Introduction:

If you’re seeking a reliable investment avenue with assured returns, then fixed-income government securities like Treasury Bills is always an option you can consider. These fixed-income government securities can offer stable and predictable returns.

In this article, we will explore the complexities of Treasury Bills, equipping you with essential insights to assess their compatibility with your investment objectives.

What is a Treasury Bill?

A Treasury Bill, also referred to as T-Bill, is a financial instrument issued by the Government of India, serving as a promissory note for future repayment. By raising funds to meet the government’s short-term financial requirements, T-Bills play a crucial role in mitigating the fiscal deficit of the country.

T-Bills are designed as short-term investments, available in three different tenures. T-Bills are issued at a discounted rate and redeemed at their nominal value, offering an opportunity for subscribers to earn a profit.

How do Treasury Bills Work?

Investing in Treasury Bills presents an opportunity for subscribers to generate profits by redeeming them at their face value. To illustrate this, consider the following example:

Imagine purchasing several units of T-Bills valued at ₹150 each but at a discounted rate of ₹144. Upon maturity, you can redeem these bills at their full face value of ₹150, resulting in a profit of ₹6 per unit.

Why does the Government issue Treasury Bills?

The Government of India issues T-Bills to secure short-term funds for various expenditures and manage cash flow effectively. By issuing T-Bills, the government can access funds from the public without the need for costlier alternatives like bank loans. Additionally, T-Bills serve a crucial function in controlling the money supply and ensuring liquidity within the financial system.

Under the open market operations (OMO) strategy, the Reserve Bank of India acts on behalf of the government to issue T-Bills for public purchase. This approach helps the RBI control inflation and influence consumer borrowing and spending patterns. During periods of high inflation resulting from economic growth, the government issues high-value T-Bills to curtail excessive money supply.

Conversely, during economic slowdowns, the government releases T-Bills at a reduced circulation rate and discounted rates. This strategy aims to redirect investor resources to specific sectors, boosting cash flows into the stock market and stimulating economic activity.

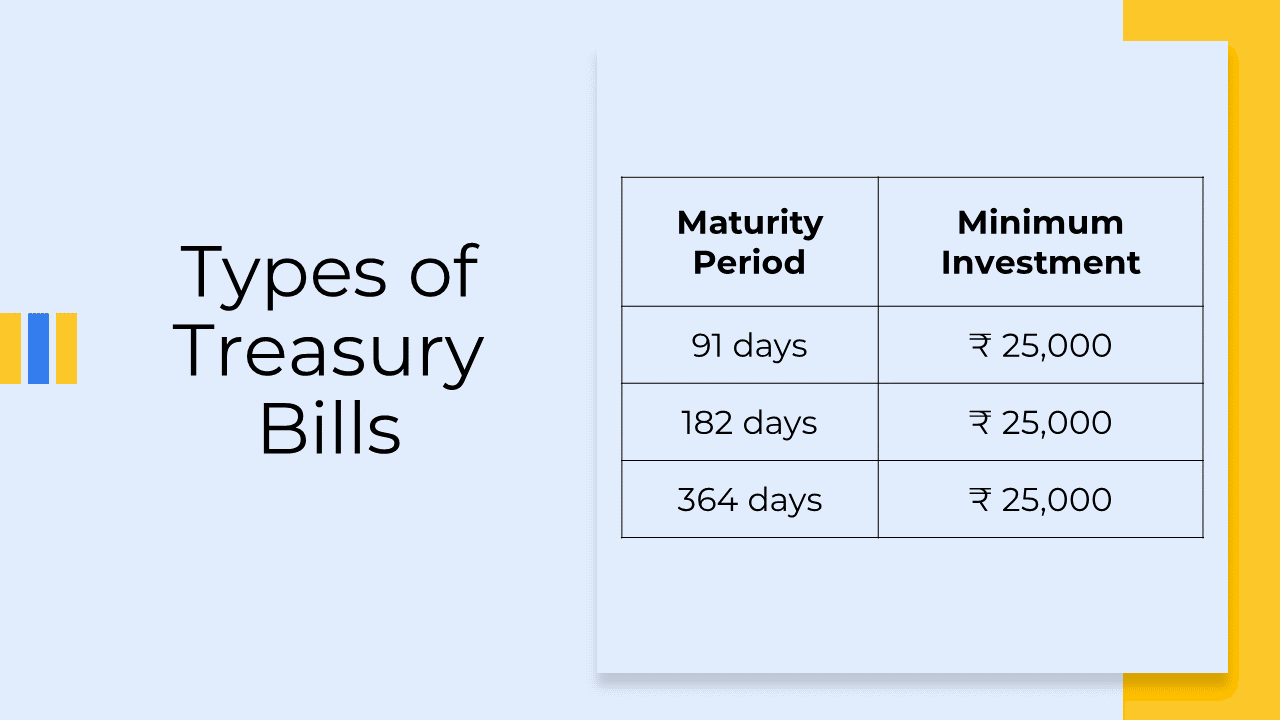

Types of Treasury Bills:

T-Bills are categorized based on their maturity period, with a maximum tenure of less than one year. The following are the primary types of Treasury Bills, distinguished by their maturity periods:

Key Features of Treasury Bills:

Minimum Investment:

According to the regulations set by the RBI, the minimum investment amount for T-Bills is ₹25,000. If an individual wishes to invest a higher amount, it must be in multiples of ₹25,000.

Zero-Coupon Securities:

Unlike other investment options, T-Bills do not provide an interest rate. Instead, they function as zero-coupon securities, generating returns based on the price differential, which is the difference between the discounted rate and the selling price.

Trading:

Treasury Bills and Bonds are issued by the Reserve Bank of India (RBI) into the market every Wednesday. Investors can purchase them directly from the government or through authorized primary dealers and participating banks. Additionally, depending on the submitted bids, securities can be traded with T-Bills. Following the redemption of a T-Bill, a T+1 settlement process is initiated.

How to calculate yield on Treasury Bills?

As previously stated, T-Bills provide guaranteed returns. The yield of a T-Bill represents the annual return on your investment. To clarify, if you earned a profit of ₹6 over a period of 91 days on an investment of ₹100, the question arises: based on this rate, how much would you earn on an annual basis?

With that being said, the formula for calculating the T-Bill yield is as follows:

Yield = (Discount Value / Bond Price) * (365 / number of days to maturity)

By applying this formula to calculate the T-Bill yield, we have:

Yield = (6 / 100) * (365 / 91) = 24.06%

Benefits of Treasury Bills:

High Liquidity:

T-Bills have a maximum maturity period of 364 days. Nonetheless, you have the option to invest in T-Bills for as little as 91 days, which makes them suitable for your short-term objectives. In the event that you have acquired T-Bills with a longer tenure, you have the opportunity to sell these government securities in the secondary market and obtain returns in the event of a financial emergency.

No Market Risk:

Returns from equity or other investment schemes are tied to market performance and are influenced by the ups and downs of the market. During a period of the market boom, you can expect high returns, but during an underperforming market, you may face financial losses. In contrast, when you invest in T-Bills, your returns are fixed and predictable. This means that regardless of market performance, your returns remain guaranteed. These returns are generated by purchasing T-Bills at a discounted rate and selling them at face value.

Price Discovery:

Price discovery in the context of Treasury Bills involves the determination of their market value through the interplay of supply and demand.

The market determines the price and overall value of these short-term government securities by carefully assessing various factors, which include economic conditions, prevailing interest rates, and investor sentiment.

This process of price discovery enables investors to accurately evaluate the risks and potential returns associated with T-Bills, empowering them to make well-informed investment choices.

Limitations of Treasury Bills:

Low Returns:

While government T-Bills are considered the safest investment option, they typically do not yield significant returns compared to other securities in the market. The returns generated from T-Bills are also predetermined, meaning that they do not increase even if the market performs well. These returns may sometimes be insufficient to outpace inflation as well.

Taxable Returns:

Returns earned from T-Bill investments are subject to short-term capital gains tax (STCG) and are taxed according to the investor’s tax slab rate. Consequently, the tax rate can reach as high as 30%, depending on the applicable slab rate, which can further reduce the overall returns.

Barrier to Entry:

The minimum investment requirement for T-Bills is set at ₹25,000, which may pose affordability or feasibility challenges for numerous investors.

Who should consider investing in Treasury Bills?

RBI-issued T-Bills can be an ideal investment option for individuals who meet the following criteria:

- Those with a low-risk appetite

- Individuals seeking assured returns

- Investors with short-term financial goals and available surplus funds

- Those looking for alternatives to fixed deposits or liquid funds

Resources:

https://www.ccilindia.com/Research/Statistics/Pages/TenorwiseIndicativeYields.aspx

https://rbiretaildirect.in/#/rdg-account-registration

Frequently Asked Questions:

Who issues Treasury Bills?

T-Bills are exclusively issued by the central government. State governments do not possess the authority to issue or regulate T-Bills. The Reserve Bank of India acts on behalf of the central government to bring T-Bills to the market.

What do I get as proof after purchasing Treasury Bills?

Upon purchasing T-Bills, you will receive a treasury bill certificate from the issuing authority. This certificate will contain essential details such as your name, the invested amount, the maturity date, and the amount to be received at the end of the maturity period.

Are T-bills considered safe investment instruments?

Indeed, T-bills are regarded as a secure investment instrument. They are purchased at a discounted rate and redeemed at par value, providing returns that remain unaffected by market risks.

Why does the government issue Treasury Bills?

The government issues T-Bills to raise funds to fulfill short-term financial goals and mitigate the overall fiscal deficit.

What are the maturity periods of treasury bills?

In India, treasury bills are categorized into three types based on tenure. Currently, investors can choose from 91-day, 182-day, and 364-day T-Bills for purchase.

Can I retain T-bills beyond their maturity period?

No, you must return them to the government after the maturity period to receive the investment returns. Holding them for an extended period, beyond the maturity period, will not alter their return value.

Does the face value of Treasury Bills fluctuate during their tenure?

The face value of T-Bills may fluctuate over their tenure. Nevertheless, these fluctuations have no impact on your returns. The amount you invested and the return you will receive are explicitly stated on your bill, ensuring your returns remain unaffected. While the face value may change for subsequent investors, it remains constant for you once you have made the purchase.

What happens when Treasury Bills mature?

Upon the maturity of the T-Bills you possess, they are automatically debited from your Demat account, and you receive payment of the par value. This payment is typically made through a bank account linked to your trading account.

What is the difference between T-bills and bonds?

The primary distinction between T-bills and bonds lies in their tenure. T-bills have a maturity period of less than a year, whereas bonds mature after one year. Furthermore, T-bills generate returns based on the price difference between buying and selling, whereas bonds generate returns through periodic interest payments, typically paid twice a year.

Conclusion:

In summary, Treasury Bills offer a safe investment choice with assured returns for short-term goals. Although they may have lower returns and taxable earnings, T-Bills can be used to park funds for a shorter duration. By considering your risk tolerance, objectives, and available funds, you can decide if T-Bills are suitable for your investment portfolio.

We hope you enjoyed reading this article. If you have any questions, please feel free to Contact Us. We will be more than happy to assist you.

Disclaimer:

This article provides general information only and does not constitute financial advice. Financial regulations, product terms, and industry guidelines are revised from time to time. While we have made efforts to ensure the accuracy of the information presented, we do not guarantee its completeness or accuracy. We disclaim any liability for loss or damage arising from actions taken based on the information provided in this article. To make informed financial decisions, please do your own research and consult with a qualified financial professional.

SPREAD THE WORD WITH YOUR NETWORK