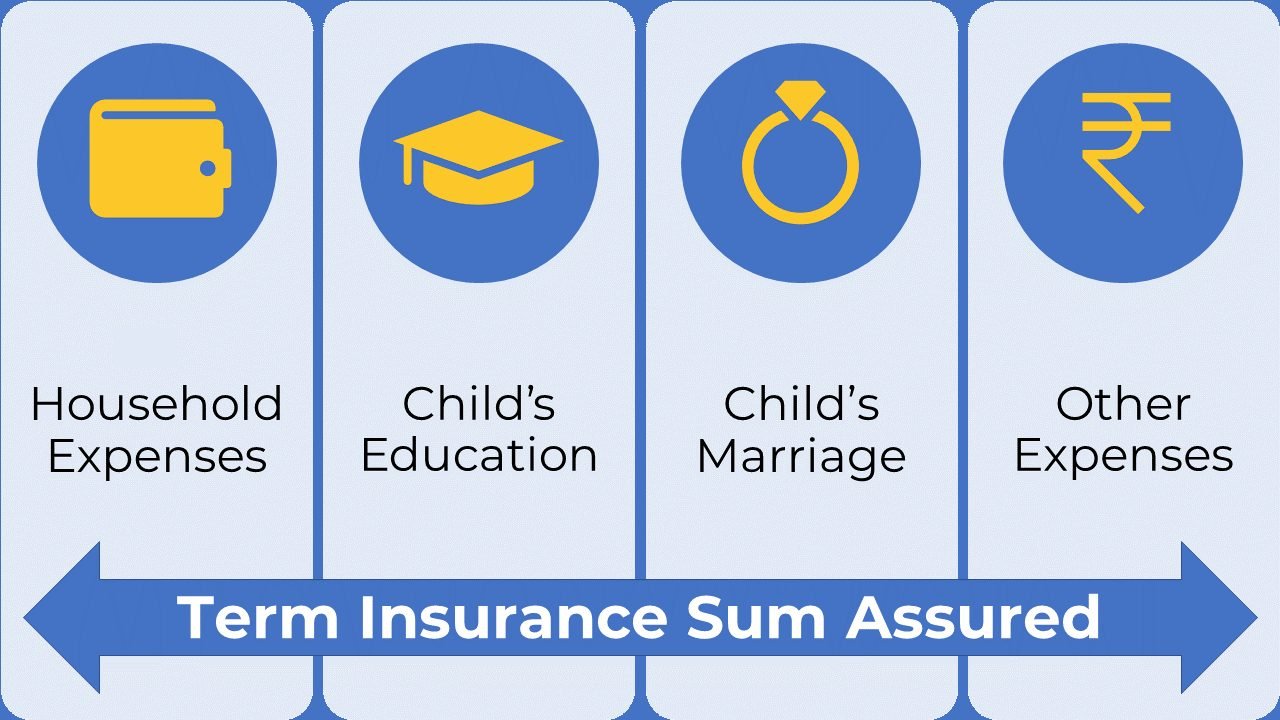

Term Insurance is a financial product designed to safeguard the family from the loss of a primary earning member in a household. If your family solely relies on your earnings, it is necessary to ensure that they are able to meet their daily household expenses as well as long-term financial goals in case of your untimely demise. The best way to do this is by having the right Term Insurance Plan.

Most Term Insurance Policies pay the death benefit as a lump sum, but some also allow you to have it paid out monthly or annually for a set period. You can also choose to have a combination of the two options. This gives you a great deal of flexibility to customize your policy to suit your needs. Term Insurance Plans are not market-linked and hence market-risk-free.

Types of Term Insurance Plans:

Term Plans can be classified based on the Premium Payment Term and the Design of the Plan.

Types of Term Insurance Plans based on Premium Payment Term:

There are three different variants of Term Plans based on the Premium Payment Term.

Regular Premium Payment Term Plan:

This type of plan requires you to pay the premium for the entire duration of the policy. It is suitable for those who choose a policy term that coincides with their earning years, enabling them to pay the premium throughout the term.

Limited Premium Payment Term Plan:

This type of plan allows you to pay the premium for a period much shorter than the entire policy duration. For example, you can choose to pay premiums only for five years for a Policy Term of thirty years.

The most common Premium Payment Terms available are 5, 10, 15, & 20 years and term to age 60. This type of plan is ideal for those who do not wish to commit to paying premiums for a longer duration but want policy coverage for an extended period.

Single Premium Payment Term Plan:

This type of plan allows you to pay the premium as a lump sum for the complete policy duration. This type of plan is ideal for business people who need insurance coverage to secure a large business loan they have taken but their income isn’t stable.

Types of Term Insurance Plans based on the Design of the Plan:

There are multiple variants of Term Plans based on the Design of the Plan. Some of them are mentioned below.

Level Term Insurance Plan:

This is the simplest form of a Term Insurance Plan. It allows you to choose the Sum Assured at the inception of the policy, which remains constant throughout the policy term. Therefore, it is a good choice for people with a conservative approach towards investment.

Increasing Term Insurance Plan:

This type of Term Insurance Plan provides the option to enhance the Sum Assured at specific important life milestones during the Policy Term. The increase in Sum Assured is usually capped at 100% of the original Sum Assured. This plan helps keep up with inflation by ensuring the family has sufficient funds to support themselves. If the policyholder chooses to increase the Sum Assured, the premium also increases.

This option is helpful for individuals who cannot afford an adequate Sum Assured initially. However, as their financial situation improves, they can enhance their insurance coverage to align with their obligations.

Decreasing Term Insurance Plan:

The Sum Assured of the Decreasing Term Insurance Plan gradually decreases each year to match with the diminishing insurance need. Such policies are typically taken when the life assured has taken a significant amount of loan. For example, if the person has taken a home loan, the risk level he is exposed to is very high during the initial phase of loan repayment. Therefore, one can opt for a Sum Assured equal to the home loan amount to mitigate this risk.

Thus, in the event of the death of the policyholder before fully repaying the loan, the death benefit payout can be utilized to repay the outstanding loan amount. The policy term corresponds to the loan repayment term. As the balance loan amount reduces with repayment installments, the Sum Assured of the policy also reduces to match the outstanding loan amount.

Term Insurance Plan with Return of Premiums:

In this policy, if the policyholder survives the Policy Term, the premiums paid are returned to him at the end of the Policy Term. The premium for this policy is higher than that of Pure Term Insurance since a portion of the premium paid is allocated towards the risk cover. The remaining part is allotted to facilitate the return of the premium at the end of the policy. The insurer later utilizes the returns earned on the savings component to refund the entire premium paid back to the policyholder.

Convertible Term Insurance Plan:

A Convertible Term Insurance Plan allows the policyholder to convert his policy into a permanent policy of his choice, such as a Whole Life or Endowment. For instance, the policyholder may choose to convert a Term Insurance Policy into an Endowment Plan after five years.

In such a scenario, the premium is revised, and the policyholder is charged a higher premium based on the newly selected type of plan.

Term Insurance with Guaranteed Renewal:

Term Insurance with Guaranteed Renewal is a type of Term Policy that can be renewed at the end of the initial term chosen, thereby extending the policy term for an additional period, such as another 5 or 10 years, without demanding any evidence of insurability, like a medical examination.

How to choose the Best Term Insurance Plan?

Though it may be a daunting task to sort through all the different Term Life Insurance Plans available, it’s essential to take your time in order to find the one that best suits your needs.

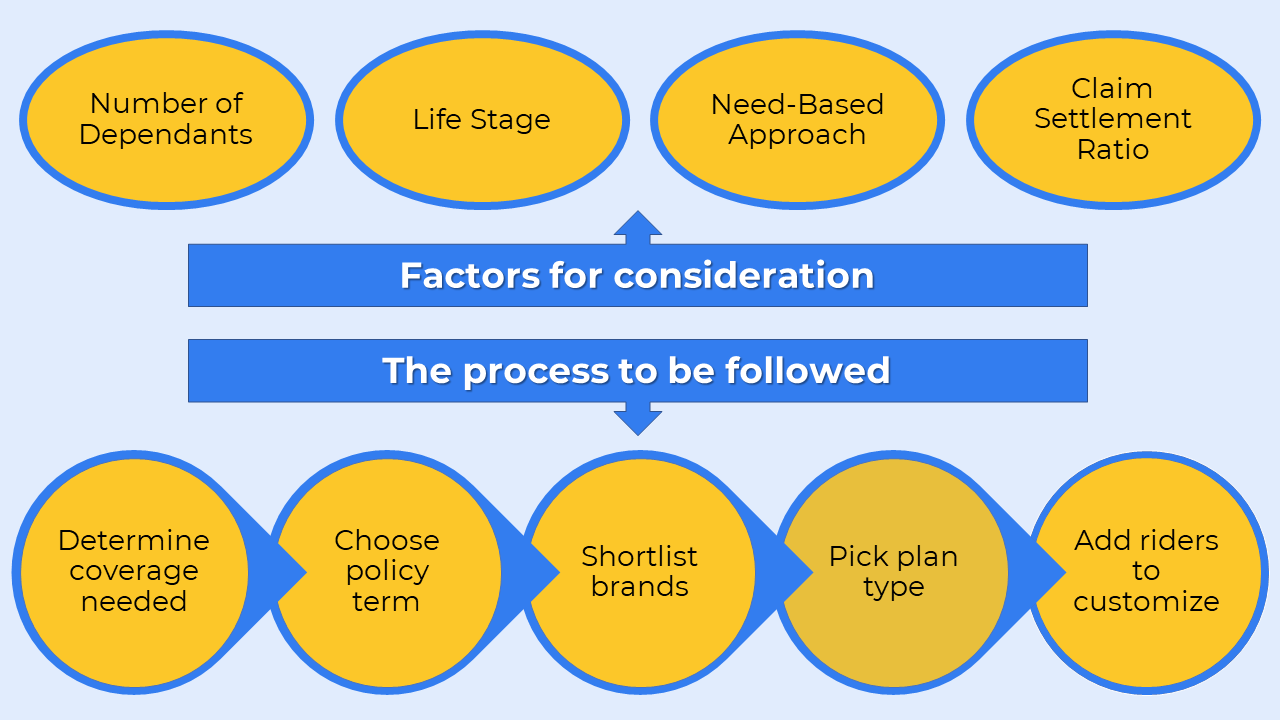

The first step is choosing the optimal level of coverage for you.

Apart from the level of coverage, some crucial factors to be considered are Policy Term, Brand, and Type of Plan to buy. The points mentioned below will help you choose the right plan.

Number of Dependents:

How many people are dependent on your income? The more the number of dependents, the larger should be the insurance coverage you should buy.

Life Stage:

Our life goals evolve with time. For example, the priorities of a young adult who has just started his career would be very different from those who are about to retire. Hence you must factor in your life stage while choosing an insurance plan.

Need-Based Approach:

Many people make the mistake of purchasing an insurance cover worth their HLV (Human Life Value) instead of thoroughly analyzing their needs. Although HLV is one of the contributing factors, one must carefully evaluate his liquid assets and current & future liabilities to calculate the precise insurance coverage needed.

Claim Settlement Ratio:

The Claim Settlement Ratio is the number of claims settled per 100 claims lodged. This number is a fair indicator of the probability of your claim being settled. A higher Claim Settlement Ratio signifies that the chances of the claim settlement are higher, and hence you should go with the company with a high Claim Settlement Ratio. Most of the life insurance companies in India have a Claim Settlement Ratio above 95% and can be trusted. However, we would advise you to avoid companies with a Claim Settlement Ratio below 90%, even if their policy is much cheaper.

Type of Policy:

When looking for a TermLife Insurance Plan, it’s important to ensure you’re getting the right type of policy for your needs. You can consult with your insurance advisor about minute details of the plan or check out the policy wording to determine which option is the most suitable for you.

Riders Available:

Apart from the regular death benefit offered by a Term Plan; there are some additional benefits, also called riders. Customize your insurance policy to provide more comprehensive coverage by adding to it:

Personal Accident Rider:

It covers you for death due to an accident. In case of accidental death, the nominee receives an additional sum assured over and above the regular sum assured.

Critical Illness Rider:

Just in case you are diagnosed with any of the critical illnesses mentioned in the policy contract, you get the Critical Illness Sum Assured you have opted for on the diagnosis of that critical illness. This amount can be used for treatment.

Disability Rider:

This rider covers any kind of permanent disability due to an accident or an illness.

Waiver of Premium:

If you have this rider, the future premiums are waived off if you become disabled due to an accident or an illness.

These are some commonly offered riders. In addition, some riders are only offered by specific companies that help you customize your plan to suit your specific needs. Some of the riders are in-built, while some come at an extra cost.

Resources:

https://economictimes.indiatimes.com/definition/term-insurance

Frequently Asked Questions:

What are the different premium payment modes available?

You can pay your premiums Annually, Semi-annually, Quarterly, or Monthly.

What is the Policy Term?

The Policy Term (PT) is the duration of the policy for which you are covered.

What is the Premium Payment Term?

The Premium Payment Term (PPT) is the span of time for which you are supposed to pay the premium.

Can PT and PPT be different?

Yes. At the inception of the policy, you can choose Polocy Term (PT) and Premium Payment Term (PPT).

What are the different options for death benefit payout?

Typically, insurance companies offer three main options for death benefits: a lump sum, periodic payouts, or a combination of both.

Can I buy Term Insurance as a Rider?

The Term Insurance benefit can be added as a rider to other conventional insurance plans, such as Endowment or Whole Life Plans, to boost the Sum Assured. For instance, if you buy a Whole Life Insurance Policy today, and after five years, realize that you need higher death cover for the next twenty years as you have taken a significant amount of home loan.

In such a case, instead of buying a separate Term Insurance Policy, you can add a Term Insurance Rider for the required additional coverage amount. Then, in the event of your unfortunate death during the 20-year term, your beneficiaries will receive the Sum Assured of the basic Whole Life Policy as well as the Term Insurance Rider.

Can the insurance company decline my Term Insurance application?

Term Insurance Policies are inherently high-risk policies. Once you apply for Term Insurance, the underwriting team reviews all the information you have mentioned in the application. Some of the critical factors that can influence the decision of the underwriting team are:

Your Health Profile: A standard premium rate is applicable to a healthy individual. Whereas for an unhealthy individual, a higher premium is charged for the same policy. The excess premium charged (also called loading) depends on the longevity and severity of the health condition. If the health condition is severe, the underwriter may decline the proposal.

Your Family Health History: The health condition of your parents and sibling is also taken into consideration by the underwriters while reviewing your proposal. Any ongoing illness or cause of death of your parents due to major illness can lead to a hike in your premium, or sometimes your proposal might get declined altogether.

Your Work Profile: If your nature of work exposes you to undue risk to your life, that can also influence your underwriter’s decision. Some of the examples could be mine workers, people working in radiology labs, marine commandoes, etc.

Your Lifestyle & Hobbies: If you regularly participate in adventure sports like Bungy Jumping, Paragliding, Skydiving, Mountain Biking, Rafting, etc., you might have to pay an additional premium.

Your Smoking and Drinking Habits: Term Insurance premiums are higher for Smokers than Non-Smokers. The type, quantity, and frequency of alcohol consumption also influence the underwriting decision.

After meticulously evaluating your application, the underwriter makes a decision regarding its status. There are multiple potential outcomes, including:

1. Your application may get declined.

2. Your application may get accepted.

3. You may have to pay an additional premium (loading) in order to proceed with the proposal.

4. The underwriter may ask you to reduce the Sum Assured.

5. You may be advised to apply for the policy at a later date. For example, if the policyholder happens to be a pregnant woman, she might be advised to apply for the policy after delivery.

What is the difference between Term Policies bought online and offline?

There is no difference between Term Policies bought online or offline. However, some companies offer additional discounts for Term Policies purchased online.

Do I get any tax benefits on Term Life Insurance premiums paid?

You can claim tax benefits under Sec 80C of the income tax act for the amount of premium paid for any life insurance plan.

Does my nominee have to pay tax on the death benefit received?

The death benefit amount received is tax-free under Income Tax Act, Section 10(10D).

Is the maturity amount of Return of Premium Term Insurance Plans taxable?

For all traditional life insurance plans issued before 1st April 2023, the maturity proceeds will be tax-free u/s Section 10 (10D).

For all traditional plans issued on or after 1st April 2023, the maturity proceeds will be tax-free u/s Section 10 (10D) only if the aggregate premium of all the traditional life insurance policies does not exceed ₹5,00,000/-, else the maturity proceeds will be taxable.

Conclusion:

If you’re looking for an affordable way to protect your family, Term Life Insurance is the way to go.

Thanks for reading our article on Term Life Insurance. If you have any further queries, please feel free to Contact Us. We will be happy to assist you with your insurance needs!

Disclaimer:

This article provides general information only and does not constitute financial advice. Financial regulations, product terms, and industry guidelines are revised from time to time. While we have made efforts to ensure the accuracy of the information presented, we do not guarantee its completeness or accuracy. We disclaim any liability for loss or damage arising from actions taken based on the information provided in this article. To make informed financial decisions, please do your own research and consult with a qualified financial professional.

SPREAD THE WORD WITH YOUR NETWORK