Introduction:

Looking for a reliable long-term tax-saving option in India? The Public Provident Fund may be a good choice for you. Launched by the Finance Ministry in 1968, the PPF scheme has gained immense popularity due to its winning combination of tax benefits, returns, and safety.

With the primary goal of encouraging individuals to save small amounts, the PPF Scheme offers an attractive interest rate. The best part? The returns generated from the interest rates are entirely tax-free.

If you’re seeking a simple and secure way to grow your savings while enjoying tax advantages, opening a PPF account is the way to go. Discover more about the benefits and guidelines associated with a PPF in this informative article.

What is a PPF account?

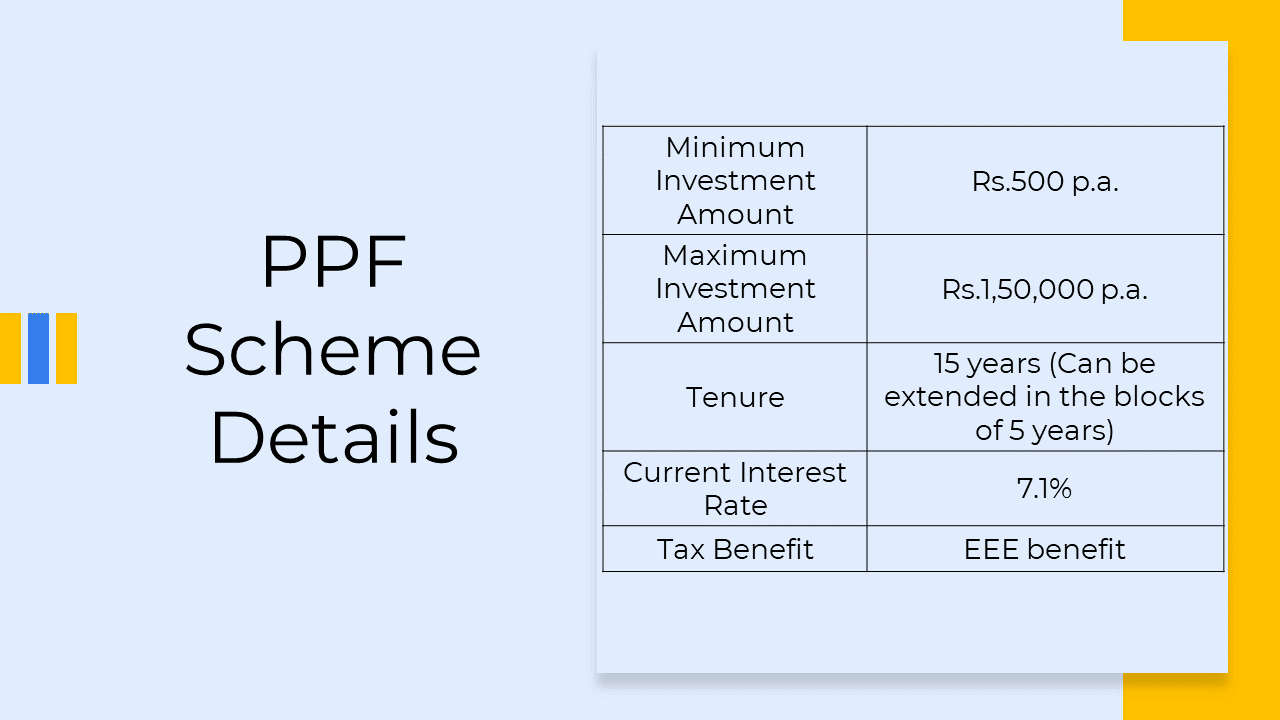

In order to encourage small savings, the Ministry of Finance launched the Public Provident Fund (PPF) Scheme. It is a simple and secure way to accumulate a sizable fund. Additionally, the PPF offers appealing tax benefits under the Exempt-Exempt-Exempt (EEE) framework. Take a look at the infographic below to discover the key highlights of a PPF scheme.

Who can open a PPF Account?

- Only Indian residents are eligible to invest in PPF scheme.

- Non-Resident Indians (NRIs) cannot invest in PPF scheme. However, if an Indian resident becomes an NRI after opening an account, they can continue the account until maturity.

- Parents or guardians can open PPF accounts for their minor children.

- Joint accounts and multiple accounts are not permitted for PPF.

Documents required to open a PPF Account:

To ensure a smooth PPF Account opening process, it is important to have the following documents handy:

- Account Opening Form: This form can be obtained from any authorized bank that offers PPF services.

- KYC Documents for Identity Verification: Please provide any of the following documents – Aadhaar Card, Voter ID card, or Driving License.

- Proof of Address: Submit a document that serves as proof of your address.

- PAN Card: Make sure to have your PAN Card handy.

- Passport Size Photograph: Include a recent passport-size photograph of yourself.

- Nomination Form (Form E): Obtain Form E, the nomination form, from any authorized bank offering PPF services.

Having these documents ready will facilitate the process of opening your PPF account without any hassle.

How to open a PPF Account?

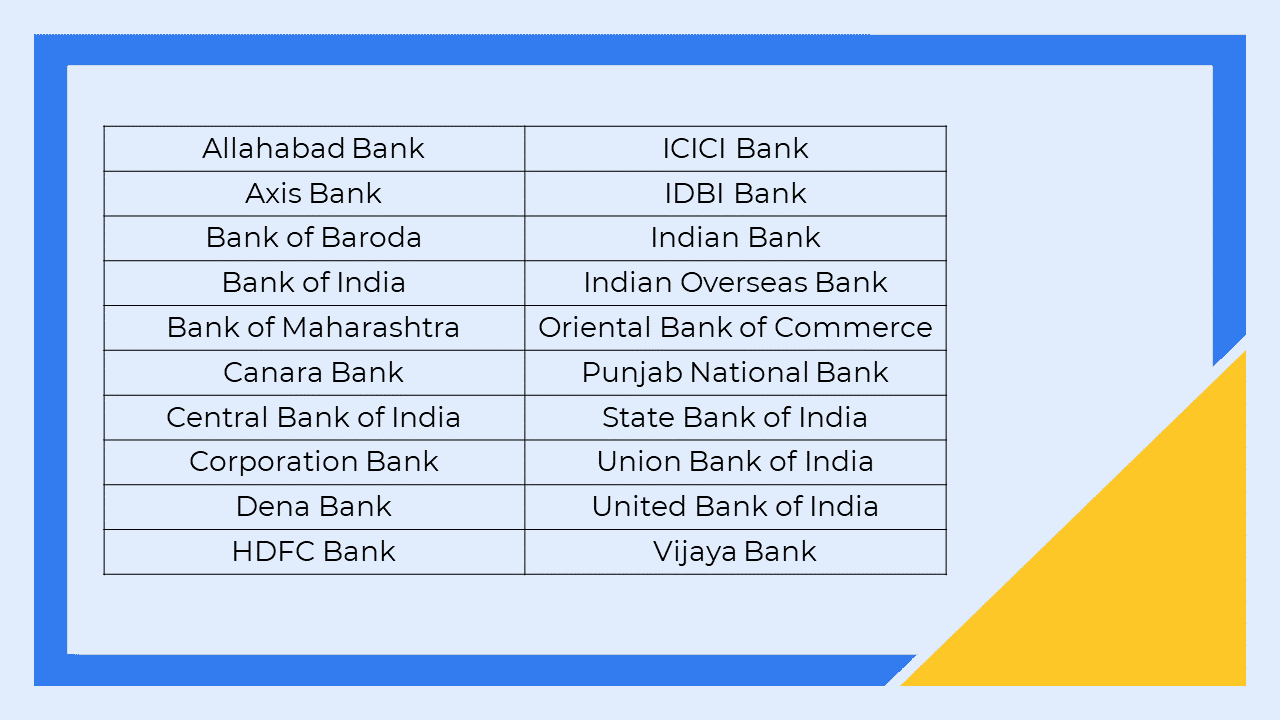

Opening a PPF account is a straightforward process that can be done at post offices or through various nationalized and major private banks such as ICICI, Axis, HDFC, etc. Follow these simple steps to get started:

- Fill out the Account Opening form by providing accurate and relevant information.

- Attach all the required documents, as mentioned in the form’s instructions, such as identity proof, address proof, PAN card, passport-size photograph, and any other specified documents.

- Submit the duly filled Account Opening form along with the necessary documents to the bank or post office. The bank or post office will verify your details and documents.

- Make the initial deposit amount as specified by the bank or post office. This amount can be between ₹500 to ₹1,50,000.

Once the verification process is complete and the initial deposit is made, your PPF account will be activated.

Banks authorized to open PPF Account:

How to open a PPF Account online?

To open a PPF account online using the net banking service of authorized banks, follow these steps:

- Log in to your net banking portal.

- Look for the option to “Open a PPF Account” and click on it.

- Choose whether to open a “Self Account” or a “Minor Account.”

- Provide the necessary information, including nominee details, bank details, and more.

- Verify the displayed details, such as your Permanent Account Number (PAN).

- Once the details are verified, enter the amount you wish to deposit into your account.

- Set up standing instructions for the bank to deduct the amount at fixed intervals or in a lump sum, as per your preference.

- You will receive an OTP (One-Time Password) for verification on your registered mobile number.

- After successful verification, your account will be opened. Make sure to save the displayed account number for future reference.

Certain banks may require you to submit a hard copy of the entered details along with the reference number and your KYC details to the respective bank.

Please note that while the general steps for opening a PPF account through net banking remain the same, the specific process may vary slightly from bank to bank.

Important Features of PPF Account:

- Investment Limits: Individuals are required to make a minimum investment of ₹500 per year in their PPF account. A maximum investment of ₹1,50,000 can be made in an account during a single financial year.

These investment limits ensure flexibility for individuals, allowing them to contribute according to their financial capacity while maximizing the benefits of the PPF scheme.

- Lock-in Period: The PPF scheme entails a long-term investment commitment with a lock-in period of 15 years. The accumulated funds in an account cannot be withdrawn during this time. The maturity of the account occurs after 15 years from the account opening date.

Furthermore, individuals can extend the lock-in period by another five years once the initial 15 years period concludes. While premature withdrawals are permitted in emergency situations, they are subject to certain conditions.

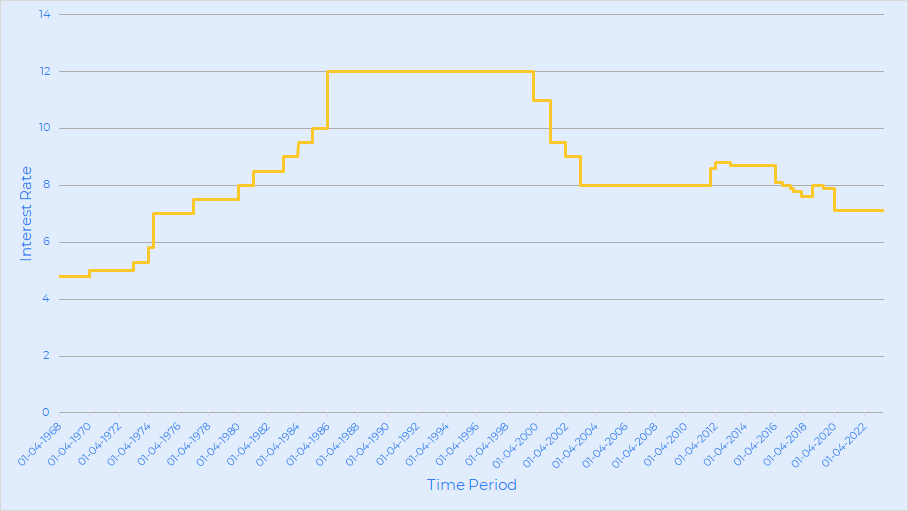

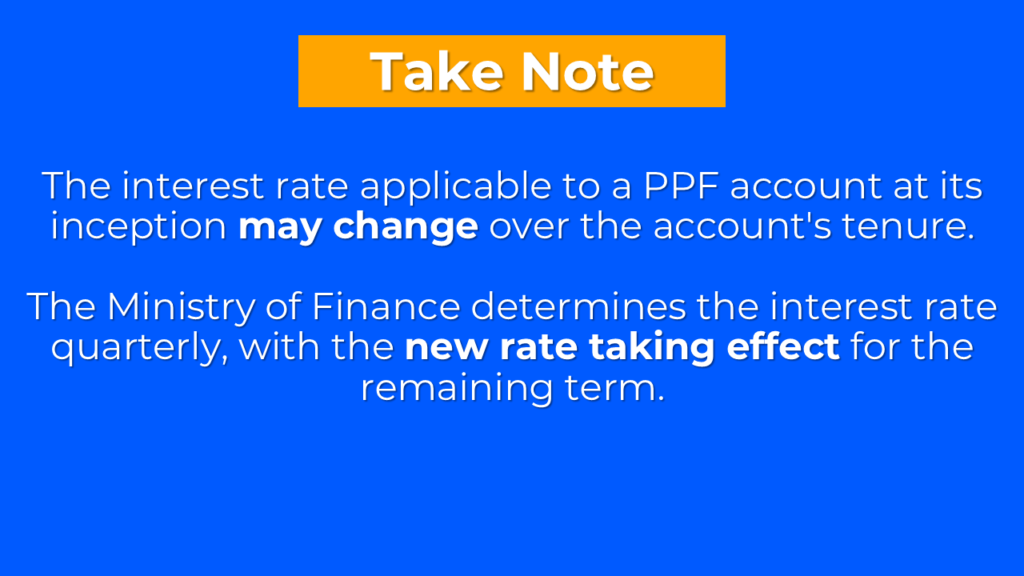

- Interest Rate: The Ministry of Finance announces the PPF interest rate on a quarterly basis. The interest calculation is done monthly, based on the lowest account balance between the 5th and last days of each month.

Although the interest calculation is done monthly, the interest amount is only credited at the end of the financial year. Therefore, PPF investors should make their contributions to the account before the 5th day of every month to maximize the interest earned.

How to check PPF Account balance online?

The steps to check your PPF account balance are given below.

- Log in to your PPF account using your internet banking credentials.

- Upon successful login, your current account balance will be prominently displayed on the screen.

In addition to checking your balance, logging in to your account via internet banking offers other convenient features. You can transfer funds to your account online, set up standing instructions for your account, download your account statement, and even submit your PPF loan application.

By utilizing the online platform and net banking services, you can easily stay updated on your PPF balance and conveniently manage various aspects of your PPF account.

How to check PPF Account balance offline?

To check your PPF Account balance offline, you should update your PPF passbook, which provides essential information such as your account balance, account number, bank branch details, and transaction history. Here’s how you can update your PPF passbook:

- Visit the branch of the bank where you opened your PPF account. They will provide you with a separate passbook specifically for your account.

- Some banks have automated passbook update machines available at their branches. Ensure that you visit the bank during their operating hours to update your passbook using these machines.

- After updating, your PPF passbook will reflect all the credit and debit transactions made in your account, along with the current outstanding balance.

- If you have a PPF account opened through a Post Office, you must visit the same Post Office to update your passbook.

Regularly updating your PPF passbook lets you stay informed about the transactions and balance in your account, providing a tangible record of your account activity.

Rules for withdrawal from PPF Account:

The PPF scheme operates with a mandatory lock-in period of 15 years. However, in emergency situations, individuals are eligible for partial withdrawals from their PPF balance. Some key points you should keep in mind while applying for withdrawal are:

- Eligibility: You can apply for partial withdrawals only after the completion of the 5th financial year from the year in which the PPF account was opened. For instance, if the account was opened in February 2015, withdrawals can be made from the financial year 2020-21 onwards.

- Frequency: Only one partial withdrawal is allowed per financial year.

- Withdrawal Limit: The withdrawal limit for each financial year is calculated based on the lower of two options:

a) 50% of the account balance at the end of the previous financial year.

b) 50% of the account balance at the end of the fourth financial year preceding the year of withdrawal.

These guidelines ensure that individuals have access to their funds in times of emergency while maintaining the long-term nature of the PPF scheme.

How to withdraw money from PPF Account?

To initiate a partial withdrawal from your account, you need to submit an Application Form for Withdrawal from the PPF Account. Here are the key details and documents required for the withdrawal process:

- Fill in the application form with essential information, including your PPF account number and the amount you wish to withdraw.

- Attach a declaration confirming that no other withdrawals have been made during the same financial year.

- If the account is in the name of a minor, provide an additional declaration stating that the withdrawn amount is intended for the use of the minor child who is still minor and alive.

- Along with the application form, submit your account passbook.

By completing the Application Form for Withdrawal from the PPF Account and providing the necessary declarations and passbook, you can withdraw a partial amount from your account.

Loan against PPF Account:

The option to avail a loan against the PPF balance is available after one year but before five years from the end of the financial year in which the first contribution was made. Once you have availed a loan from your account, you are not eligible to apply for another loan within the same financial year. Also, a second loan can be obtained after the first loan is completely paid off.

For example, if the PPF account was opened on January 1, 2015 (FY 2014-15), the end of the financial year in which the account was opened would be March 31, 2015. The loan can be taken from April 1, 2016 (FY 2016-17) onwards. The eligibility to acquire a loan remains available for up to five years from the end of the financial year in which the account was initiated. In this particular scenario, that would be until March 31, 2021 (FY 2020-21). Consequently, loans can be obtained anytime between March 31, 2016, and March 31, 2021.

To avail a loan against your PPF balance,

- You need to submit Form D and provide details such as your account number and the amount you wish to borrow.

- Additionally, you must commit to repay the loan amount with interest within three years.

The maximum loan amount that can be availed against PPF is 25% of the balance at the end of the second financial year preceding the year in which the loan is applied for.

Interest Rate of Loan against PPF Account:

It is sensible to repay the loan in 36 months as the rate of interest would be 1% p.a. over and above the prevailing PPF interest rate. However, if the loan repayment period exceeds 36 months, the rate of interest applicable would be 6% p.a. over and above the prevailing PPF interest rate.

It’s important to note that the interest is not paid along with the principal amount in equated monthly installments (EMIs). As soon as the principal is completely repaid, the interest amount due must be paid within the next two months.

PPF Interest Rate History:

Premature Closure of PPF Account:

PPF account cannot be closed prematurely within the first five years of opening. However, after five years, closure of the PPF account is only permitted under specific circumstances, such as:

- The account holder, spouse, and dependent children are facing life-threatening conditions. In such cases, valid medical documents must be submitted as evidence to support the closure request.

- For higher education of dependent children or the account holders himself.

- Change in the account holder’s residential status, i.e., if the account holder becomes an NRI.

Extension of PPF Account:

Extension of PPF Account with Contributions: A PPF subscriber has the option to extend the duration of their account indefinitely, in increments of 5 years. To extend the account and continue making contributions, the subscriber needs to submit Form H, indicating their request for extension.

- The decision to extend the account with contributions must be made within one year from the maturity date.

- If no choice is made within this period, the default option of extension without further contributions will be applied.

- If you opt for extensions of your PPF account with contributions, you can withdraw up to 60% of the balance available on the date of extension. This withdrawal can be taken in a lump sum or spread out over multiple years.

Please note that only one withdrawal is allowed per year.

Extension of PPF Account without Contributions: If no explicit choice is made, the default option of extension without further contribution will be automatically applied. Choosing this option does not require filling out any forms.

- Only a single withdrawal is permitted per year, and the entire account balance is available for withdrawal.

- The option cannot be switched once the account is renewed, either with or without contributions.

- This means that you cannot switch from the option with contribution to the option without contribution, or vice versa.

If the amount is deposited into the account without selecting the correct option, no interest will be payable on such deposits. Furthermore, you cannot claim deductions under the Income Tax Act for such contributions.

How to activate inactive PPF Account?

If the minimum annual contribution of ₹500 is not made, the PPF account becomes inactive. However, it can be reactivated by following below steps:

- Submit a written request to reactivate your Account at the post office or bank where the account is held.

- Pay a fine of ₹50 for each year that the account has remained inactive.

- Clear the arrears by making a minimum payment of ₹500 for each year that the account has been inactive.

By following these steps, the inactive PPF account can be successfully reactivated.

PPF Account Nomination:

Nomination for a PPF account can be made in favor of one or multiple individuals. If multiple nominees are appointed, the percentage share of each nominee should be specified.

To add a nominee to the account, the account holder must submit Form E. Nomination can be made at any time during the account’s tenure. Changes, cancellations, or alterations to the nomination can be made through an Application for Change of Nomination.

Nomination forms need to be signed by the account holder and two witnesses. The nominees themselves are not required to sign the form. Once the nomination form is duly filled, it must be submitted at the relevant bank or post office branch.

Tax Benefit on PPF Account:

The PPF scheme provides the EEE (Exempt-Exempt-Exempt) benefit.

- You can avail a tax deduction under section 80C for the entire investment made in the PPF, up to ₹1,50,000 per year.

- The interest earned on the invested amount is also exempt from taxes.

- Furthermore, the maturity amount is also tax-free.

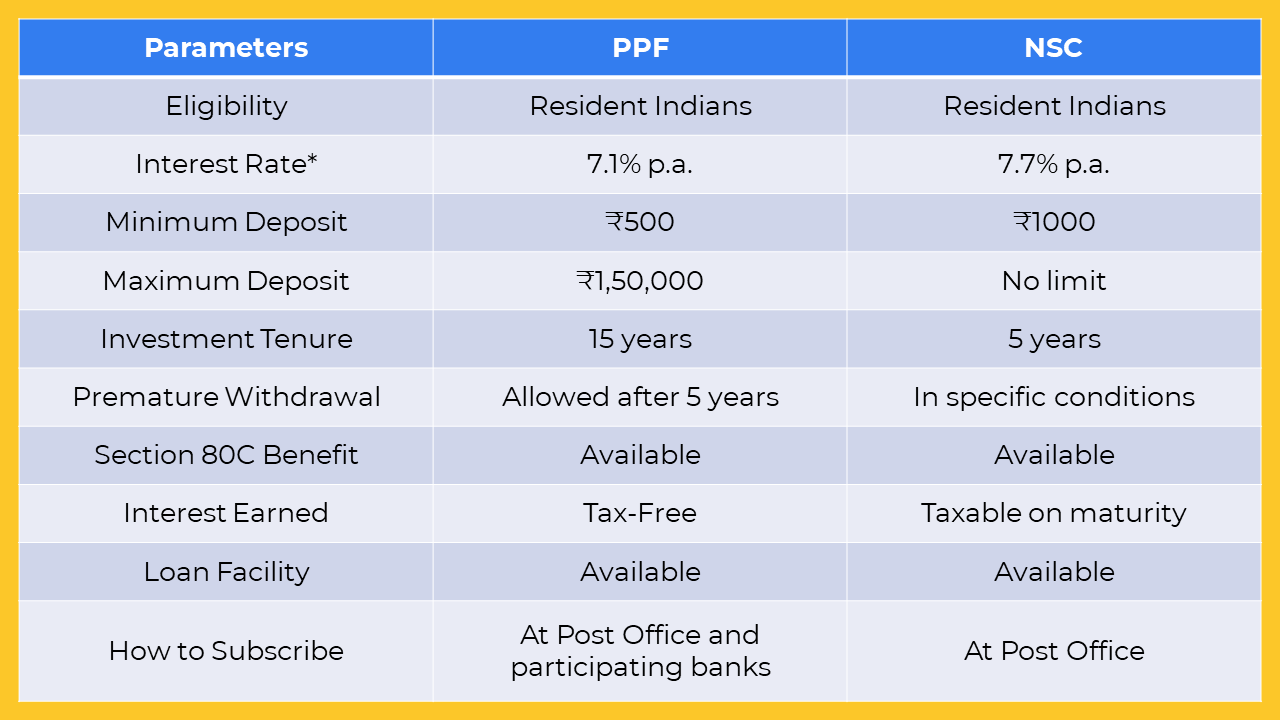

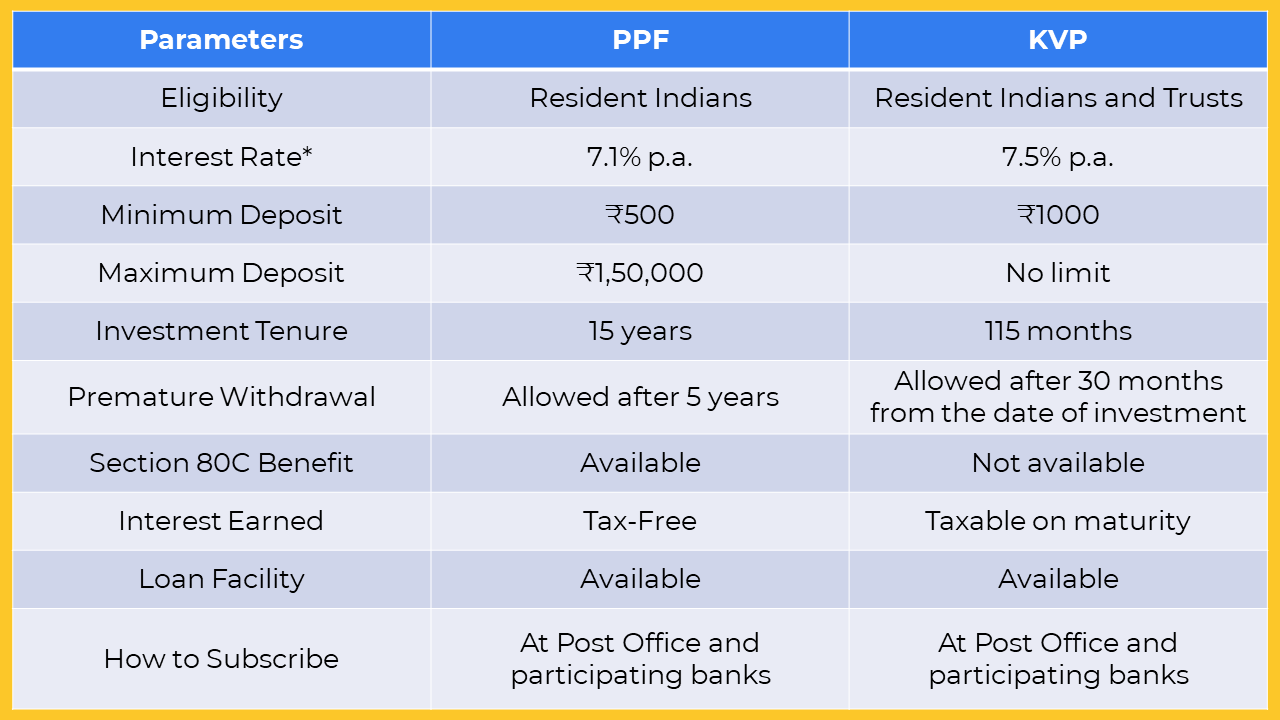

Comparing PPF with other Post Office Schemes:

Kindly refer to the images below to assess and compare PPF with other Post Office Schemes.

*The interest rates for the respective scheme are subject to periodic revisions. Prior to investing, please verify the prevailing interest rate.

Resources:

https://groww.in/calculators/ppf-calculator

https://www.indiapost.gov.in/VAS/DOP_PDFFiles/form/AccountopeningCertificate.pdf

Frequently Asked Questions:

Why should I invest in PPF?

PPF serves as a valuable tool for individuals seeking to earn a comparatively steady rate of interest while simultaneously enjoying tax benefits. Investors with a low risk tolerance often choose to invest in PPF, as they can avail tax deductions of up to ₹1,50,0000 under Section 80C when filing their Income Tax Return.

Can I transfer PPF Account from one bank to another?

Yes. You can transfer your PPF Account from one bank to another. Transferring your account from a bank to a post office (also from post office to bank) is also possible.

Will I continue to earn interest if my PPF account is inactive?

No, interest is not accrued on an inactive PPF account. During the period of inactivity, no interest is calculated or added to the account. However, once the account is revived, interest will be calculated based on the total balance available at the time of reactivation.

Can NRI open a PPF Account?

No

Can I open a PPF account for my grandchild?

No, only parents or legal guardians have the authority to open and manage a PPF account for their minor child.

However, in the unfortunate event of both parents of the minor child passing away, the grandparents can act as guardians. And hence will be authorized open and manage a PPF account for the minor child.

What is the process to claim a PPF account in the event of the account holder’s death?

In case of the account holder’s demise, the nominees can claim the PPF account by completing Form G. Along with the form; the following documents need to be attached: the death certificate, succession certificate (unless the account balance is below ₹1,00,000/-), PPF Passbook, Letter of Indemnity, and Affidavit.

If no nominees are appointed, a legal heir can claim the account by presenting all the aforementioned documents, even without the presence of any nominee.

Conclusion:

In conclusion, the Public Provident Fund (PPF) presents a smart opportunity to build a substantial corpus with minimal risk exposure. The PPF scheme provides the potential for significant growth and offers the advantage of tax-free returns upon maturity. With these benefits in mind, considering the PPF as an investment option is a wise decision for individuals seeking to secure their financial future.

We hope you found this article informative. Should you have any queries, please feel free to Contact Us; we will gladly assist you.

Disclaimer:

This article provides general information only and does not constitute financial advice. Financial regulations, product terms, and industry guidelines are revised from time to time. While we have made efforts to ensure the accuracy of the information presented, we do not guarantee its completeness or accuracy. We disclaim any liability for loss or damage arising from actions taken based on the information provided in this article. To make informed financial decisions, please do your own research and consult with a qualified financial professional.

SPREAD THE WORD WITH YOUR NETWORK