Introduction:

We buy a life insurance policy to ensure that our loved ones do not have to compromise their dreams and goals for lack of funds. However, do you know that just writing your wife’s or kid’s name in the “Details of Nominee” block in an insurance application does not ensure that they will be the ones who will receive the claim amount in case of an eventuality?

Read on to understand the Married Women’s Property Act and how it addresses this concern and ensures that nobody else but your loved ones enjoys the benefits of your policy.

Why was Married Women’s Property Act enacted?

The Married Women’s Property Act of 1874 was legislated in India as a substantial welfare measure to address married women’s property rights and financial independence. The act aims to ensure that married women have absolute ownership over any property they acquire or are vested with, safeguarding their rights in a patriarchal community.

Under the Married Women’s Property Act, once a woman gets married, her husband cannot acquire any interest or claim any right over her property. This legal protection is extended to the wages, earnings, property, investments, and savings accumulated by a married woman, ensuring that they remain her exclusive possessions and separate from those of her husband and relatives.

MWP Act was enacted with the intent of empowering married women and providing them with the means to maintain financial freedom. It acknowledges the significance of securing a woman’s ownership and control over her own assets, enabling her to make autonomous decisions regarding their use and disposal.

The Married Women’s Property Act of 1874 was a significant step towards correcting the cultural disadvantages married women faced regarding property rights. It aimed to promote gender equality and protect women from potential exploitation by ensuring that their property remained secure and beyond the reach of their husbands, in-laws, or any other relatives.

MWP Act played an important role in empowering married women, granting them legal protection and economic autonomy over their property, and contributing to their overall well-being and social progress.

In this article, we will focus specifically on Sections 5 and 6 of the Married Women’s Property Act, which deals with the life insurance policy bought under MWP Act.

What is Married Women’s Property Act, Section 6?

Married Women’s Property Act is commonly referred to as MWPA.

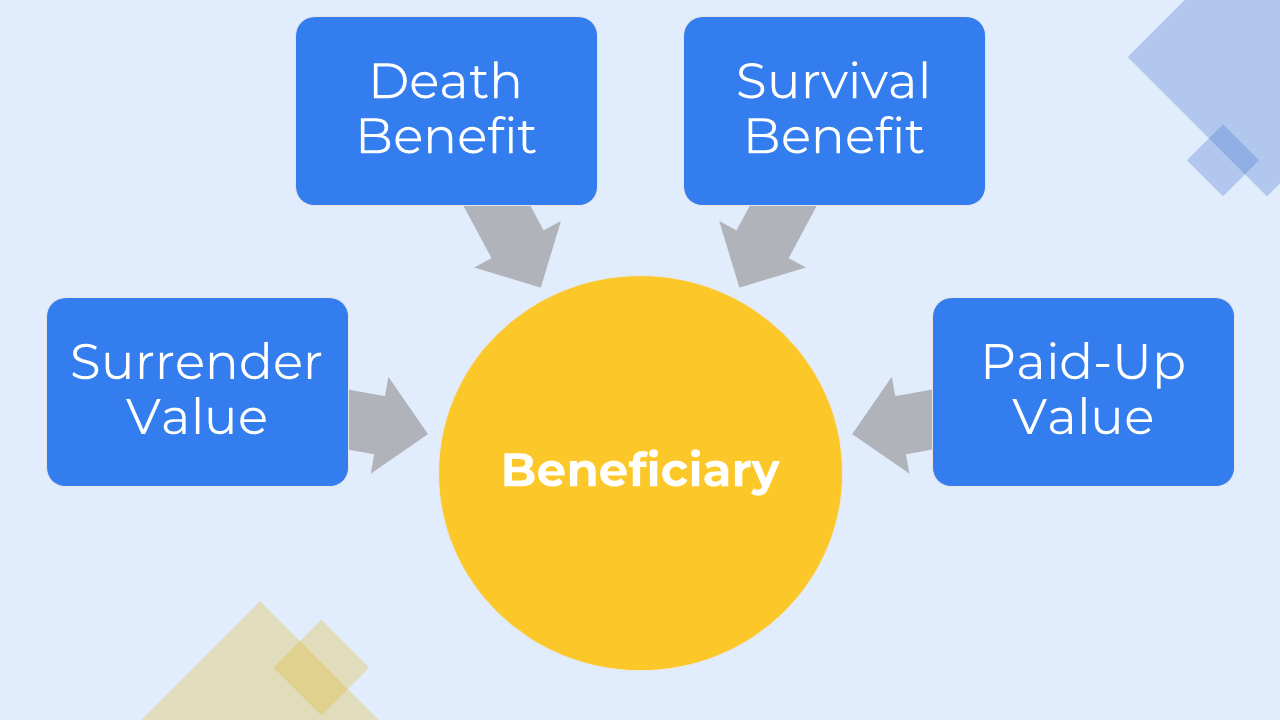

If your policy is bought under MWPA, all the benefits (maturity benefit/survival benefit/death benefit/surrender benefit/paid-up value) are paid to the beneficiaries you have opted for while purchasing the policy. Beneficiaries can be your wife and/or kids. Also, the insured can dedicate a specific percentage of the sum assured to each of the policy’s beneficiaries.

How to buy a policy under MWPA?

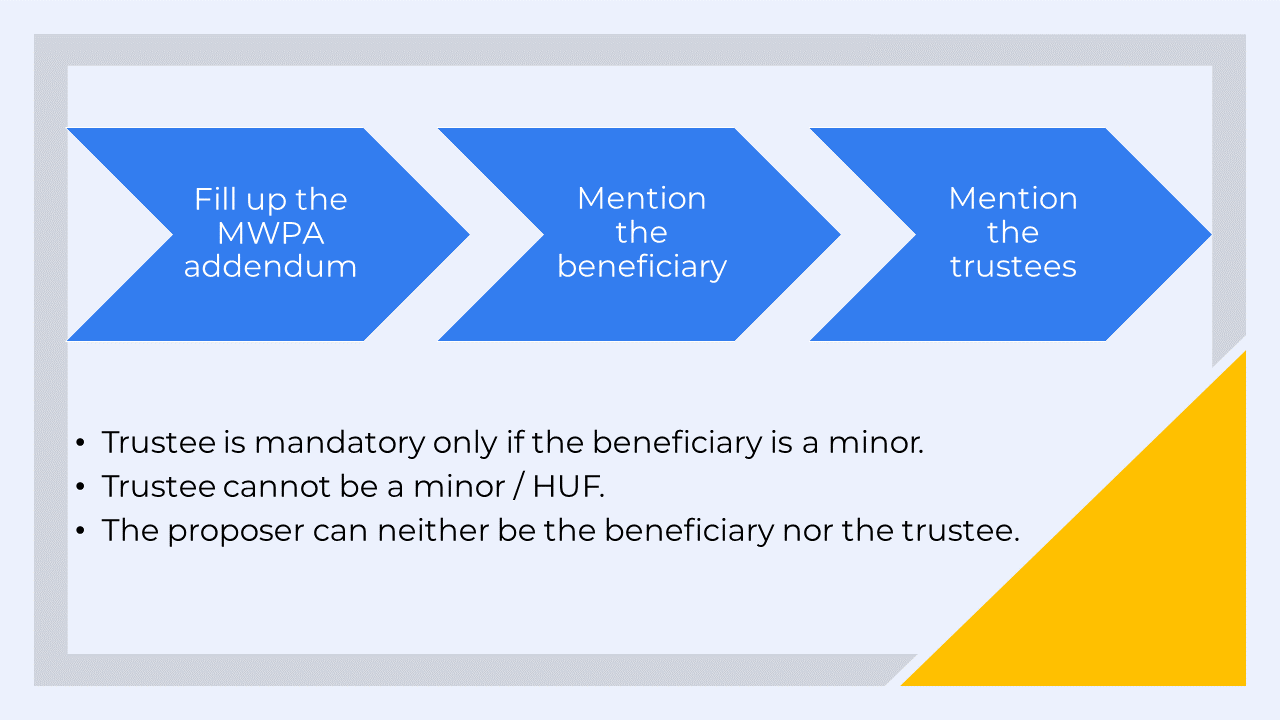

While applying for the policy, you need to fill out the MWPA addendum. Each policy under Married Women’s Property Act is automatically considered a separate trust (there is no need to create one).

You have to mention the beneficiaries’ names at the time of the proposal. You may also mention the names of trustees (not mandatory, though). However, if the beneficiary is minor, then the appointment of the Trustee is compulsory. A trustee cannot be a minor / HUF (Hindu Undivided Family).

Also, you (the proposer) can neither be the Beneficiary nor the Trustee. However, the Beneficiary and the Trustee can be the same person (e.g., Your wife can be both the Beneficiary and the Trustee).

Why should you buy a policy under MWPA?

To understand this, let us consider a hypothetical scenario. Mr. Kumar bought a 1Cr life insurance policy. A few months after purchasing the policy, he met with an accident resulting in his untimely death. He had taken a significant amount of unsecured loans to launch his dream start-up. His creditors initiated legal action against him to recover this amount. And the court passed the verdict in favour of their creditors, and a court order was issued to recover the money from his insurance policy. Thus, his family was deprived of the claim amount due.

This situation could have been easily avoided if the policy had been purchased under MWPA. Because once a policy is availed under the Married Women’s Property Act, it can’t be attached by courts to repay the policyholder’s debts.

Let us explore various scenarios to understand how policy bought under Married Women’s Property Act safeguards the beneficiary’s interest under all circumstances.

Death Benefit: As seen in the example above, the Death Benefit is always paid to the assigned beneficiary.

Survival Benefit: If the policy is bought under MWPA is Endowment, MoneyBack, Whole Life, or ULIP and has any survival or maturity payouts, those payouts are always paid to the assigned beneficiary.

Surrender Value: If the policyholder decides to surrender the policy, all the accumulated cash value is paid to the beneficiary.

Paid-Up Value: All cash-value life insurance policies acquire a paid-up value if the premium is paid for a specific period (as specified by the policy wording). However, the beneficiary will get a reduced maturity amount if the premiums are not paid as and when due.

Which additional laws were enacted by the MWP Act?

Life Insurance Policies purchased in the Name of Married Women:

Prior to the implementation of the Married Women’s Property Act, in the event of a man’s death without settling his debts, his creditors had the legal right to stake a claim on any assets he left behind. This covered both tangible assets, such as real estate and movable property, as well as liquid assets, like cash. It even extended to any payments designated for his beneficiaries through life insurance policies.

However, the Married Women’s Property Act, specifically through Section 6, brought about a significant change in this scenario. It established that the assured sums from life insurance policies would be considered as the property of a man’s wife and children rather than being treated as part of his assets or estate.

Right to Choose Insurance Coverage:

Another crucial aspect of the MWP Act pertains to the autonomy of married women in acquiring insurance policies. Under this provision, the insurance policy and its resulting benefits become the exclusive property of the woman who holds it. In the context of the insurance contract, the policy is considered fully valid, just as it would be if the woman were unmarried. This provision is especially significant because, historically, married women did not have the capacity to enter into contracts independently.

Ownership over Earnings of a Married Woman:

The Married Women’s Property Act addresses the ownership of earnings for married women. Regardless of the nature of a woman’s employment, occupation, or trade, if it is independent of her husband, her wages and earnings are considered her exclusive property.

Additionally, any money or property acquired by a woman through her skills or talents, whether in the fields of literature, art, or science, is also recognized as her separate property. This extends to all savings and investments derived from her income, further establishing them as her distinct assets.

Liability for Post-Nuptial Debts:

The Married Women’s Property Act of 1874 addresses the issue of post-nuptial debts. While the act primarily outlines the rights of women, it also delineates their responsibilities. This specific section pertains to contracts or agreements made by married women concerning their property. If someone enters into an agreement regarding the property of a married woman, they retain the legal right to take legal action against her and recover the same as they would if the woman were unmarried.

Husband’s Liability for Ante-Nuptial Debts:

Moreover, the Married Women’s Property Act of 1874 addresses the husband’s exemption from responsibility for debts incurred by his wife prior to their marriage. The MWP Act also clarifies that when it comes to debts acquired, a married woman’s liability, in terms of being subject to legal actions, remains unchanged, akin to her status if she were unmarried.

Husband’s Liability for Breach of Trust or Devastation:

The Married Women’s Property Act also provides clarity on the husband’s responsibility when his wife serves as a trustee or executor. If the husband has no active involvement in the trust’s affairs, he will not bear liability for any breach of trust or damage inflicted upon the estate due to her actions.

Authority to Initiate Legal Actions:

The Married Women’s Property Act (MWPA) grants women the authority to initiate legal proceedings. This provision was incorporated to furnish women with a legal avenue to pursue cases in order to reclaim their individual property, whether obtained under the Married Women’s Property Act or the Indian Succession Act.

Under this section, it is explicitly stated that all legal remedies, both civil and criminal, which would be accessible to an unmarried woman for safeguarding her property, are equally available to a married woman.

Resources:

https://lddashboard.legislative.gov.in/sites/default/files/A1874-3.pdf

https://www.indmoney.com/articles/insurance/married-womens-property-act-in-india

Frequently Asked Questions:

Who can be beneficiaries under the MWPA policy?

The beneficiaries under the MWPA policy can be your wife and/or child(ren). As a policyholder, you can assign specific percentages of the sum assured to each beneficiary or divide it equally.

Can I assign the insurance policy issued under MWP Act?

No. The policy endorsed under the Married Women’s Property Act 1874 cannot be assigned to someone else.

Can I take a loan on the life insurance plan bought under the Married Women’s Property Act?

No. You cannot take a loan on the policies endorsed under the Married Women’s Property Act. (However, if a loan request comes from you, signed by the Beneficiary & Trustee, it can be processed).

Can a policy bought under MWPA be surrendered?

Surrender request should come from the policyholder and be signed by the Trustee (if appointed) and beneficiary. The beneficiary should be a major at the time of the request. Surrender proceeds will be paid to the Trustee/Beneficiary. The policy maturity benefits will also go to the Trust.

What happens if I name my wife the beneficiary and she passes away before me?

If your beneficiary (wife) passes away before you, the legal heir of the policyholder shall be eligible to receive the claim amount. However, mentioning more than one beneficiary when taking the policy is advisable.

Can I change the Trustees & Beneficiaries?

You (the policyholder) have the option to change the trustees at any point in time. However, once declared, the plan’s beneficiaries cannot be changed.

Can I have more than one plan under the MWP Act?

Yes, you can have more than one plan under the MWP Act. But you must register each one of them separately under Married Women’s Property Act.

Can I endorse my existing life insurance plan under MWP Act 1874?

No. Once a life insurance plan is issued, you cannot assign it under the MWP Act later. You have to endorse your insurance under the MWPA at the time of the purchase of the policy.

If I make my wife the beneficiary and we later divorce, will she continue to be the beneficiary of the policy?

For any insurance policy covered under the Married Women’s Property Act, the beneficiary cannot be changed once opted in when taking the policy. So, when you appoint your wife as the beneficiary, and if you divorce, your beneficiary (wife) will remain the same.

Can parents be added as beneficiaries under the MWP Act?

No, parents cannot be added as beneficiaries under the MWP Act. Only your wife/kid/kids can be chosen as beneficiaries.

What type of life insurance plans can be purchased under MWPA?

Almost all life insurance plans (Whole Life / ULIP / Money-Back / Term / Endowment etc.) can be endorsed under Married Women’s Property Act. However, Pension Plans cannot be purchased under MWP Act.

Can a married woman buy a life insurance policy under MWP Act?

Yes, even a married woman can buy a policy under Married Women’s Property Act in her name with her children as beneficiaries; the husband will not get anything from the policy. It will be considered as a separate asset as if she is unmarried.

Section 5 of the MWP Act 1874 states that any married woman may effect a policy of insurance on her behalf and independently of her husband. In such a policy, which may or may not be with her husband’s consent, only she has the sole authority over the policy’s benefits.

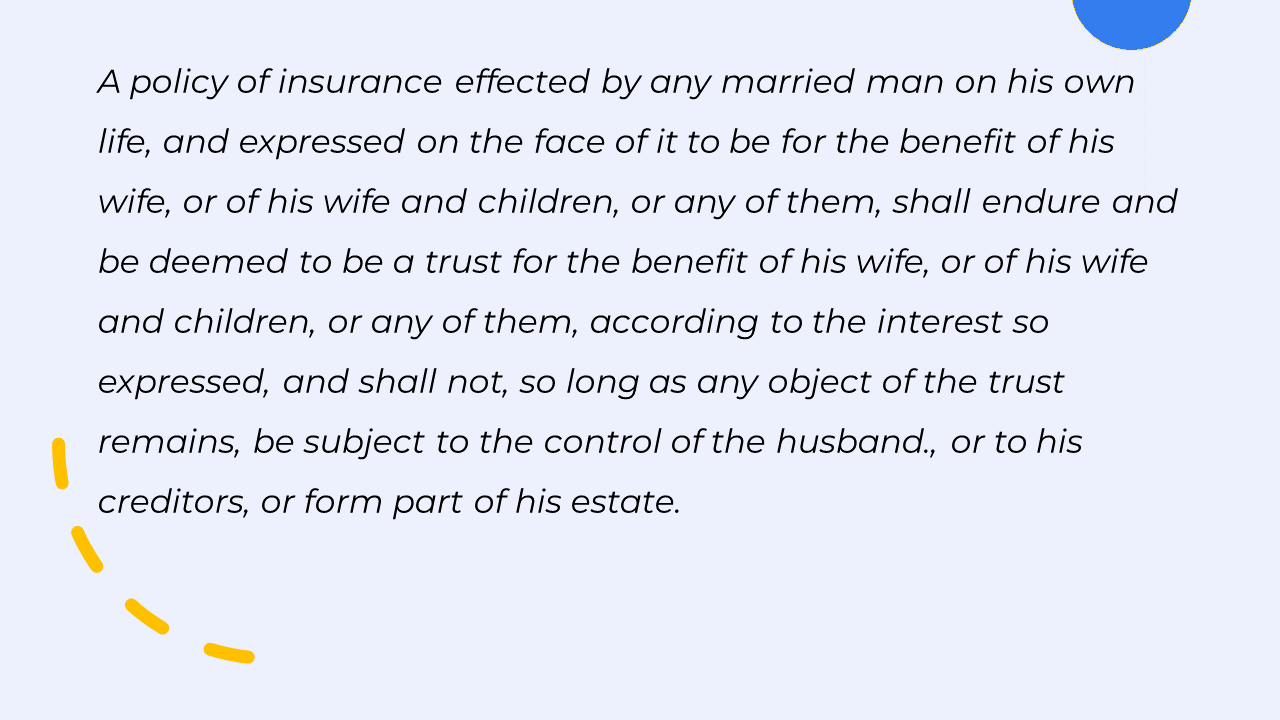

Section 6 of the MWP Act pertains to the policy of insurance effected by any married man on his own life and to the benefit of his wife. Such a policy will not be subject to the control of the husband or his creditors and will not form part of his estate. Both sections empower married women. But the difference is between the policyholder and the beneficiaries.

Under section 5 of the MWP Act, the policyholder and beneficiary are both women. In contrast, under section 6 of the MWP Act, the policyholder is the man who creates a policy for his wife and/or children, and the beneficiaries are the latter.

How does a ‘Beneficial Nominee’ differ from a nominee in a life insurance policy?

In traditional life insurance policies, nominees have historically served as receivers of the insurance proceeds on behalf of the legal heirs of the policyholder. However, with the introduction of the Insurance (Amendment) Act 2015, a new category known as ‘Beneficial Nominee’ has been established. This category designates nominees, such as spouses, parents, and children, as the ultimate recipients of the insurance proceeds.

Under this new clause, when a person designates someone as a ‘Beneficial Nominee,’ that nominee becomes both the receiver and the final beneficiary of the insurance proceeds. Moreover, this clause simplifies the process for policyholders to specify multiple beneficial nominees and define their respective shares in the proceeds.

Why is a simple nomination not always adequate in life insurance?

It’s important to note that in a life insurance policy, a husband has the option to designate his wife and children as beneficial nominees. Once these beneficial nominees are named, their right to receive the death benefits of the policy becomes legally protected, and no one else can contest this claim. However, it’s vital to understand that you can make changes to the chosen beneficial nominees during the policy term. This flexibility means that, in situations like divorce or under the influence of other family members, the husband can make changes to the policy’s beneficiaries at a later stage. It’s important to note that the policies obtained under the Married Women’s Property Act do not permit alterations to the designated beneficiary.

Can widowers or divorcees buy a life insurance policy under MWPA?

Widowers or divorcees can also buy a life insurance policy under MWP Act to ensure that the benefit goes to the children.

Conclusion:

We hope you enjoyed this article on Married Women’s Property Act and you will take some time to think about your loved ones and consider purchasing a policy under MWPA to ensure that they are protected in the case of your unfortunate death.

If you have any questions about life insurance, please feel free to Contact Us. We will be more than happy to assist you.

Disclaimer:

This article provides general information only and does not constitute financial advice. Financial regulations, product terms, and industry guidelines are revised from time to time. While we have made efforts to ensure the accuracy of the information presented, we do not guarantee its completeness or accuracy. We disclaim any liability for loss or damage arising from actions taken based on the information provided in this article. To make informed financial decisions, please do your own research and consult with a qualified financial professional.

SPREAD THE WORD WITH YOUR NETWORK