Introduction:

India’s bustling with young talent, but there’s a looming challenge on the horizon – retirement. With living costs soaring and lifespans stretching, our youth need a plan for their golden years that can stand up to inflation and rising expenses.

That’s where NPS, or the National Pension System, comes in. Let’s begin with a simple overview of the National Pension System.

What is National Pension System?

NPS stands for the National Pension System, not the National Pension Scheme, as is commonly misunderstood.

The National Pension System (NPS) is a voluntary defined contribution pension scheme. It was initially introduced in 2004 for Government employees and later extended to all Indian citizens in 2009.

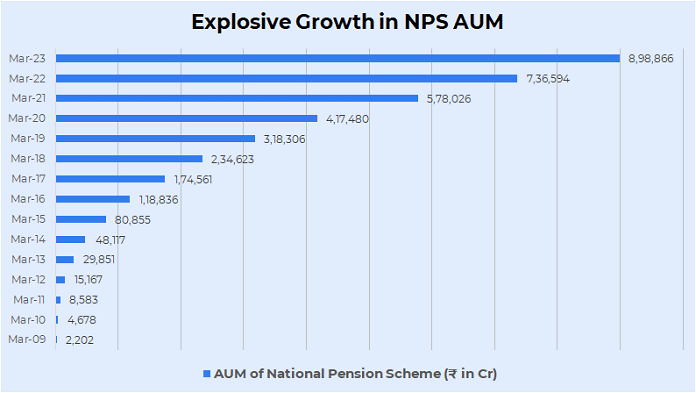

The scheme’s Assets Under Aanagement (AUM) have grown significantly, from a modest 2,200 Crores at the outset to nearly 9Lac Crores today.

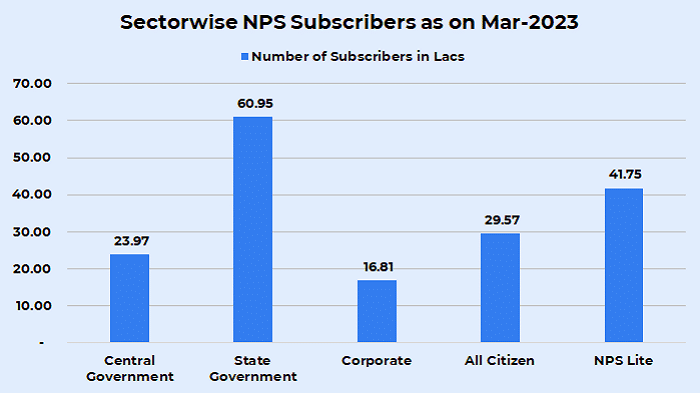

While a substantial portion of participants are Central and State Government employees, around 30Lac subscribers are in the all-citizen category.

Interestingly, recent data from an NPS statistics handbook reveals that most voluntary subscribers last year belonged to the 30 to 35 age group, with approximately 28% of them being women.

The primary goal of National Pension System is to assist individuals in building a retirement corpus that can later be converted into a post-retirement monthly payout, commonly referred to as a pension. National Pension System provides numerous advantages to its subscribers, including a cost-effective structure, tax benefits for individuals, market-linked returns, easy portability, professional management, and more. We will delve deeper into these benefits in the subsequent sections of this article.

NPS Eligibility:

Who can invest in National Pension System?

The National Pension System is available for individuals aged 18 to 70, including NRIs (non-resident Indians). NRIs must adhere to regulatory requirements set by the RBI and FEMA for their contributions.

Who cannot invest in National Pension System?

- Overseas Citizens of India (OCI)

- Persons of Indian Origin (PIOs)

- Hindu Undivided Families (HUF)

- NPS accounts cannot be jointly opened or operated.

- Rules do not allow for multiple NPS accounts for a single individual.

How does NPS work?

The National Pension System operates much like a mutual funds. You start by opening an NPS account and decide how to allocate your contributions among Equities, Debt, and other options. Over time, you make systematic contributions that help your NPS portfolio grow.

When you retire, you can withdraw a portion of your accumulated funds and establish an Annuity, which provides monthly income during your retirement years.

Interestingly, the regulatory framework set by the Pension Fund Regulatory and Development Authority (PFRDA), including elements like the NPS trust, Central Record Keeping Agency (CRA), Custodian, and more, bears a resemblance to how the Indian mutual fund industry operates, with its Sponsor, Trustees, Custodian, and Transfer Agent.

How to open an NPS Account?

Opening an NPS account offers flexibility with both offline and online options available to prospective investors.

Offline NPS Account Opening:

To initiate an NPS account manually, locate a Point of Presence (PoP), as termed by the PFRDA. This PoP can be your nearest bank branch or post office. Submit an account opening form at the PoP, along with the necessary KYC documents (which typically include a copy of your Identity Proof, Address Proof, and a Passport-sized Photograph). You will also need to provide your Bank and Nomination details. Once these steps are completed, your NPS account is ready for use.

Online NPS Account Opening:

Opening an NPS account online offers the advantage of speed and convenience, taking less than 30 minutes to complete. All you need are your PAN card, Aadhaar card, Mobile number, and access to your Net Banking Account. You can utilize platforms such as enps.nsdl.com or any other website or app that provides NPS account opening services to get started swiftly.

What is PRAN?

Whether you open your NPS account online or through the traditional offline process, the system generates a 12-digit PRAN (Permanent Retirement Account Number) upon making your initial investment. This PRAN allows you to manage your NPS account from anywhere, even if you relocate to a different city or change your employment.

Essentially, the PRAN makes your NPS account highly portable, allowing you to transition seamlessly between sectors, moving from the Central Government to the Corporate Sector, from a State Government job to a Central Government job, and so on.

It’s essential to note that there is a minimum initial contribution requirement when opening your NPS account. For a Tier-1 account, this minimum contribution is set at ₹500, while a Tier-2 account necessitates a minimum contribution of ₹1000.

Types of NPS Account:

There are two distinct types of NPS accounts: Tier-1 and Tier-2. Let’s break down the differences between them for clarity:

Tier-1 Account (Pension Account):

- Mandatory for all NPS participants.

- Often referred to as the pension account.

- Offers various taxation benefits.

- Typically, taxation benefits are more extensive for Tier-1 accounts, with broader eligibility, including government employees.

Tier-2 Account (Investment Account):

- Entirely optional, serving as a voluntary savings facility.

- Commonly referred to as the investment account.

- Provides greater flexibility, allowing withdrawals at any time.

- Taxation benefits for Tier-2 accounts are usually restricted to government employees.

Notably, National Pension System enables subscribers to tailor their investment strategies for each type of account. For instance, if you lean towards a debt-focused approach in your Tier-1 account and prefer an equity-focused approach in your Tier-2 account, you have the flexibility to structure your investments accordingly.

NPS Asset Classes:

When it comes to NPS asset classes, there are four options available, each serving distinct investment purposes.

Class E (Equity):

This class involves investing money in the stock markets, providing potential for growth through equity investments.

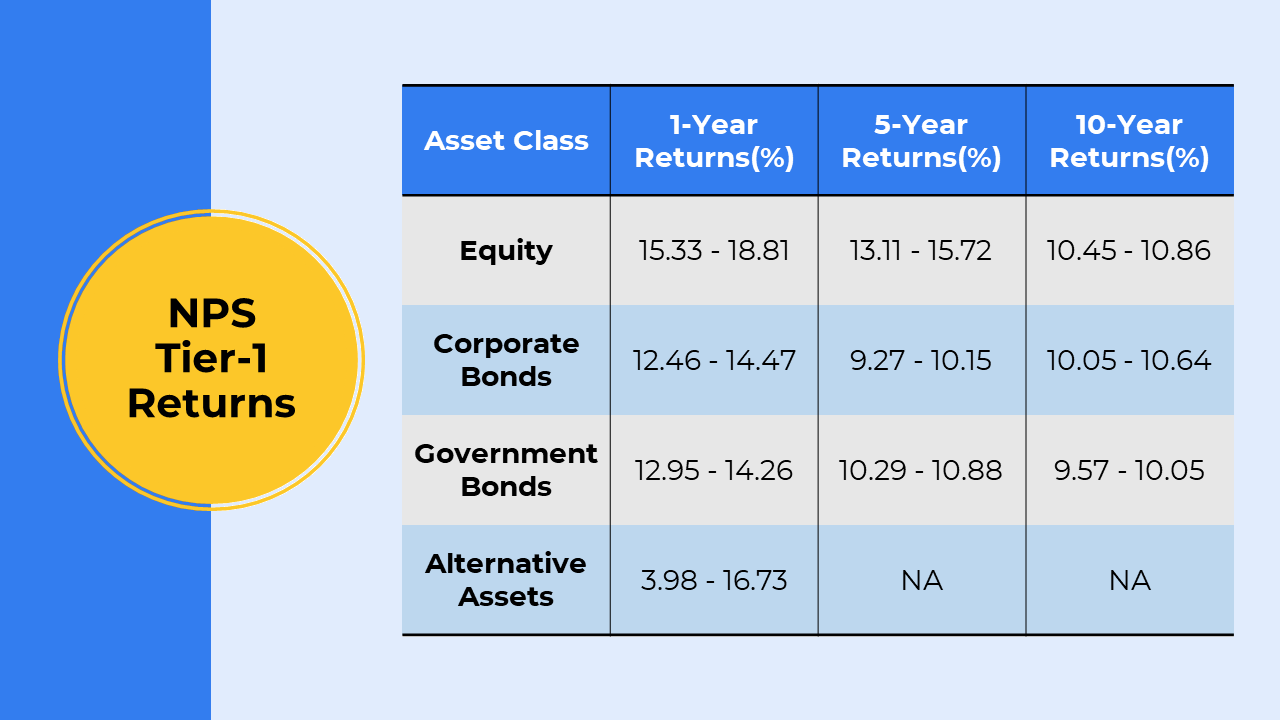

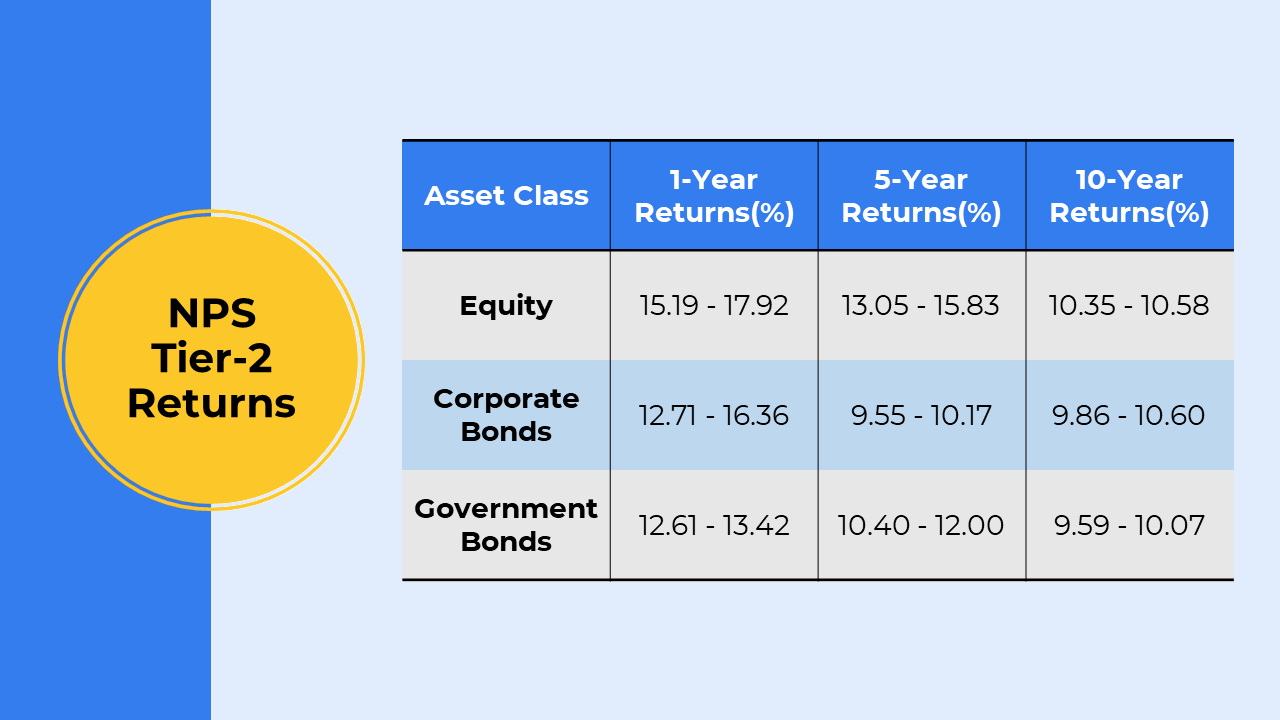

Over a past 10-year period, Equities (Class E) have delivered an average return of approximately 10%.

When assessing this landscape, it becomes evident that HDFC stands out as the most reliable and consistently performing options within this group.

Class C (Corporate Debt):

Class C focuses on corporate debt, with investments going towards bonds issued by PSUs, public financial institutions, infrastructure companies, and money market instruments.

Over the last decade, Class C Corporate Debt has delivered an average return of just above 10%.

In annual comparisons, it’s evident that HDFC and ICICI Prudential’s Scheme C funds have exhibited reasonable performance and consistency over the years.

Class G (Government Bonds):

Class G encompasses government securities, including bonds, treasury bills, and various securities issued by central or state governments, known for their stability.

Over a past 10-year period, Government Securities (Class G) have yielded close to 9%.

LIC appears to have outperformed in the NPS Class G category.

Class A (Alternative Investments):

Class A comprises alternative investment funds, such as commercial mortgage-backed securities and real estate investment trusts (REITs), offering diversified investment opportunities.

The option of an alternative investment scheme (Class A) was unavailable a decade ago. However, last year, Class A has delivered returns between 3% to 17%.

The Pension Fund Regulatory and Development Authority (PFRDA) has designed these asset classes to cater to different risk-return profiles, with Equities and Government Securities representing the endpoints of the risk spectrum. Notably, the combination of these four assets, E, G, C, and A, plays a pivotal role in determining the growth of your NPS corpus by the time you reach your retirement age.

Investment Options in NPS:

Once you’ve identified the asset classes you want to invest in, the next step for NPS subscribers is deciding how and how much to allocate. You have two primary options within the NPS framework: Auto Choice and Active Choice. These choices dictate how your funds are managed within the system.

Auto Choice:

The Auto Choice is designed for investors who prefer not to make asset allocation decisions themselves. In this mode, National Pension System functions like a passive instrument. It employs a methodology-driven Life Cycle-based approach, starting with a portfolio skewed towards equities for younger subscribers. The system systematically rebalances the portfolio as retirement approaches, reducing equity exposure.

However, even within Auto Choice, you must make one key decision: selecting the type of Life Cycle Fund that aligns with your risk tolerance. National Pension System offers three options here:

- Aggressive Life Cycle Fund: This option allows for a maximum equity allocation of up to 75%.

| Age | Asset Class E | Asset Class C | Asset Class G |

|---|---|---|---|

| 18-35 | 75 | 10 | 15 |

| 36 | 71 | 11 | 18 |

| 37 | 67 | 12 | 21 |

| 38 | 63 | 13 | 24 |

| 39 | 59 | 14 | 27 |

| 40 | 55 | 15 | 30 |

| 41 | 51 | 16 | 33 |

| 42 | 47 | 17 | 36 |

| 43 | 43 | 18 | 39 |

| 44 | 39 | 19 | 42 |

| 45 | 35 | 20 | 45 |

| 46 | 32 | 20 | 48 |

| 47 | 29 | 20 | 51 |

| 48 | 26 | 20 | 54 |

| 49 | 23 | 20 | 57 |

| 50 | 20 | 20 | 60 |

| 51 | 19 | 18 | 63 |

| 52 | 18 | 16 | 66 |

| 53 | 17 | 14 | 69 |

| 54 | 16 | 12 | 72 |

| 55+ | 15 | 10 | 75 |

- Moderate Life Cycle Fund: Equities are capped at 50%.

| Age | Asset Class E | Asset Class C | Asset Class G |

|---|---|---|---|

| 18-35 | 50 | 30 | 20 |

| 36 | 48 | 29 | 23 |

| 37 | 46 | 28 | 26 |

| 38 | 44 | 27 | 29 |

| 39 | 42 | 26 | 32 |

| 40 | 40 | 25 | 35 |

| 41 | 38 | 24 | 38 |

| 42 | 36 | 23 | 41 |

| 43 | 34 | 22 | 44 |

| 44 | 32 | 21 | 47 |

| 45 | 30 | 20 | 50 |

| 46 | 28 | 19 | 53 |

| 47 | 26 | 18 | 56 |

| 48 | 24 | 17 | 59 |

| 49 | 22 | 16 | 62 |

| 50 | 20 | 15 | 65 |

| 51 | 18 | 14 | 68 |

| 52 | 16 | 13 | 71 |

| 53 | 14 | 12 | 74 |

| 54 | 12 | 11 | 77 |

| 55+ | 10 | 10 | 80 |

- Conservative Life Cycle Fund: Equities are restricted to 25%.

| Age | Asset Class E | Asset Class C | Asset Class G |

|---|---|---|---|

| 18-35 | 25 | 45 | 30 |

| 36 | 24 | 43 | 33 |

| 37 | 23 | 41 | 36 |

| 38 | 22 | 39 | 39 |

| 39 | 21 | 37 | 42 |

| 40 | 20 | 35 | 45 |

| 41 | 19 | 33 | 48 |

| 42 | 18 | 31 | 51 |

| 43 | 17 | 29 | 54 |

| 44 | 16 | 27 | 57 |

| 45 | 15 | 25 | 60 |

| 46 | 14 | 23 | 63 |

| 47 | 13 | 21 | 66 |

| 48 | 12 | 19 | 69 |

| 49 | 11 | 17 | 72 |

| 50 | 10 | 15 | 75 |

| 51 | 9 | 13 | 78 |

| 52 | 8 | 11 | 81 |

| 53 | 7 | 9 | 84 |

| 54 | 6 | 7 | 87 |

| 55+ | 5 | 5 | 90 |

The portfolio allocation within these funds follows an age-based table set by the PFRDA. For instance, if you are 35 or younger, the Aggressive Life Cycle portfolio will hold 75% in equities, 10% in corporate debt, and 15% in government securities.

As you age, the equity portion decreases automatically, replaced by an increasing proportion of government bonds. This rebalancing occurs annually on your birthdate.

Active Choice:

The Active Choice option is available for those who want more control over their portfolio and asset allocation. It provides greater flexibility but comes with certain limitations, such as a maximum allowable equity allocation of 75% (not 100%) and a cap of 5% for alternative investment funds (Class A). Active Choice is exclusively offered to Tier-1 NPS investors.

Previously, an age-based requirement mandated a gradual reduction of equity allocation after crossing 50; however, this rule has been removed, allowing investors to maintain a 75% equity allocation until age 60.

Ultimately, the decision between Auto Choice and Active Choice depends on your understanding of asset allocation and rebalancing. If you are well-versed in these concepts, Active Choice may be suitable. Otherwise, Auto Choice provides a hassle-free option. It’s worth noting that the PFRDA allows movement between these choices, so you can switch from Auto to Active or vice versa 4 times in a financial year.

NPS Pension Fund Managers:

- SBI Pension Fund

- LIC Pension Fund

- UTI Retirement Solutions

- HDFC Pension Management

- ICICI Prudential Pension Fund Management

- Kotak Mahindra Pension Fund

- Aditya Birla Sunlife Pension Management

- Tata Pension Management

- Max Life Pension Fund Management

- Axis Pension Fund Management

While NPS rules permit subscribers to have different pension managers for their Tier-1 and Tier-2 accounts, they do not allow subscribers to choose different fund managers for various schemes within the same Tier.

In simpler terms, you cannot opt for the SBI Pension Fund for Government Securities, select LIC Pension Fund for Equities, and separately appoint Max Life Pension Fund for Corporate Debt within the same Tier.

A NPS subscriber can choose only one pension fund manager to oversee all four asset classes. This restriction can pose a minor challenge because, in the past year, Kotak Mahindra Pension Fund has demonstrated strong returns in Equities, LIC Pension Fund excelled in Corporate Bonds, and UTI Retirement Solutions performed admirably with Government Securities.

How to choose NPS Fund Manager?

Selecting a fund manager is more of a portfolio-based decision rather than a specific asset class choice. Your allocation within the NPS fund plays a crucial role. For instance, if you have an Active Choice allocation of 70% in Equities, 10% in Corporate Bonds, and 20% in Government Securities, assessing the performance of the chosen pension fund manager becomes more accurate and relevant.

However, it’s worth noting that most NPS funds tend to deliver similar returns, whether analyzing individual schemes or considering them as a portfolio. Nonetheless, every NPS subscriber must select a pension fund manager, with the flexibility to change the fund manager once per financial year, as permitted by NPS rules.

Options for NPS Subscribers at Age 60:

Upon reaching the age of 60, NPS subscribers have three choices at their disposal.

- Continued Contributions: The first option entails continuing National Pension System with regular contributions until the age of 75. Subscribers can keep adding to their NPS corpus during this period.

- No Further Contributions: The second choice is to extend National Pension System until the age of 75 but without making additional contributions. In this scenario, contributions cease while the NPS account remains active.

- Immediate Exit: The third option involves exiting National Pension System at the age of 60, where the subscriber can withdraw 60% of the corpus as a lump sum. The remaining 40% is used to purchase an annuity. However, if the total corpus is below ₹5,00,000/-, the subscriber has the option to withdraw the entire amount, without the requirement to allocate any portion to an Annuity.

It’s important to note that if a subscriber has not initiated an exit or deferment request, it will be assumed that they wish to continue NPS until the age of 75. However, NPS rules permit subscribers to exit National Pension System at any point during this continuation period, providing flexibility and control over their retirement planning.

Withdrawing Funds Before Age 60 in NPS:

A common query often arises regarding the withdrawal of funds from National Pension System before reaching the age of 60. Subscribers do have the following options in this scenario.

Exiting before age 60:

Should a subscriber wish to exit the National Pension System before turning 60, the current rules stipulate that they can withdraw 20% of the corpus as a lump sum, while the remaining 80% must be utilized to purchase an annuity. This annuity provides regular payouts to the individual during their retirement.

However, it’s important to note that there’s an exception in the rule book. If the total corpus is less than ₹2,50,000/-, the subscriber can withdraw the entire corpus prematurely without the obligation to invest any of it in an annuity.

Partial withdrawals before age 60:

If a subscriber prefers a partial withdrawal, the PFRDA does permit it, but with certain conditions.

- Premature withdrawal is allowed only after three years of regular contributions.

- The subscriber can only withdraw up to 25% of their own contributions.

- Withdrawals can occur only three times throughout the entire tenure.

Reasons for withdrawal are limited to specific situations, such as a Medical Emergency, funding a Child’s Higher Education, contributing to a Child’s Wedding Expenses, or facilitating the Construction or Purchase of a House.

How does an Annuity work?

An Annuity is a financial instrument that can be purchased by making a lump-sum payment to an Annuity Service Provider (ASP), typically an insurance company. In return, the Annuity purchaser and their family receive a fixed monthly income for a predetermined period.

The exact monthly payout is influenced by various factors, including the chosen Annuity Type, the Duration, the Annuity Service Provider selected, and other pertinent considerations. Crucially, once an Annuity is procured, it becomes a contractual agreement.

This means that the rate of return remains fixed and does not fluctuate throughout the individual’s pension-receiving period. Such predictability is highly valued, particularly among senior citizens, and is a prominent feature of Annuity products.

In India, Annuities are commonly referred to as pensions, and NPS regulations mandate that a minimum of 40 percent of the corpus be used to purchase an Annuity from an Annuity Service Provider.

Exploring different Annuity Options in NPS:

Annuities within the NPS framework come in various forms, each catering to specific preferences and circumstances. Here’s an overview of some popular annuity options.

- Life Annuity: This is the fundamental form of annuity, providing a fixed monthly payment for as long as the annuitant is alive.

- Joint Life Last Survivor Annuity: This variant extends the Annuity payments throughout the annuitant’s lifetime and continues them for the surviving spouse after the annuitant’s passing.

- Annuity with a Return of Purchase Price: This type of Annuity ensures that Annuity payments continue for the spouse after the annuitant’s death, with the nominee eventually receiving the original corpus amount.

- Increasing Pay Annuity: Under this option, Annuity payouts increase annually at a fixed rate, helping to keep pace with inflation.

- Fixed Term Annuity: This type of Annuity provides regular payments for a predetermined period, offering financial security for a fixed duration.

- Immediate Annuity: Immediate Annuities start providing regular payouts immediately after purchase, ensuring immediate financial support.

- Deferred Annuity: With deferred Annuities, payouts commence after a specified waiting period, allowing for planning and preparation before receiving regular income.

These are just a few examples of the diverse Annuity options available in NPS. As the pension industry continues to evolve, we can anticipate further innovations in Annuity offerings, providing individuals with more tailored choices for their retirement planning.

Annuity Service Providers for NPS:

The National Pension System offers you the flexibility to select from the Annuity Service Providers (ASPs) listed below.

- Aditya Birla Sun Life Insurance Company Limited

- Bajaj Allianz Life Insurance Company Limited

- Canara HSBC Life Insurance Company Limited

- Edelweiss Tokio Life Insurance Company limited

- HDFC Life Insurance Company Limited

- ICICI Prudential Life Insurance Company Limited

- IndiaFirst Life Insurance Company Limited

- Kotak Mahindra Life Insurance Company Limited

- Life Insurance Corporation of India

- Max Life Insurance Company Limited

- PNB MetLife India Insurance Company Limited

- SBI Life Insurance Company Limited

- Shriram Life Insurance Company Limited

- Star Union Dai-ichi Life Insurance Company Limited

- Tata AIA Life Insurance Company Limited

Understanding Tax Benefits in NPS:

Tax incentives play a substantial role in the National Pension System (NPS), offering advantages to Employees, the Self-Employed, and Employers. Let’s delve into the diverse tax benefits available within the NPS framework:

Tax Benefits for Employees on Self-Contribution:

Employees contributing to National Pension System can avail the following tax benefits on their contributions:

- Tax deduction of up to 10% of their salary (Basic + DA) under Section 80 CCD(1), within the overall limit of ₹1,50,000 under Section 80 CCE.

- Additional tax deduction of up to ₹50,000 under Section 80 CCD(1B), exceeding the ₹1,50,000 limit set by Section 80 CCE.

Tax Benefits for Employees on Employer’s Contribution:

Employees enjoy tax deductions on contributions made by their employers, up to 10% of their salary (Basic + DA) or 14% if the contribution is made by the Central Government, under Section 80 CCD(2), surpassing the ₹1,50,000 limit provided by Section 80 CCE.

Tax Benefits for the Self-Employed:

Self-employed individuals contributing to National Pension System can avail the following tax benefits on their contributions:

- Tax deduction of up to 20% of their gross income under Section 80 CCD (1), within the overall limit of ₹1,50,000 specified by Section 80 CCE.

- Additional tax deduction of up to ₹50,000 under Section 80 CCD(1B), exceeding the ₹1,50,000 limit as per Section 80 CCE.

Tax Benefits on Partial Withdrawal:

Individuals can enjoy tax exemption on the withdrawn amount, up to 25% of their self-contribution, subject to terms and conditions set by PFRDA under Section 10(12B).

Tax Benefit on Purchase of Annuity:

Tax exemption is granted upon purchasing an annuity when reaching the age of 60 or upon superannuation, as per section 80CCD(5). However, income received subsequently from the Annuity is taxable under Section 80CCD(3).

Tax Benefit on Lump Sum Withdrawal:

The tax exemption applies to the lump sum withdrawal of 60% of the accumulated pension wealth upon reaching the age of 60 or superannuation under section 10(12A).

Tax Benefits for Corporates/Employers:

Corporations and employers can claim tax deductions on contributions made towards the National Pension System accounts of their employees, up to 10% of the salary (Basic + DA) of the employer’s contribution, categorized as ‘Business Expense’ from the Profit & Loss Account under section 36(1)(iv)(a).

Resources:

https://npstrust.org.in/pfs-under-nps

https://npstrust.org.in/list-of-annuity-service-provider-enrolled-under-nps

https://npstrust.org.in/nps-calculator

Frequently Asked Questions:

Can I manage my NPS Account online?

Yes, you can conveniently manage your NPS account through online services available on the NSDL website or their mobile app. These online services include:

· Change of Address: You can update your address using Aadhaar-based authentication.

· Scheme Preferences: Modify your scheme preferences online.

· Contact Information: Make changes to your mobile number and Email address.

· Online Contributions: Contribute to your NPS account online.

· View Statements: Access your statement of holdings and transaction history.

· PRAN Card: Print your PRAN card online.

· Grievance Registration: Register grievances online for prompt resolution.

· Nominee Details: Update nominee details conveniently, with the option to add up to three nominees.

Managing your NPS account online offers ease and accessibility for various account-related tasks.

Who can be the Nominee for the NPS account?

The NPS subscriber can select nominees from his family members, including his Spouse, Children, and Dependent Parents. Additionally, he can determine the percentage distribution of his accumulated pension funds among his chosen nominees.

Do I receive tax benefits for investments in the NPS Tier-II Account?

No, investments made in an NPS Tier-II account do not qualify for tax benefits. There are no tax rebates or special considerations for the returns generated from investments in an NPS Tier-II account. Taxation is applied according to your income tax slab rates.

What is the difference between Tier-I and Tier-II NPS accounts?

The key difference between Tier-I and Tier-II NPS accounts lies in their purpose and withdrawal flexibility.

Tier-I Account: Tier-I accounts are the primary retirement accounts where regular contributions from the subscriber or their employer are deposited and invested as per the chosen scheme/fund manager. These accounts are designed for long-term retirement savings, and withdrawals are restricted and subject to specific conditions.

Tier-II Account: Tier-II accounts, on the other hand, are voluntary and withdrawable accounts that can only be opened if you have an active Tier-I account. These accounts offer greater flexibility when it comes to withdrawals. You can withdraw funds from your Tier-II account as and when required, making it suitable for short-term financial goals or building an emergency fund.

Is there a default Pension Fund Manager (PFM) in National Pension System?

Yes, SBI Pension Funds Private Limited serves as the default Pension Fund Manager in National Pension System.

Who is the default Annuity Service Provider (ASP) in National Pension System?

The default Annuity Service Provider (ASP) in National Pension System is the Life Insurance Corporation of India (LIC).

Can I choose different Pension Fund Managers and Investment Options for my Tier-I and Tier-II Accounts?

Yes. You can select different Pension Fund Managers (PFMs) and Investment Options for your NPS Tier-I and Tier-II accounts as per your preferences.

Who are POPs/POP-SPs, and What do they do?

Points of Presence (POPs) serve as the initial points of interaction for NPS subscribers within the National Pension System. These authorized branches of a POP are referred to as Point of Presence Service Providers (POP-SPs).

POP-SPs play a crucial role by acting as collection points and offering various customer services to NPS subscribers. These services encompass various activities, including processing withdrawal requests from NPS accounts.

How can I reactivate my NPS Account if it’s frozen due to minimum contribution requirements?

If your Tier-I NPS account has been frozen because you didn’t make the minimum annual contribution of ₹6,000/-, you can reactivate it by taking the following steps:

1. Visit your Point of Presence (POP)

2. Pay the total of the minimum contributions for the period when your account was frozen.

3. Make the minimum contribution required for the current year when you want to reactivate the account.

4. Include a penalty fee of ₹100.

This process will restore your NPS Tier-I account.

Conclusion:

The National Pension System is an excellent choice for securing your financial future. By choosing National Pension Scheme, you take a prudent step toward financial independence while enjoying valuable tax benefits and the potential for substantial investment returns.

Should you require guidance on maximizing the benefits of the National Pension Scheme, please don’t hesitate to Contact Us.

Disclaimer:

This article provides general information only and does not constitute financial advice. Financial regulations, product terms, and industry guidelines are revised from time to time. While we have made efforts to ensure the accuracy of the information presented, we do not guarantee its completeness or accuracy. We disclaim any liability for loss or damage arising from actions taken based on the information provided in this article. To make informed financial decisions, please do your own research and consult with a qualified financial professional.

SPREAD THE WORD WITH YOUR NETWORK