Introduction

In today’s world, financial security is more important than ever. Whether you’re planning for retirement, your child’s education, or simply looking for guaranteed wealth accumulation, a reliable insurance plan can be a game-changer.

One such option that has been gaining attention is the Max Life Smart Wealth Advantage Guarantee Plan (SWAG). This non-linked, non-participating individual life insurance savings plan promises guaranteed maturity benefits, flexible payout options, and life protection. But is it the right choice for you?

In this comprehensive Max SWAG Plan review, we’ll break down everything you need to know about this policy, including its features, benefits, eligibility, and suitability. By the end of this article, you’ll be able to determine whether the Smart Wealth Advantage Guarantee Plan by Max Life Insurance aligns with your financial goals.

What is the Smart Wealth Advantage Guarantee Plan?

The Smart Wealth Advantage Guarantee Plan from Max Life Insurance is a Non-Linked, Non-Participating Individual Life Insurance Savings Plan.

What does this mean?

- Non-Linked → Your returns are not affected by stock market fluctuations.

- Non-Participating → No variable bonuses; all benefits are pre-defined and guaranteed.

- Life Insurance + Savings Plan → You get both insurance coverage and a structured savings plan.

Now, let’s take a deep dive into its key features and benefits.

Key Features of the Max Life Smart Wealth Advantage Guarantee Plan

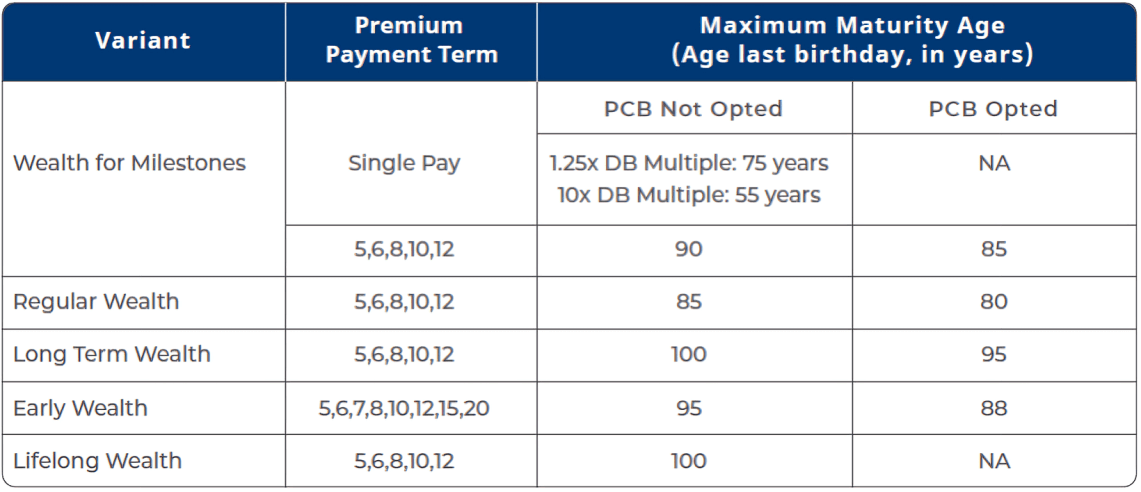

This plan offers five different variants, allowing you to customize it according to your financial goals.

Guaranteed Returns

One of the biggest advantages of this plan is that all maturity, survival, and death benefits are guaranteed. There are no surprises, making it easier to plan your future finances.

Multiple Plan Variants for Flexibility

The Smart Wealth Advantage Guarantee Plan from Axis Bank provides five different options:

- Wealth for Milestones – Ideal for those who want a lump sum payout at maturity.

- Regular Wealth – Offers periodic income, making it great for meeting regular expenses.

- Long-Term Wealth – Provides an extended income stream, making it suitable for retirement planning.

- Early Wealth – Provides income from the first policy year, ensuring liquidity from the beginning.

- Lifelong Wealth – Ensures income until the age of 100, making it a strong financial support system for life.

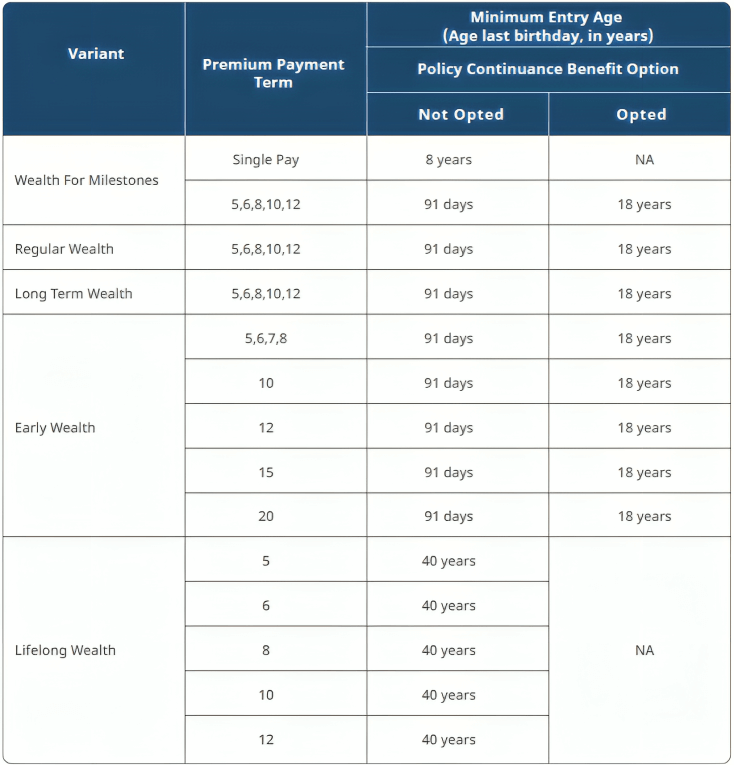

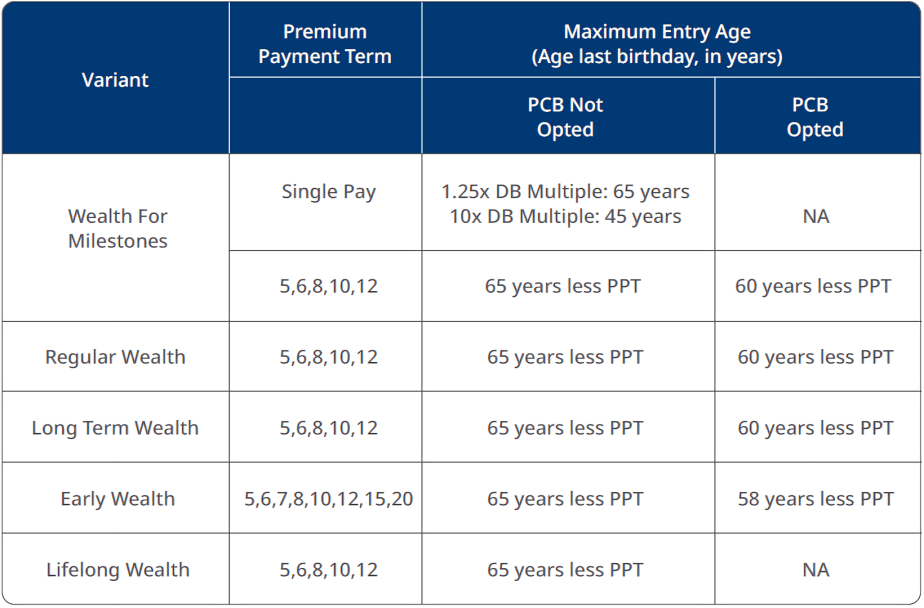

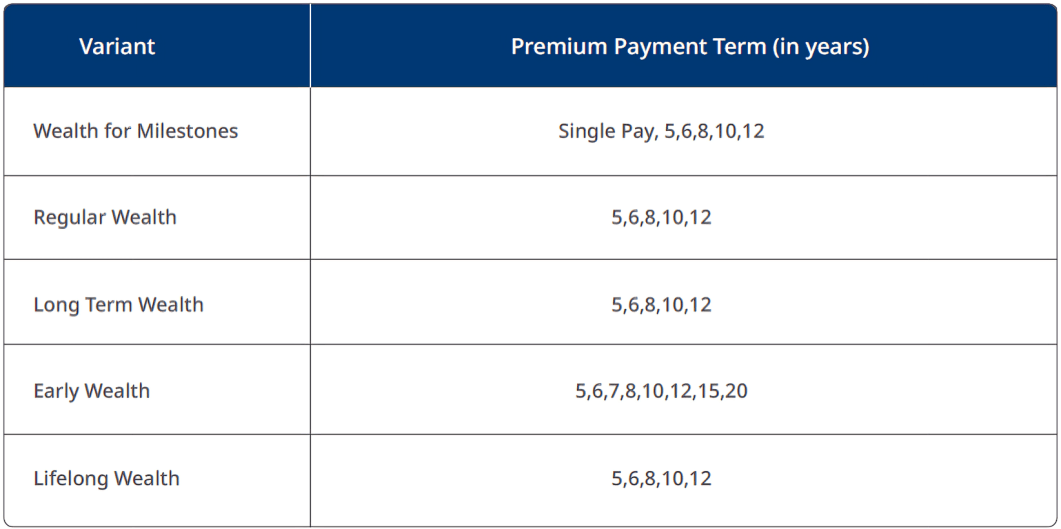

Flexible Premium Payment Terms

Options to pay one-time, for a limited period, or regularly.

Loan Availability

A policyholder can avail loans against the policy in times of need.

How Does the Smart Wealth Advantage Guarantee Plan Work?

The Max Life Insurance Smart Wealth Advantage Guarantee Plan allows policyholders to choose from five customizable variants based on their financial goals. You pay premiums based on your selected Premium Payment Term (PPT) and receive benefits in different forms such as lump sum, guaranteed income, or long-term payouts.

Variants of the SWAG Plan

The Smart Wealth Advantage Guarantee Plan by Axis Bank and Max Life Insurance offers five distinct variants. Let’s explore each in detail.

Wealth for Milestones (Lump Sum Payout at Maturity)

- How it works:

- Choose a policy term (5 to 30 years).

- Pay premiums for a selected duration.

- Get a guaranteed lump sum at the end of the term.

- Payout Structure: A Guaranteed lump sum at the end of the policy term.

- Premium Payment Term (PPT): 5, 6, 8, 10, 12 years.

- Maturity Benefit: Sum Assured on Maturity + Guaranteed Additions.

- Best For: Saving for a house purchase, a child’s higher education, or retirement.

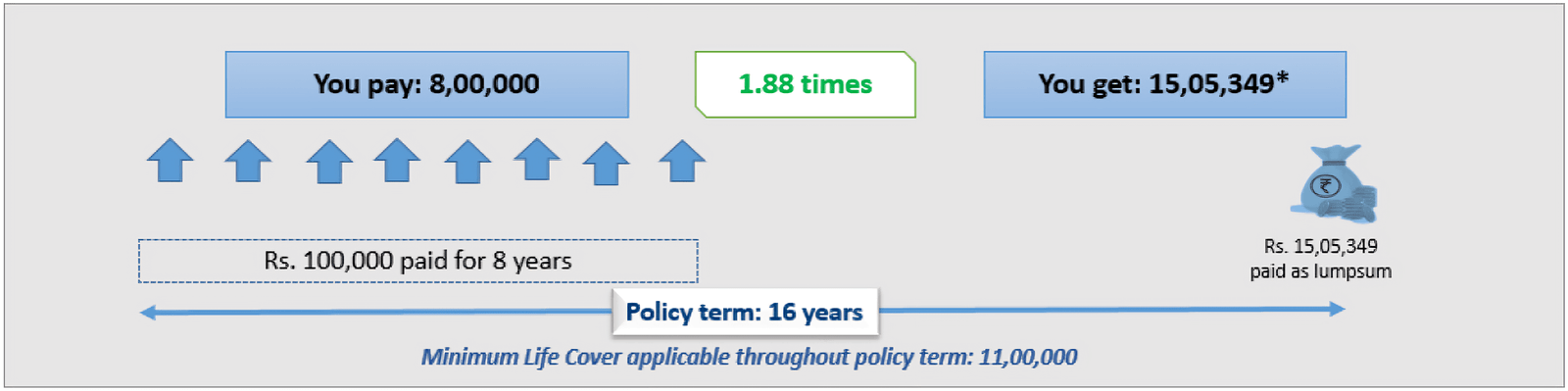

Example: Bipin, aged 35 years, pays a premium of ₹1,00,000 (via ECS mode of payment) in Axis Max Life Smart Wealth Advantage Guarantee Plan on an annual mode. He opts for the Wealth for Milestones variant, 8-year Premium Payment Term & 16-year Policy Term. His Sum Assured at Maturity is ₹11,40,416. Let us see how this plan would work for him:

| Policy Year | Life Insured’s Age (at the end of the year) | Annualised Premium (At the end of Year) | Auto Debit Booster (End of Year) | Accrued Guaranteed Additions1 (End of Year) | Sum Assured at Maturity2 (End of Year) | Maturity Benefit(1+2) (End of Year) |

|---|---|---|---|---|---|---|

| 0 | 35 | 1,00,000 | 0 | – | – | – |

| 1 | 35 | 1,00,000 | 0 | – | – | – |

| 2 | 36 | 1,00,000 | 0 | – | – | – |

| 3 | 37 | 1,00,000 | 0 | – | – | – |

| 4 | 38 | 1,00,000 | 0 | – | – | – |

| 5 | 39 | 1,00,000 | 0 | – | – | – |

| 6 | 40 | 1,00,000 | 0 | – | – | – |

| 7 | 41 | 1,00,000 | 0 | – | – | – |

| 8 | 42 | – | 7,000 | – | – | – |

| 9 | 43 | – | 0 | – | – | – |

| 10 | 44 | – | 0 | – | – | – |

| 11 | 45 | – | 0 | – | – | – |

| 12 | 46 | – | 0 | – | – | – |

| 13 | 47 | – | 0 | 91,233 | 0 | 0 |

| 14 | 48 | – | 0 | 1,82,467 | 0 | 0 |

| 15 | 49 | – | 0 | 2,73,700 | 0 | 0 |

| 16 | 50 | – | 0 | 3,64,933 | 11,40,416 | 15,05,349 |

- The total premiums paid by Bipin is ₹8,00,000.

- He receives a maturity benefit of ₹15,05,349 at the end of year 16.

- The Life Cover applicable for him at the inception of the policy is ₹11,00,000 and it may keep increasing further as per the applicable terms of his policy.

Regular Wealth (Steady Income After Deferment Period)

- How it works:

- Choose an income period of 5, 10, or 15 years.

- Pay premiums for 5-12 years.

- After the deferment period, receive a guaranteed annual income.

- Payout Structure: Guaranteed income payouts for 5, 10, or 15 years.

- Premium Payment Term: 5, 6, 8, 10, 12 years.

- Additional Benefits: Loyalty Income Boosters (10% of Income Benefit).

- Best For:

- Those looking for a secondary source of income.

- Salaried employees planning for financial independence.

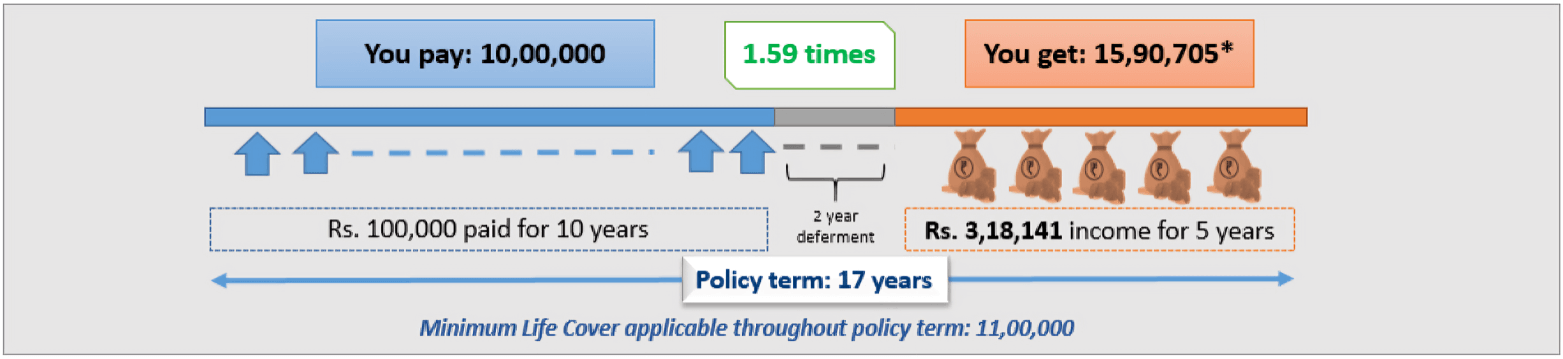

Example: Samir, aged 35 years, pays a premium of ₹1,00,000 (via ECS mode of payment) in Axis Max Life Smart Wealth Advantage Guarantee Plan on an annual mode. He opts for the Regular Wealth variant, a 10-year Premium Payment Term, a 2-year Deferment Period and a 5-year Income Term. He chooses the income payout option as Annually. Let us see how this plan would work for him:

| Policy Year | Life Insured’s Age (at the end of the year) | Annualised Premium (At the end of the Year) | Auto Debit Booster (End of Year) | Base Income Benefit (End of Year) | Loyalty Income Booster (End of Year) |

|---|---|---|---|---|---|

| 0 | 35 | 1,00,000 | 0 | 0 | 0 |

| 1 | 35 | 1,00,000 | 0 | 0 | 0 |

| 2 | 36 | 1,00,000 | 0 | 0 | 0 |

| 3 | 37 | 1,00,000 | 0 | 0 | 0 |

| 4 | 38 | 1,00,000 | 0 | 0 | 0 |

| 5 | 39 | 1,00,000 | 0 | 0 | 0 |

| 6 | 40 | 1,00,000 | 0 | 0 | 0 |

| 7 | 41 | 1,00,000 | 0 | 0 | 0 |

| 8 | 42 | 1,00,000 | 0 | 0 | 0 |

| 9 | 43 | 1,00,000 | 0 | 0 | 0 |

| 10 | 44 | 0 | 9,000 | 0 | 0 |

| 11 | 45 | 0 | 0 | 0 | 0 |

| 12 | 46 | 0 | 0 | 0 | 0 |

| 13 | 47 | 0 | 0 | 2,89,219 | 28,922 |

| 14 | 48 | 0 | 0 | 2,89,219 | 28,922 |

| 15 | 49 | 0 | 0 | 2,89,219 | 28,922 |

| 16 | 50 | 0 | 0 | 2,89,219 | 28,922 |

| 17 | 51 | 0 | 0 | 2,89,219 | 28,922 |

- The total premiums paid by Samir is ₹10,00,000, to receive a total income of ₹15,90,705 (₹3,18,141 every year).

- The Life Cover applicable for him at the inception of the policy is ₹11,00,000 and it may keep increasing further as per the applicable terms of his policy.

Long-Term Wealth (Extended Income Stream)

- How it works:

- Choose an income period of 20, 25, or 30 years.

- Pay premiums for 5-12 years.

- After deferment, receive a guaranteed annual payout for decades.

- Payout Structure: Guaranteed income for 20 to 30 years.

- Premium Payment Term: 5, 6, 8, 10, 12 years.

- Maturity Benefit: Return of Total Premiums Paid at the end of the term.

- Best For:

- Retirement planning.

- Self-employed individuals looking for long-term financial stability.

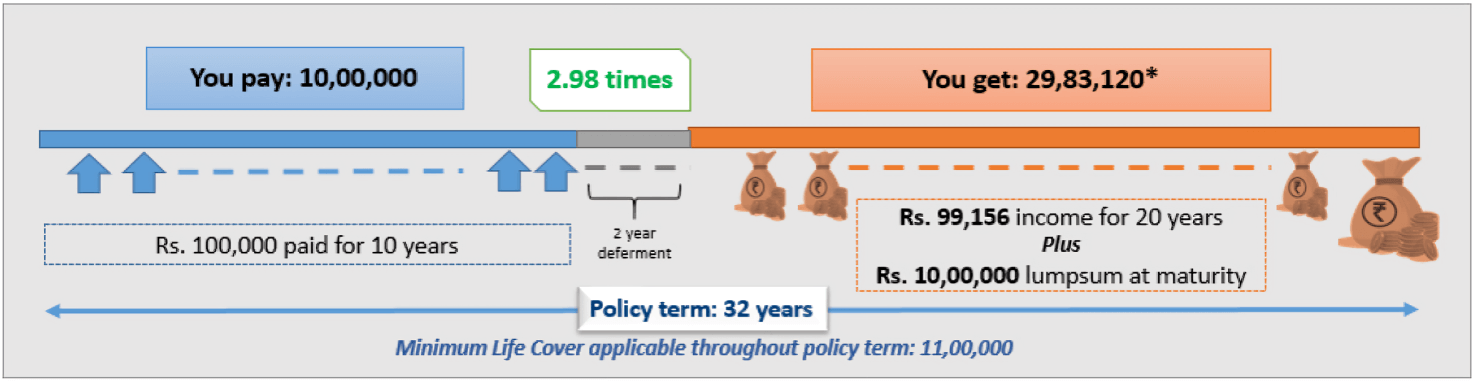

Example: Kartik, aged 35 years, pays a premium of ₹1,00,000 (via Direct Debit mode of payment) in Axis Max Life Smart Wealth Advantage Guarantee Plan on an annual mode. He opts for the Long Term Wealth variant, 10-year Premium Payment Term, 2-year deferment period and 20-year income term. He chooses the income payout option as Annually. Let us see how this plan would work for him:

| Policy Year | Life Insured’s Age (at the end of the year) | Annualised Premium (at the end of the year) | Auto Debit Booster (End of Year) | Base Income Benefit (End of Year) | Loyalty Income Booster (End of Year) | Sum Assured on Maturity (End of the year) |

|---|---|---|---|---|---|---|

| 0 | 35 | 1,00,000 | 0 | 0 | 0 | 0 |

| 1 | 35 | 1,00,000 | 0 | 0 | 0 | 0 |

| 2 | 36 | 1,00,000 | 0 | 0 | 0 | 0 |

| 3 | 37 | 1,00,000 | 0 | 0 | 0 | 0 |

| 4 | 38 | 1,00,000 | 0 | 0 | 0 | 0 |

| 5 | 39 | 1,00,000 | 0 | 0 | 0 | 0 |

| 6 | 40 | 1,00,000 | 0 | 0 | 0 | 0 |

| 7 | 41 | 1,00,000 | 0 | 0 | 0 | 0 |

| 8 | 42 | 1,00,000 | 0 | 0 | 0 | 0 |

| 9 | 43 | 1,00,000 | 0 | 0 | 0 | 0 |

| 10 | 44 | 0 | 9,000 | 0 | 0 | 0 |

| 11 | 45 | 0 | 0 | 0 | 0 | 0 |

| 12 | 46 | 0 | 0 | 0 | 0 | 0 |

| 13 | 47 | 0 | 0 | 82,630 | 16,526 | 0 |

| 14 | 48 | 0 | 0 | 82,630 | 16,526 | 0 |

| 15 | 49 | 0 | 0 | 82,630 | 16,526 | 0 |

| 16 | 50 | 0 | 0 | 82,630 | 16,526 | 0 |

| 17 | 51 | 0 | 0 | 82,630 | 16,526 | 0 |

| 18 | 52 | 0 | 0 | 82,630 | 16,526 | 0 |

| 19 | 53 | 0 | 0 | 82,630 | 16,526 | 0 |

| 20 | 54 | 0 | 0 | 82,630 | 16,526 | 0 |

| 21 | 55 | 0 | 0 | 82,630 | 16,526 | 0 |

| 22 | 56 | 0 | 0 | 82,630 | 16,526 | 0 |

| 23 | 57 | 0 | 0 | 82,630 | 16,526 | 0 |

| 24 | 58 | 0 | 0 | 82,630 | 16,526 | 0 |

| 25 | 59 | 0 | 0 | 82,630 | 16,526 | 0 |

| 26 | 60 | 0 | 0 | 82,630 | 16,526 | 0 |

| 27 | 61 | 0 | 0 | 82,630 | 16,526 | 0 |

| 28 | 62 | 0 | 0 | 82,630 | 16,526 | 0 |

| 29 | 63 | 0 | 0 | 82,630 | 16,526 | 0 |

| 30 | 64 | 0 | 0 | 82,630 | 16,526 | 0 |

| 31 | 65 | 0 | 0 | 82,630 | 16,526 | 0 |

| 32 | 66 | 0 | 0 | 82,630 | 16,526 | 10,00,000 |

- The total premiums paid by Kartik is ₹10,00,000. He receives a total income benefit of ₹19,83,120 (₹99,156 every year) and a maturity benefit (return of total premiums payable) of ₹10,00,000 at the end of the 32nd year.

- The Life Cover applicable for him at the inception of the policy is ₹11,00,000 and it may keep increasing further as per the applicable terms of his policy.

Early Wealth (Immediate Income from Year 1)

- How it works:

- Pay premiums for 5-15 years.

- Start receiving income immediately.

- Payout Structure: Guaranteed monthly income starting immediately.

- Premium Payment Term: 5, 6, 7, 8, 10, 12, 15 years.

- Maturity Benefit: Sum Assured on Maturity + Guaranteed Additions.

- Best For:

- People who need immediate liquidity.

- Business owners looking for a steady income source.

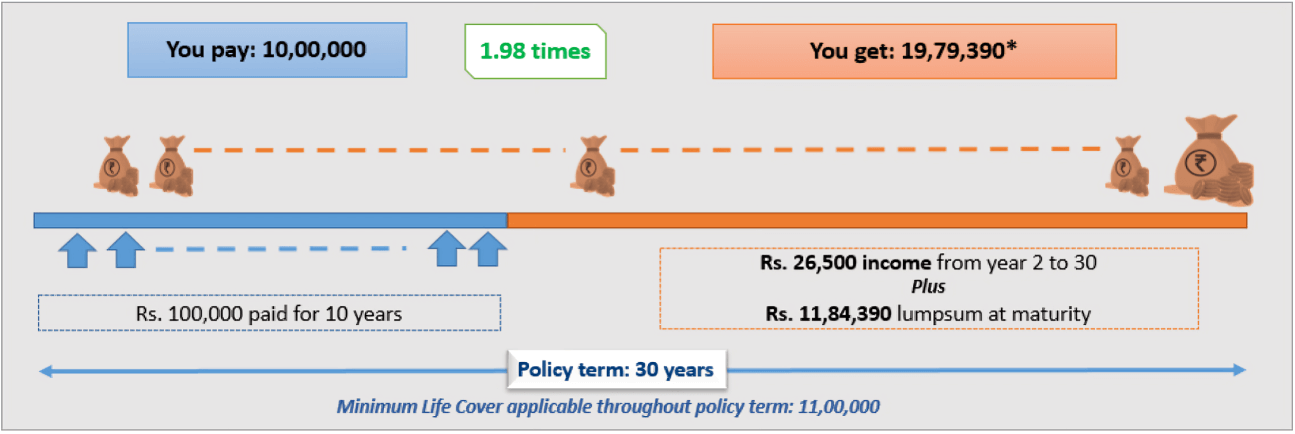

Example: Sumit, aged 35 years, pays a premium of ₹1,00,000 (via ECS mode of payment) in the Axis Max Life Smart Wealth Advantage Guarantee Plan on an annual mode. He opts for the Early Wealth variant, 10-year Premium Payment Term and 30-year Policy Term. He chooses to take his income from 1st year and payout option as Annually. Let us see how this plan would work for him:

| Policy Year | Life Insured’s Age (at the end of the year) | Annualised Premium (At the end of the Year) | Auto Debit Booster (End of the Year) | Base Income Benefit (End of Year) | Accrued Guaranteed Additions1 (End of Year) | Sum Assured at Maturity2 (End of Year) | Maturity Benefit(1+2) (End of Year) |

|---|---|---|---|---|---|---|---|

| 0 | 35 | 1,00,000 | 0 | 0 | 0 | 0 | 0 |

| 1 | 35 | 1,00,000 | 0 | 26,500 | 0 | 0 | 0 |

| 2 | 36 | 1,00,000 | 0 | 26,500 | 0 | 0 | 0 |

| 3 | 37 | 1,00,000 | 0 | 26,500 | 0 | 0 | 0 |

| 4 | 38 | 1,00,000 | 0 | 26,500 | 0 | 0 | 0 |

| 5 | 39 | 1,00,000 | 0 | 26,500 | 0 | 0 | 0 |

| 6 | 40 | 1,00,000 | 0 | 26,500 | 0 | 0 | 0 |

| 7 | 41 | 1,00,000 | 0 | 26,500 | 71,781 | 0 | 0 |

| 8 | 42 | 1,00,000 | 0 | 26,500 | 1,43,562 | 0 | 0 |

| 9 | 43 | 1,00,000 | 0 | 26,500 | 2,15,344 | 0 | 0 |

| 10 | 44 | 0 | 9,000 | 26,500 | 2,87,125 | 0 | 0 |

| 11 | 45 | 0 | 0 | 26,500 | 2,87,125 | 0 | 0 |

| 12 | 46 | 0 | 0 | 26,500 | 2,87,125 | 0 | 0 |

| 13 | 47 | 0 | 0 | 26,500 | 2,87,125 | 0 | 0 |

| 14 | 48 | 0 | 0 | 26,500 | 2,87,125 | 0 | 0 |

| 15 | 49 | 0 | 0 | 26,500 | 2,87,125 | 0 | 0 |

| 16 | 50 | 0 | 0 | 26,500 | 2,87,125 | 0 | 0 |

| 17 | 51 | 0 | 0 | 26,500 | 2,87,125 | 0 | 0 |

| 18 | 52 | 0 | 0 | 26,500 | 2,87,125 | 0 | 0 |

| 19 | 53 | 0 | 0 | 26,500 | 2,87,125 | 0 | 0 |

| 20 | 54 | 0 | 0 | 26,500 | 2,87,125 | 0 | 0 |

| 21 | 55 | 0 | 0 | 26,500 | 2,87,125 | 0 | 0 |

| 22 | 56 | 0 | 0 | 26,500 | 2,87,125 | 0 | 0 |

| 23 | 57 | 0 | 0 | 26,500 | 2,87,125 | 0 | 0 |

| 24 | 58 | 0 | 0 | 26,500 | 2,87,125 | 0 | 0 |

| 25 | 59 | 0 | 0 | 26,500 | 2,87,125 | 0 | 0 |

| 26 | 60 | 0 | 0 | 26,500 | 2,87,125 | 0 | 0 |

| 27 | 61 | 0 | 0 | 26,500 | 2,87,125 | 0 | 0 |

| 28 | 62 | 0 | 0 | 26,500 | 2,87,125 | 0 | 0 |

| 29 | 63 | 0 | 0 | 26,500 | 2,87,125 | 0 | 0 |

| 30 | 64 | 0 | 0 | 26,500 | 2,87,125 | 8,97,265 | 11,84,390 |

- The total premiums paid by Sumit is ₹10,00,000. He receives a total income benefit of ₹7,95,000 (₹26,500 every year) and a maturity benefit of ₹11,84,390 at the end of the 30th year.

- The Life Cover applicable for him at the inception of the policy is ₹11,00,000 and it may keep increasing further as per the applicable terms of his policy.

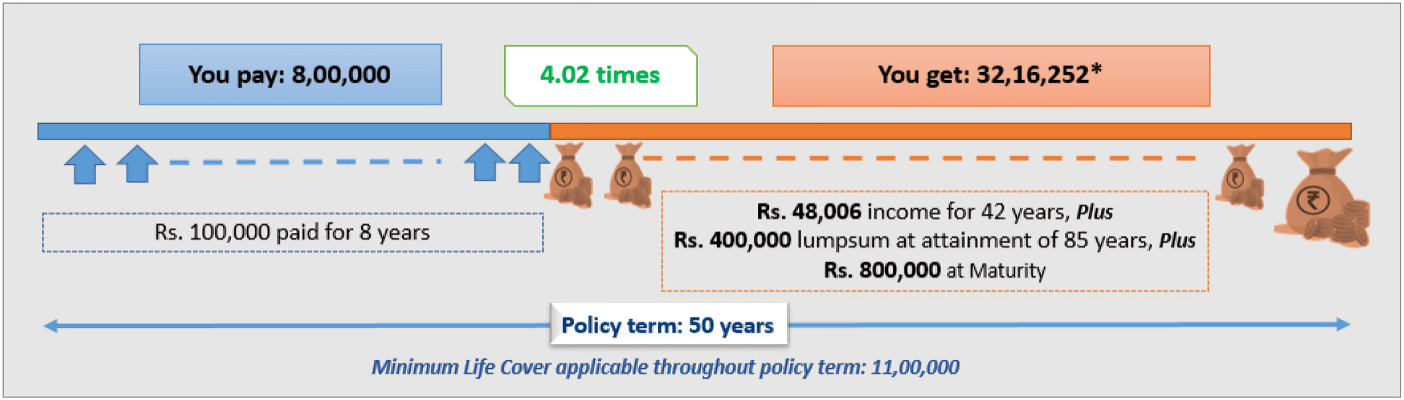

Lifelong Wealth (Guaranteed Income Until Age 100)

- How it works:

- Pay premiums for 5-12 years.

- Receive regular income till age 100.

- 50% of premiums returned at age 85.

- 100% of premiums returned at maturity.

- Payout Structure: Guaranteed annual income for life.

- Premium Payment Term: 5, 6, 8, 10, 12 years.

- Additional Benefits: 50% return of total premiums at age 85, 100% return at age 100.

- Best For:

- Individuals seeking financial security for life.

- Those planning for legacy wealth.

Example: Ramesh, aged 50 years pays a premium of ₹1,00,000 in Axis Max Life Smart Wealth Advantage Guarantee Plan. He opts for the Lifelong Wealth variant with an 8-year Premium Payment Term. He chooses the income payout option as annually. Let us see how this plan would work for him:

| Policy Year | Age at Entry (at the end of the year) | Annualised Premium (At the end of the Year) | Auto Debit Booster (End of year) | Base Income Benefit (End of Year) | Loyalty Income Benefit (End of Year) | Money back Amount | Sum Assured at Maturity (End of year) |

|---|---|---|---|---|---|---|---|

| 0 | 50 | 1,00,000 | 0 | 0 | 0 | 0 | 0 |

| 1 | 50 | 1,00,000 | 0 | 0 | 0 | 0 | 0 |

| 2 | 51 | 1,00,000 | 0 | 0 | 0 | 0 | 0 |

| 3 | 52 | 1,00,000 | 0 | 0 | 0 | 0 | 0 |

| 4 | 53 | 1,00,000 | 0 | 0 | 0 | 0 | 0 |

| 5 | 54 | 1,00,000 | 0 | 0 | 0 | 0 | 0 |

| 6 | 55 | 1,00,000 | 0 | 0 | 0 | 0 | 0 |

| 7 | 56 | 1,00,000 | 0 | 0 | 0 | 0 | 0 |

| 8 | 57 | – | 7,000 | 0 | 0 | 0 | 0 |

| 9 | 58 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 10 | 59 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 11 | 60 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 12 | 61 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 13 | 62 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 14 | 63 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 15 | 64 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 16 | 65 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 17 | 66 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 18 | 67 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 19 | 68 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 20 | 69 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 21 | 70 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 22 | 71 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 23 | 72 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 24 | 73 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 25 | 74 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 26 | 75 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 27 | 76 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 28 | 77 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 29 | 78 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 30 | 79 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 31 | 80 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 32 | 81 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 33 | 82 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 34 | 83 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 35 | 84 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 36 | 85 | – | 0 | 40,005 | 8,001 | 4,00,000 | 0 |

| 37 | 86 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 38 | 87 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 39 | 88 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 40 | 89 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 41 | 90 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 42 | 91 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 43 | 92 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 44 | 93 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 45 | 94 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 46 | 95 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 47 | 96 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 48 | 97 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 49 | 98 | – | 0 | 40,005 | 8,001 | 0 | 0 |

| 50 | 99 | – | 0 | 40,005 | 8,001 | 0 | 8,00,000 |

- The total premiums paid by Ramesh is ₹8,00,000. Further, he receives a total income benefit of ₹48,006 every year. Upon death any time before attaining 100 years of age, he further receives a death benefit as applicable.

- The Life Cover applicable for him at the inception of the policy is ₹11,00,000 and it may keep increasing further as per the applicable terms of his policy.

Benefits & Payouts of the SWAG Plan

Maturity Benefit

- Based on the chosen variant, the maturity benefit can be a lump sum payout or guaranteed income.

- Some variants return 100% of the total premiums paid.

Death Benefit

- Higher of Sum Assured on Death or 105% of total premiums paid.

- If the Policy Continuance Benefit (PCB) is opted for, future benefits continue even after the policyholder’s demise.

- In-Built Accidental Death Benefit: All variants (except single premium options) come with a built-in accidental death benefit of 50% of the Sum Assured on Death. This provides an additional layer of security for your family.

Survival Benefits

- Income payouts are available in Regular Wealth, Long-Term Wealth, Early Wealth, and Lifelong Wealth.

- Additional Loyalty Income Boosters enhance benefits over time.

Tax Benefits

- Premiums qualify for tax deductions under Section 80C.

- Payouts may be tax-free under Section 10(10D).

Who Should Consider the Axis Max SWAG Plan?

The Smart Wealth Advantage Guarantee Plan by Axis Bank and Max Life Insurance is ideal for:

✔️ Individuals looking for guaranteed returns and risk-free wealth accumulation.

✔️ Those who want regular income post-retirement or after a deferment period.

✔️ Parents planning for their child’s higher education or future expenses.

✔️ Individuals who want lifetime income security up to 100 years of age.

However, if you are looking for high-risk, high-reward investments, this may not be the right choice since it is not market-linked.

Comparison: SWAG Plan vs. Other Investment Options

| Features | SWAG Plan | ULIPs | Fixed Deposits | Mutual Funds |

| Risk | Low (Guaranteed) | Medium | Low | High |

| Returns | Fixed & Assured | Market-linked | Fixed | Market-linked |

| Liquidity | Moderate | High | High | High |

| Life Cover | Yes | Yes | No | No |

| Tax Benefits | Yes | Yes | Yes | Partial |

Pros and Cons of the Axis Max SWAG Plan

✅ Pros:

✔ Guaranteed maturity and death benefits.

✔ Multiple variants to suit different needs.

✔ Accidental death benefit included.

✔ Flexible premium payment terms.

✔ Tax benefits available.

❌ Cons:

✘ Returns are lower compared to market-linked plans.

✘ Lack of liquidity if choosing a lump sum variant.

✘ Higher premium requirements for some variants.

Frequently Asked Questions

Who should invest in this plan?

Anyone looking for guaranteed returns with insurance benefits.

Can I take a loan against this policy?

Yes, loans are available after the policy acquires a surrender value.

What happens if I stop paying premiums?

The policy may lapse, but revival options are available.

What is the difference between participatory and non-participatory plans?

A participating policy entitles the policyholder to receive a stake in the profits of the insurance company through bonuses or dividends. Such policies are also called with-profit policies. Whereas non-participating policies do not have any stake in profits, and no dividends are paid to the policyholder.

Guaranteed Savings Plans provide a guaranteed payout, but the extent of guarantee depends on whether the plan is participatory or non-participatory. Non-participatory plans guarantee the entire payout, while participatory plans only guarantee a certain portion of the payout.

How is this different from ULIPs or mutual funds?

This plan offers fixed, guaranteed returns, unlike ULIPs/mutual funds, which are market-linked.

Do I get any tax benefits on life insurance premiums paid?

You can claim tax benefits under Sec 80C of the Income Tax Act for the amount of premium paid for all Guaranteed Return Insurance Plans.

Does my nominee have to pay tax on the death benefit received?

The death benefit amount received is tax-free under Income Tax Act, Sec 10(10D).

Is the maturity amount of Guaranteed Savings Insurance Plans taxable?

For all Guaranteed Savings Investment Plans issued before 1st April 2023, the maturity proceeds will be tax-free u/s Section 10 (10D).

For all Guaranteed Savings Insurance Plans issued on or after 1st April 2023, the maturity proceeds will be tax-free u/s Section 10 (10D) only if the aggregate premium of all the policies does not exceed ₹5,00,000/-, else the maturity proceeds will be taxable.

Conclusion

The Max Life Smart Wealth Advantage Guarantee Plan is a well-structured savings and insurance solution that offers guaranteed returns, flexible payouts, and life protection. Its multiple variants allow you to customize your plan based on your financial needs.

If you are looking for stability, guaranteed returns, and a hassle-free wealth accumulation plan, then the Axis Max SWAG Plan could be an excellent option. However, if you prefer higher returns with market exposure, you might want to explore ULIPs or mutual funds instead.

Final Verdict:

Now that you know everything about this plan in detail, it doesn’t mean that you should immediately buy it. As with any other financial product, careful consideration and a thorough analysis of your individual circumstances should guide your decision.

Ask yourself:

✅ Do you need guaranteed, risk-free returns for future financial security?

✅ Are you looking for a stable income stream for retirement or major life goals?

✅ Do you prefer a structured savings plan with insurance coverage?

✅ Will the premium payments fit within your budget comfortably?

If the answer to most of these is yes, this plan could be a great fit for you. However, if you are looking for higher returns and are comfortable with market risks, you may want to explore mutual funds, ULIPs, or other investment options.

You can also seek the help of a financial professional to analyze your needs and assess whether this plan is the best option for you. A financial advisor can help you understand how this plan fits into your overall portfolio and whether it aligns with your long-term goals. Please feel free to reach out if you have any queries.

At the end of the day, the right financial decision is one that aligns with your individual needs, goals, and risk appetite. Take your time, evaluate your priorities, and make an informed choice. Financial security is a long-term commitment—choose wisely!

Disclaimer:

This article provides general information only and does not constitute financial advice. Financial regulations, product terms, and industry guidelines are revised from time to time. While we have made efforts to ensure the accuracy of the information presented, we do not guarantee its completeness or accuracy. We disclaim any liability for loss or damage arising from actions taken based on the information provided in this article. To make informed financial decisions, please do your own research and consult with a qualified financial professional.